- within Real Estate and Construction and Strategy topic(s)

- with readers working within the Banking & Credit industries

DAMITT, theDechertAntitrustMerger Investigation Timing Tracker, is the leading source of analysis for significant U.S. and EU antitrust merger investigation and litigation trends.In this report, we discuss the return of merger remedies in the United States and the EU Commission's launch of a "comprehensive and ambitious review" of its EU merger control guidelines.

Key Facts

United States

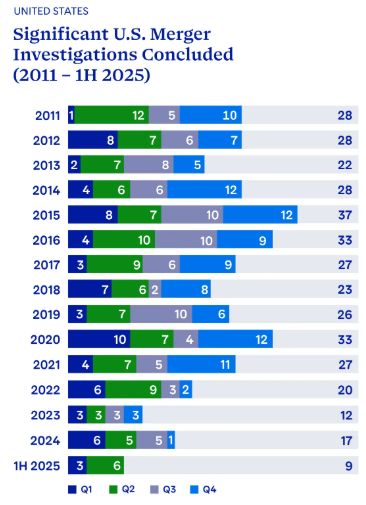

- Six significant U.S. merger investigations concluded in Q2 2025 – more than double the number in the first quarter of this year and on pace to exceed the total for 2024.

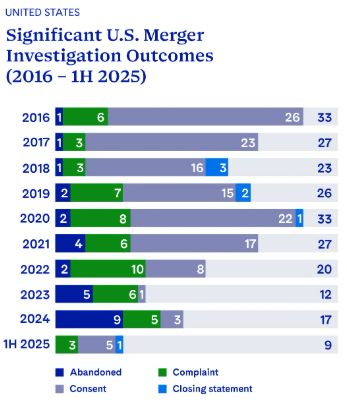

- Five of the six U.S. merger investigations concluded in Q2 2025 were consents, marking the return of merger remedies to the United States as there were more consents in Q2 2025 than in the prior nine quarters combined.

- Consistent with these outcomes, both the FTC and DOJ under the Trump Administration have expressed a willingness to negotiate merger remedies under certain circumstances. Merging parties should nonetheless expect close scrutiny of any proposed fixes to competitively problematic mergers.

- The average duration of a significant merger investigation in the U.S. reached 12.6 months for 1H 2025, compared to 11.3 months in 2024.

European Union

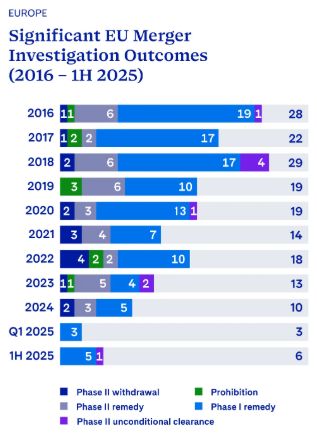

- In Q2 2025, the European Commission concluded three significant merger investigations: one cleared unconditionally in Phase II and two in Phase I with remedies, consistent with the relatively low enforcement activity observed in recent quarters.

- The average duration of Phase I remedy cases in 1H 2025 reached 12.1 months, in line with the average duration seen in 2023 and 2024, but approximately four months longer than the average duration observed from 2011-2022.

- Both Phase I remedy cases involved divestitures of substantial physical assets, confirming the Commission's continued preference for structural remedies.

- At mid-year, the Commission has concluded six significant merger investigations in 2025, tracking closely with last year's record low.

United States

Number of Significant U.S. Merger Investigations Increases Substantially in Q2 2025

Six significant U.S. merger investigations concluded in Q2 2025. That is double the number of such investigations completed in the first quarter of this year. Both the number and outcomes of these investigations are welcome news to U.S. dealmakers.

Q2 2025's total still slightly lagged below the average of 7 significant investigations for second quarters historically between 2011-2024. But with a total of nine significant investigations through 1H 2025, the U.S. agencies are on pace to exceed last year's total of 17 significant investigations.

Pre-Complaint Settlements Return to the United States

Even more welcome than the number of significant U.S. merger investigations completed in the second quarter is the outcomes reached in those matters: five consents and one closing statement. There were more consents in Q2 2025 (five) than there were in the prior nine quarters combined (four). The five consents in Q2 2025 also represented the most consents in a single quarter since Q2 2022. The return of pre-complaint settlements in merger investigations is good news for dealmakers looking for greater certainty of closing their transactions. With the possibility of negotiated settlements, the likelihood of broken deals due to antitrust scrutiny decreases.

Leaders of both the FTC and DOJ recently announced their willingness to accept merger remedies, drawing a sharp contrast with their predecessors in the Biden Administration, who accepted such remedies at historically low rates. In a statement accompanying the Synopsys/Ansys consent, FTC Chairman Ferguson announced that "remedies must be an option for the FTC as it fulfills its mission of protecting competition." FTC Commissioner Holyoak followed shortly thereafter with a speech on merger remedies, noting that "the Trump FTC is reversing course and will engage with merging parties when they present serious divestitures that will preserve competition." Finally, FTC Commissioner Meador chimed in on the subject in a statement accompanying the Alimentation Couche-Tard/Giant Eagle consent: "Negotiating remedies is an integral part of the Commission's merger review toolkit."

Similarly, Gail Slater, the head of the DOJ Antitrust Division, indicated a willingness to accept merger settlements both at her Senate confirmation hearing in February and in a more recent interview where she contrasted the current and previous administrations on this issue. One of Slater's deputies overseeing mergers at the Division confirmed this approach in a recent speech, noting: "If antitrust is law enforcement, settlement must be recognized as an efficient and legitimate resolution of claims under our adversarial system."

While clearly indicating an openness to merger remedies, the FTC and DOJ also made it clear that they will not merely rubber-stamp fixes proposed by merging parties. Among other things, the agencies have expressed a strong preference that any merger remedy is structural (e.g., a divestiture), rather than behavioral (e.g., prohibitions against taking, or requirements to take, specific actions). Though it should be noted that the FTC consent in Omnicom/Interpublic Group was limited to a behavioral remedy that prohibits the merged company from entering into certain agreements relating to advertising based on political or ideological viewpoints. FTC and DOJ leadership also have stated their strong preference for divestitures of standalone businesses. Though the FTC also provided an exception to this general rule, with the Synopsys/Ansys consent including the divestiture of less than an independent business unit in one of the markets it addressed.

In addition to the return of pre-complaint consent orders, Q2 2025 saw a post-litigation consent in DOJ's challenge to the HPE/Juniper Networks merger. This was the first post-litigation consent since the FTC settled its challenge to the Intercontinental Exchange/Black Knight merger in September 2023 (discussed in our DAMITT Q3 2023 report). Although counted as a complaint for DAMITT purposes based on the investigation outcome, DOJ's settlement of its HPE/Juniper challenge is further evidence of the return of merger remedies under the Trump Administration.

Finally, the second quarter featured the U.S. agencies' first closing statement since Q3 2020. Closing statements can provide important transparency into the agencies' approach to merger review, including how the agencies define markets and analyze competitive effects. The Mars/Kellanova closing statement states FTC staff reviewed "both specific product markets and potential portfolio effects from the acquisition." But, the statement otherwise provides limited information about the FTC's substantive analysis of the transaction – certainly compared to what we typically see from the European Commission and many closing statements issued by the U.S. agencies in the past. Nevertheless, the administration's increased transparency is a positive development to help guide antitrust lawyers and the business community on future mergers.

The Duration of Significant U.S. Merger Investigations Spikes

Although the return of merger remedies in the United States is welcome news, the latest on average duration of merger investigations is not. The average duration of a significant merger investigation in the U.S. increased to 13.6 months in Q2 2025 – twenty percent higher than the 11.3-month average duration for 2024.

A closer look at the data shows substantial variation in the duration of investigations completed this quarter. The shortest – at 6.5 months – was the FTC's investigation of the Omnicom/Interpublic transaction, which concluded with a somewhat unconventional behavioral remedy, as discussed above. Meanwhile, the longest – at 23.2 months – was DOJ's investigation of the Safran/Collins Aerospacetransaction, which featured the divestiture of a business that the buyer had acquired in 2019 when United Technologies spun off the business to get DOJ approval of its acquisition of Rockwell Collins.

The average duration for the first half of 2025 is 12.6 months – about 1.3 months longer than the average duration for 2024. If that pace were to continue for the rest of 2025, it would be the longest average duration for any year in the history of DAMITT.

Two factors that are likely to affect the average duration of significant U.S. merger investigations during the remainder of this year are the change in administration and the revisions to the HSR filing requirements. First, all of the merger investigations that concluded in Q2 2025 were announced under the Biden Administration, meaning they were subject to reviews by both the Biden and Trump Administrations. As discussed in our DAMITT Q1 2025 report, the Trump Administration has indicated an interest in speeding up merger reviews, though these changes can take time to implement. Second, the mergers concluding in the second quarter were entered into prior to the issuance of the new HSR filing requirements that went into effect in February of this year (See Dechert's OnPoint discussing those new requirements here.). Any delays to HSR filings caused by the increased burdens under the new rules could increase the duration of investigations. DAMITT will continue to monitor the net impact of these trends on the duration of significant U.S. merger investigations for the remainder of this year.

European Union

A Steady Pulse: Q2 2025 Underscores Persistent Low in EU Merger Enforcement Activity

Following the faint pulse observed in the first quarter, the second quarter of 2025 offered a continuation of the same rhythm. The European Commission concluded only three significant merger investigations: two were cleared in PhaseI with remedies (Safran/Collins Aerospace and UniCredit/Banco BPM) and one was cleared unconditionally in PhaseII (Liberty Media/Dorna Sports). The PhaseII clearance, the first of its kind since 2023, stood out in an otherwise quiet quarter. With only two additional PhaseII investigations opened in late June (Mars/Kellanova) and late July (Universal Music Group/Downtown Music), the Commission's enforcement pipeline remains sparsely populated, continuing the trend of reduced scrutiny seen since 2023.

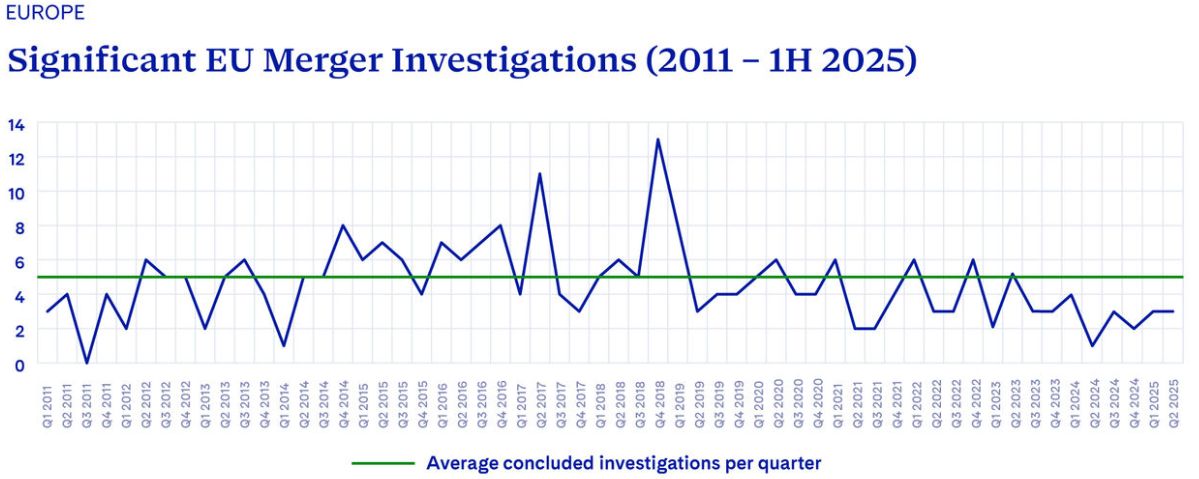

Over the first half of the year, the Commission concluded just six significant investigations, on track to match the record low set in 2024. Compared with previous second quarters, Q2 2025 marks only a modest recovery from the historic low of one significant outcome seen in Q2 2024. Q2 totals have fluctuated over the years but Q2 2025 reinforces the view that the pulse of EU merger control is no longer irregular or spiking, but rather subdued and steady.

The trend is further illustrated by the Commission's quarterly enforcement pattern, which has settled into a visibly lower rhythm. As the chart above shows, the number of significant merger investigations has hovered around or below the historical average for several years, and Q2 2025 is no exception. The sharp peaks and irregular spikes of earlier years have given way to a steadier, more subdued line - the once-variable heartbeat of merger control now faint and increasingly regular. And no change should be expected any time soon: with only two Phase II investigations currently pending, the pipeline remains sparse. Whether this reflects a conscious shift in enforcement posture is still an open question, though.

Against this backdrop, broader discussions about the future of EU merger control are gaining momentum. Policymakers and industry voices are increasingly questioning whether current merger control policy strikes the right balance between protecting competition and supporting European industrial competitiveness. While any legislative or policy shift remains uncertain, the current low enforcement activity in Q2 2025 may reflect a Commission in transition, carefully assessing how to reconcile traditional competition principles with emerging industrial policy goals.

Still No Quick Fix: Phase I Remedy Cases Continue to Take Their Time

Phase I remedy cases remained the workhorse of EU merger enforcement, but not a swift one. The two Phase I cases cleared with commitments in Q2 2025 (Safran/Collins Aerospace and UniCredit/Banco BPM) pushed the average duration of Phase I remedy cases in the quarter to 13.8 months. This raises the 1H 2025 average for Phase I remedy cases to 12.1 months, in line with the elevated timelines observed since 2023.

The prolonged Q2 average was driven primarily by the Safran/Collins Aerospace case, which took an exceptional 20.8 months from announcement to clearance - one of the longest durations DAMITT has recorded for a Phase I remedy case. The UniCredit/Banco BPM case was reviewed in a shorter timeframe of approximately 7 months.

Structural Fixes Prevail, but new Hurdles Emerge

Both cases concluded in Phase I with remedies reflected the Commission's well-established preference for structural solutions:

InSafran/Collins Aerospace, the Commission identified concerns in the market for trimmable horizontal stabiliser actuator ("THSA") systems, used in civil aircraft to ensure stable and fuel-efficient manoeuvring. The transaction would have combined two of the main suppliers in a market marked by high entry barriers and long contract cycles. To resolve these concerns, Safran committed to divest its entire North American THSA business, including sites in Canada, the U.S., and assets in Mexico.

InUniCredit/Banco BPM, the Commission addressed concerns in local retail and SME banking markets across Italy through the divestiture of 209 physical bank branches, reflecting a textbook geographic remedy in a consolidating national market. However, Italy's government imposed certain conditions on the merged entity under its national "Golden Power" regime – a political screening tool for transactions in strategic sectors, including the banking sector. The Commission subsequently issued a preliminary assessment, finding that the Italian measures may contravene Article 21 EUMR, which grants the Commission exclusive competence to review transactions meeting the EU threshold, and may be incompatible with other provisions of EU law, including those on the free movement of capital and prudential oversight by the European Central Bank. Approximately a month after EU clearance, UniCredit withdrew from the deal, citing the uncertainty created by these conditions.

Phase II Activity Low: Only One Phase II Clearance in 2025 So Far

Only one Phase II decision was issued in the first half of 2025: the Commission cleared the Liberty Media/Dorna Sports case unconditionally, 14.9 months after its announcement. This duration is in line with the average duration observed in 2020, and notably shorter than the average durations seen in subsequent years, ranging from 17.3 months to a record-22.5 months. It remains to be seen whether this trend will hold.

EU Merger Guidelines Under "Comprehensive and Ambitious Review"

In Q2 2025, the Commission has launched what it describes as a "comprehensive and ambitious review" of its EU merger control guidelines. The public consultation, open until 3 September 2025, covers both the 2004 Horizontal and the 2008 Non-Horizontal Merger Guidelines, with the aim of modernising the framework in light of developments such as digitalisation, decarbonisation, and geopolitical shifts. The initiative responds to growing political momentum for a more "forward-looking and agile" competition policy as outlined in the Draghi Report and endorsed by Commission President von der Leyen. In launching the consultation, EVP Teresa Ribera stated that the revised guidelines should give greater weight to innovation, investment intensity, and resilience, particularly in strategic sectors. In addition to a general questionnaire, the Commission has published targeted papers on issues ranging from competitiveness and innovation to sustainability, media plurality, labour conditions, and national security. While the consultation does not propose immediate legal changes, it suggests an openness to recalibrating how merger control balances potential harms with broader policy objectives. What this means in practice remains to be seen. But dealmakers should be aware that the review could influence future enforcement - for example, by prompting more nuanced assessments of innovation-driven mergers. Revised guidelines are expected by the end of 2027.

Conclusion

The second quarter saw the return of merger remedies to the United States, with the FTC and DOJ publicizing their willingness to enter into merger consents where appropriate. This marks a significant change in merger policy from the Biden Administration, which strongly disfavored merger settlements and often chose to litigate rather than negotiate. The second quarter also saw a substantial increase in the average duration of U.S. merger investigations. Because each of the investigations concluded in Q2 began during the previous administration, however, it remains to be seen what impact the current leadership at the FTC and DOJ will have on the speed of U.S. merger investigations.

On the EU side, parties to transactions likely to proceed to Phase II should allow for at least 18 months from announcement to clearance and should not rely on the formal deadlines provided for in the EU Merger Regulation, even after a deal has been formally notified. Parties should be aware that the EU Commission is becoming less and less likely to accept remedies without an in-depth investigation. If parties still plan on obtaining a Phase I clearance with commitments, they should factor in about 11 months from announcement to a decision, with significant time set aside for pre-notification talks with the EU Commission and the potential need to pull and refile their notification.

Report Methodology

The Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) is a quarterly study from Dechert LLP's Antitrust/Competition practice reporting on trends in significant merger control investigations in the United States (U.S.) and European Union (EU).

In the U.S., "significant" merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions for which the result of the investigation by the Federal Trade Commission (FTC) or the Antitrust Division of the Department of Justice (DOJ) is a consent order, a complaint challenging the transaction, an official closing statement by the reviewing antitrust agency, or the abandonment of the transaction with the antitrust agency issuing a press release.

In light of the procedural differences between the EU and U.S., DAMITT defines "significant" EU merger investigations to include transactions subject to the EU Merger Regulation (EUMR) and resulting in either a Phase I remedy or the initiation of a Phase Il investigation.

DAMITT calculates the durations of significant investigations in both jurisdictions from the deal announcement date through the completion of the investigation, and therefore includes the time attributable to pre-notification consultation efforts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]