- within Tax topic(s)

- within Law Department Performance topic(s)

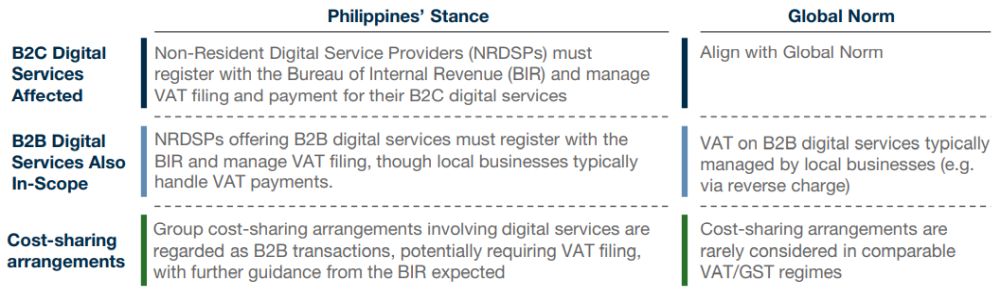

The implementation of a 12% VAT on Non-Resident Digital Service Providers (NRDSPs) in the Philippines officially commenced on 2 June 2025. Below summary captures some key VAT implications of the rules to help you navigate these changes.

COMPARISON WITH SIMILAR REGIMES IN OTHER COUNTRIES

INDUSTRY-SPECIFIC IMPLICATIONS

While the rules primarily target obvious digital service providers (e.g., cloud services, e-commerce platforms, digital content providers), other sectors should also assess their exposure. For example:

Traditional Financial Services (bank and insurance)

- Less likely to be affected as service providers

- As customers, they should review potential reverse charge obligations

- Cost-sharing arrangements involving digital services require re-evaluation

Fintech (digital payment platforms, virtual asset services)

- Determine whether their offerings qualify as digital services to Philippine individuals

- Ensure compliance with invoicing requirements, in addition to managing VAT filing and payment

Retail / Manufacturing (tangible goods)

- Sales of physical goods generally fall outside the scope of these rules

- Fees related to online marketplace listings or platform services may be subject to VAT

HOW TO PREPARE

Review Business Operations

Evaluate how the VAT will impact your business model.

Consider pricing adjustments, cost structures, and potential

changes in consumer behavior.

Update Systems and Processes

Ensure that the accounting and invoicing systems can handle VAT

calculations accurately. Train staff on compliance requirements and

reporting procedures.

Assess Customer Base

Identify whether your customers fall into B2B or B2C categories as

the compliance requirements are different. Understand their VAT

registration status and adjust your billing processes

accordingly.

Monitor Marketplace Activities

If your business operates as an online marketplace, be aware of

your responsibilities regarding VAT remittance for non-resident

sellers. Implement necessary controls and reporting mechanisms.

Seek Professional Advice

Consult with A&M tax experts to navigate the complexities.

Understand the potential income tax implications and assess any PE

risks, in addition to VAT

TAKEAWAYS

Some key features of the rules have been highlighted above, noting however that more details have been outlined in the relevant regulations and circulars released by the BIR. More comprehensive and specific analysis on how the rules impact specific business model is critical.

Originally published 30 June 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]