- within Real Estate and Construction topic(s)

- in United States

- with readers working within the Law Firm industries

- within Real Estate and Construction, Finance and Banking and Transport topic(s)

Introduction

As Lagos State takes a bold legislative step towards reshaping its housing framework, the introduction of the Tenancy and Recovery of Premises Bill ("TRPB" or the "Bill") 2025 has sparked both hope and skepticism. Framed as a progressive overhaul of the Tenancy Law of 2011, the bill aims to address current challenges, ranging from rent exploitation and vague eviction protocols to the unchecked influence of estate agents. While public discourse around the Bill has largely focused on residential tenants and affordability concerns, its implications for commercial landlords, institutional property owners, mall operators, and developers of large multi-tenant developments are equally significant.

For owners and managers of commercial assets, such as office complexes, shopping centres, mixed-use developments, and properties located in formerly excluded areas, the critical question is not whether the Bill is progressive in theory, but how it reshapes rent structuring, lease administration, enforcement rights, and recovery timelines in practice. This is particularly relevant for landlords accustomed to bespoke commercial arrangements, indexed rent reviews, and long term investment planning.

This article examines the key provisions of the Bill through the lens of corporate and large-scale landlords, assessing whether the proposed reforms offer meaningful clarity and efficiency—or merely repackage existing rules without addressing long-standing commercial concerns.

Tenancy & Recovery of Premises Bill 2025

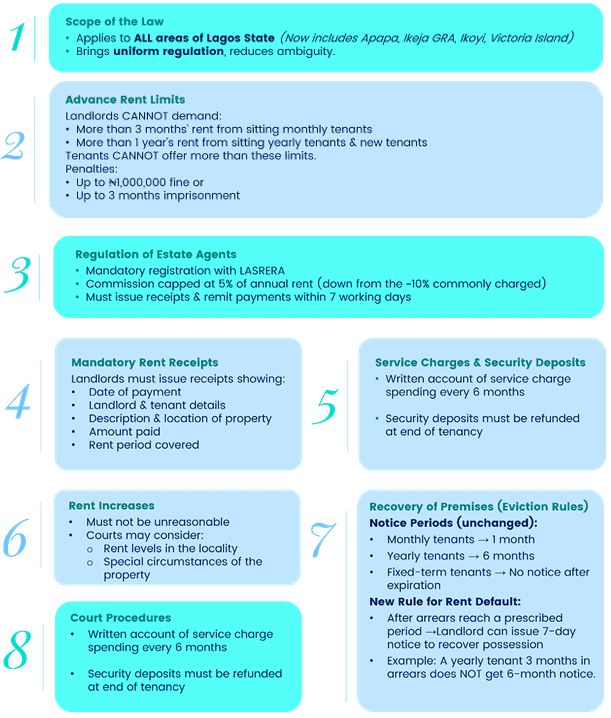

Key provisions proposed under the Bill:

1. Application and Scope of the Law: The Tenancy and Recovery of Premises Bill 2025 will be applicable to all areas of Lagos State; unlike the existing Tenancy Law of 2011 which is limited in its scope of application, as it does not apply to areas like Apapa, Ikeja GRA, Ikoyi, and Victoria Island.1 This change is a welcome development. By extending the law uniformly across the state, the bill will reduce the uncertainty and ambiguity that characterise the current framework, particularly in the excluded areas. For commercial landlords operating premium office locations, malls, and mixed-use developments in these areas, this reform brings regulatory certainty. The removal of geographic exclusions eliminates ambiguity about whether statutory tenancy protections and recovery procedures apply, enabling landlords to structure leases with clearer expectations of their legal rights and obligations across their entire Lagos portfolio.

2. Restriction on Demand for Advance Rent: At the heart of the bill is a commitment to fairness and transparency. One of its most striking provisions in this regard is the regulation of rent demands. Landlords will no longer be permitted to demand more than three months' rent from sitting monthly tenants or more than one year's rent from sitting yearly tenants and new (or would be) tenants. Interestingly, tenants, too, are prohibited from offering rent beyond these limits.2 Violations of this provision could result in fines of up to one million naira or imprisonment for up to three months3, signaling the government's intent to enforce compliance.

Notably, the existing Tenancy Law 2011 already restricts landlords and agents from demanding advance rent beyond statutory limits. However, in practice, many landlords and tenants continue to agree on payment terms that exceed these limits, suggesting a gap between legislation and enforcement. The Lagos State Government's approach to enforcement under the new Tenancy and Recovery of Premises Bill 2025 will be crucial in determining its effectiveness.

For institutional landlords, the key issue is not novelty but whether the State intends to enforce these limits more aggressively, and how this may affect cash-flow planning, financing arrangements, and lease negotiations in large developments. Commercial landlords may therefore need to reassess reliance on advance rent structures and explore alternative risk-management mechanisms, such as stronger security deposits, bank guarantees, or parent company guarantees.

3. Regulation of Agents: The bill introduces strict regulations for estate agents. All agents must be registered with the Lagos State Real Estate Regulatory Authority (LASRERA), and agency commission fees will be capped at five percent of the annual rent4, a reduction from the ten percent that is presently obtainable in practice. Agents are required to issue receipts and remit payments within seven working days; a move aimed at curbing fraudulent practices and enhancing accountability. For commercial and institutional landlords who routinely engage multiple agents across portfolios, this provision may reduce transaction costs and curb unethical practices. However, it also places an indirect compliance burden on landlords, who will need to ensure that only properly registered agents are engaged to avoid regulatory exposure.

4. Service Charge and Security Deposit: The Bill introduces more structured obligations in relation to service charges and security deposits, matters of particular relevance to landlords of multi-tenant commercial developments, malls, and mixed-use properties. Under the proposed framework, landlords are required to render a written account of service charge expenditures every six months, a provision aimed at improving transparency and curbing disputes over the management of common facilities and shared services. In addition, the Bill mandates the refund of security deposits upon the determination of a tenancy, subject only to deductions for verifiable repairs or outstanding obligations. While this reflects a response to longstanding complaints around delayed or withheld deposits, it also imposes a clear compliance and record-keeping burden on landlords, who must now ensure that deductions are properly documented and justifiable.

For corporate landlords, these provisions underscore the importance of robust service charge accounting systems, clearly drafted lease provisions on deductible items, and defined timelines for reconciliation and refund of deposits.

5. Rent Increase: The Bill retains the existing provision that any rent increase must not be "unreasonable".5 While it does not provide a specific numerical or percentage threshold for determining reasonableness, it, nevertheless, outlines factors that a court may consider in making this determination. These factors include the general level of rents in the locality or a similar locality, as well as any special circumstances relating to the premises.6

Importantly, the Bill neither expressly permits nor prohibits index-linked rent increases, leaving scope for contractual negotiation. For corporate landlords, this highlights the need for carefully drafted rent review clauses, supported by market data and valuation evidence, to withstand potential challenges. In practice, formula-based increases — such as those tied to the Consumer Price Index (CPI) — may still be defensible, provided they can be justified as reasonable within the relevant market context.

Ultimately, a more explicit mechanism would have provided clarity for commercial landlords seeking predictable rent escalation models.

6. Recovery Procedure: Eviction procedures have also been streamlined. The bill retains the existing notice periods based on tenancy type: one month for monthly tenants, six months for yearly tenants;7 and no notice required for fixed-term tenants whose lease has expired8, consistent with the practice under the current law.

Worthy of note, however, is that bill introduces new procedures for recovery in cases of rent default. Under these provisions, landlords are required to serve a sevenday notice to recover possession once the prescribed period of rent arrears has elapsed. This timeline is generally shorter than the notice period applicable to evict a tenant who remains current on rent. For example, a yearly tenant who has fallen into arrears for three months would not be entitled to the statutory six- month Notice to Quit before the issuance of the -sevenday notice to recover -possession.9

For landlords, these provisions are commercially attractive. The new procedure enables landlords to take swift action in cases of rent default, to protect their interests. The shorter notice period may equally deter tenants from defaulting on rent payments, promoting a more responsible and timely payment culture.

Court Proceedings: The bill outlines the procedure for court proceedings related to possession claims. When a person claims possession of premises, with or without arrears of rent, they may bring proceedings by Originating Summons. If the defendant intends to oppose the summons, they must file a Counter Affidavit and Written Address within 14 days of service. The Summons will then be scheduled for a hearing within 14 days after the time for filing and serving a reply has expired.10

Additionally, the bill provides that a tenant may initiate an action against a landlord in respect of their tenancy or premises only after serving a thirty-day written notice of intention to commence the suit. In doing so, the tenant must furnish evidence of rent payments being up to date and undertake to continue paying rent, utility bills, and any applicable service charges until the suit is finally determined.

It should be noted that court proceedings initiated through Originating Summons are streamlined, allowing the court to decide the matter based on the affidavit evidence submitted by the parties, without the need for a full evidentiary trial.

These provisions are designed to facilitate efficient, fair and cost-effective dispute resolution procedures, safeguarding the rights of both landlords and tenants while discouraging frivolous suits. As a result, the recovery process is likely to become more structured and efficient, enabling landlords to recover possession of their properties in a faster and more expedient manner.

Conclusion- Our Thoughts

The Lagos State Tenancy and Recovery of Premises Bill 2025, undoubtedly heralds a new dawn for tenants and landlords in the state. With its emphasis on protecting tenants' rights and promoting accountability among landlords, this legislation is poised to bringing about and enthroning a significant improvement on the quality of landlord-tenant relationships, and ultimately, contributing to a more stable and thriving property market in Lagos State. For commercial and institutional landlords, its greatest value lies in procedural clarity, faster recovery mechanisms, and uniform statewide application.

Notwithstanding, while the Bill brings much-needed clarity to various aspects of tenancy law, it would have been beneficial for it to specifically address the eviction procedure in cases of breach of covenants beyond rent arrears. Prescribing shorter notice periods for such breaches, similar to those for rent arrears, could have further streamlined the process and provided landlords with a more efficient means of addressing non-compliance. Yet, the key provisions in the Bill offer a significant step forward in promoting fairness and efficiency in landlord-tenant relationships.

By a similar fashion, certain protections, such as the restriction on advance rent payments, already exist under the current law. This demonstrates that the challenge lies not in the absence of legislation, but rather in the enforcement of these laws. To truly achieve meaningful change, the government must prioritize effective enforcement mechanisms, ensuring that both landlords and tenants are held accountable for their obligations. Without robust enforcement, the Bill's provisions risk remaining mere rhetoric, failing to translate into tangible improvements for tenants and landlords alike.

Footnotes

1. Section 2(1) of the TRPB states that the Law shall apply to all premises within Lagos State, including business and residential premises unless otherwise specified.

2. Section 5(1) and (2) TRPB.

3. Section 5 (5) TRPB

4. Section 3 TRPB

5. Section 33 (1) TRPB

6. Section 33 (2) TRPB

7. Section 14 TRPB

8. Section 29 TRPB

9. Section 14 TRPB

10. Section 22 TRPB

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.