- within Tax topic(s)

- in United States

- within Tax topic(s)

- in United States

- with readers working within the Securities & Investment and Utilities industries

- within Tax, Employment and HR and Corporate/Commercial Law topic(s)

This update highlights recent legal developments impacting businesses, being the implementation of e-invoicing, the treatment for stamping of employment contracts, and the revision and expansion of the Sales and Services Tax (SST).

E-Invoicing

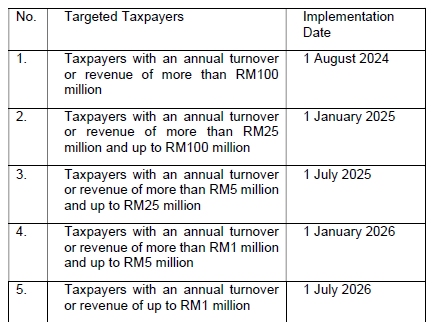

The Inland Revenue Board ("LHDN") had announced a change in the implementation deadline with regards to e-invoicing. The updated implementation deadline is as follows:

Taxpayers with an annual turnover or revenue of less than RM500,000 are now exempted from implementing e-invoicing

Stamping of Employment Contracts

In Malaysia, instruments specified under the First Schedule of the Stamp Act 1949 ("SA 1949") are chargeable with stamp duty, with the stamp duty for employment contracts between employers and employees set at RM10 per document.

Effective 1 January 2025, LHDN had conducted stamp duty audits nationwide and found that a high number of employment contracts were not stamped.

Arising from the audit finding, and to reduce the burden on employers, LHDN had announced that:

- employment contracts finalized before 1 January 2025 are exempted from stamp duty under the SA 1949;

- employment contracts finalized between 1 January 2025 and 31 December 2025 are still subject to stamp duty, but are granted a remission for late stamping, provided the employment contracts are stamped on or before 31 December 2025; and

- employment contracts finalized after 1 January 2026 will still be subjected to stamp duty, and late stamping of the same will be subjected to penalty accordingly.

Employers are advised to be mindful of their stamp duty obligations in light of the Stamp Duty Self-Assessment System slated to be introduced in phases starting 1 January 2026.

Sales and Service Tax

The Ministry of Finance ("MOF") had on 9 June 2025 announced the revision of the Sales Tax and the expansion of the Service Tax scope. The key updates are summarised below:

- Sales Tax rate remains unchanged for essential goods consumed

by the public (rate of 0%):

- Daily essentials such as staple foods (e.g., rice, vegetables, noodles, meat, certain seafood, grains, oil), pet food, medical devices, books, journals, etc.

- Basic construction materials such as cement, stones and sand, as well as agricultural inputs such as fertilizer, pesticides and agricultural and livestock machinery.

- Sales Tax at rates of 5% or 10% will apply to discretionary and

non-essential goods:

- 0% to 5% - Premium seafood (e.g., king crab, salmon, cod), truffle mushrooms, imported fruits, essential oils, silk fabrics, and industrial machinery.

- 10% - Premium discretionary items such as racing bicycles and antique hand-painted artworks.

- Scope of the Service Tax will be expanded to include new

services such as leasing or rental, construction, financial

services, private healthcare, education, and beauty services. This

expansion includes targeted exemptions to avoid cascading tax

effects and to ensure that certain essential services for Malaysian

citizens remain exempt.

- Service Tax imposed on these services ranges between 6% to 8%, with certain exemptions applicable.

For the full list of affected goods and services, please refer to the Appendix attached to the MOF's official announcement https://www.mof.gov.my/portal/pdf/siaran-media/expansion-sstscope.Pdf and the relevant industry guidelines on SST https://mysst.customs.gov.my/IndustryGuides.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.