- within Food, Drugs, Healthcare and Life Sciences topic(s)

- with readers working within the Technology, Media & Information and Law Firm industries

"What had kept us ahead for decades – engineering excellence and strong customer relationships – no longer guaranteed a competitive edge. Data, software, and AI had become the main levers of differentiation, profitability and growth. We had to rethink not just what we built, but how we competed."

To stay ahead, 'SynthCo' realized they needed to fundamentally redefine their competitive approach. With margins under pressure and digitally savvy new players moving fast, traditional competitive moats could vanish overnight. It was no longer sufficient to solely rely on established business models and innovation focused on product-plus-aftermarket-services. The company set out to reshape its strategy, revisiting its go-to-market model and product portfolio. SynthCo needed to align new commercial objectives with a clear approach to differentiation through technology and data. This included securing control of the capabilities that would define its competitive edge and mitigate the risks associated with rapid technological change.

To do this, SynthCo adopted a Tech Differentiation Strategy* when developing its new digital services. Once implemented, the Tech Differentiation Strategy approach quickly delivered results across four competitive situations.

A synthetic case from real-world experience

This article is based on a synthetic case, drawing on Konsert's experience from recent Tech Differentiation Strategy engagements with real-world clients. The insights are grounded in actual work, but all details have been anonymized and combined into a single, fictional case: SynthCo. SynthCo is portrayed as a manufacturer of high-performance industrial process equipment, historically focused on equipment sales and service contracts, and faced the pressure and opportunity of a shift toward smart, data-driven solutions.

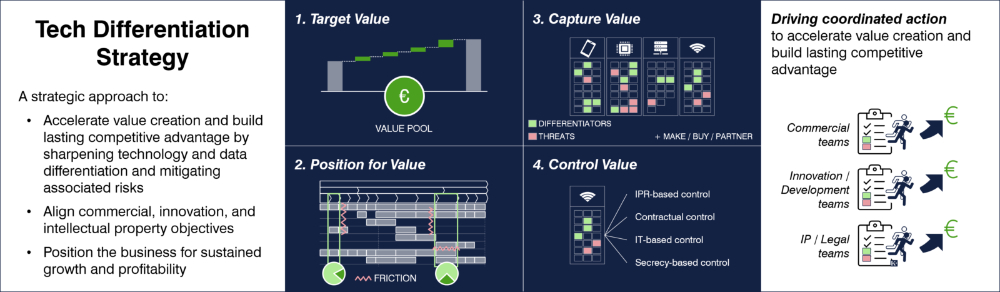

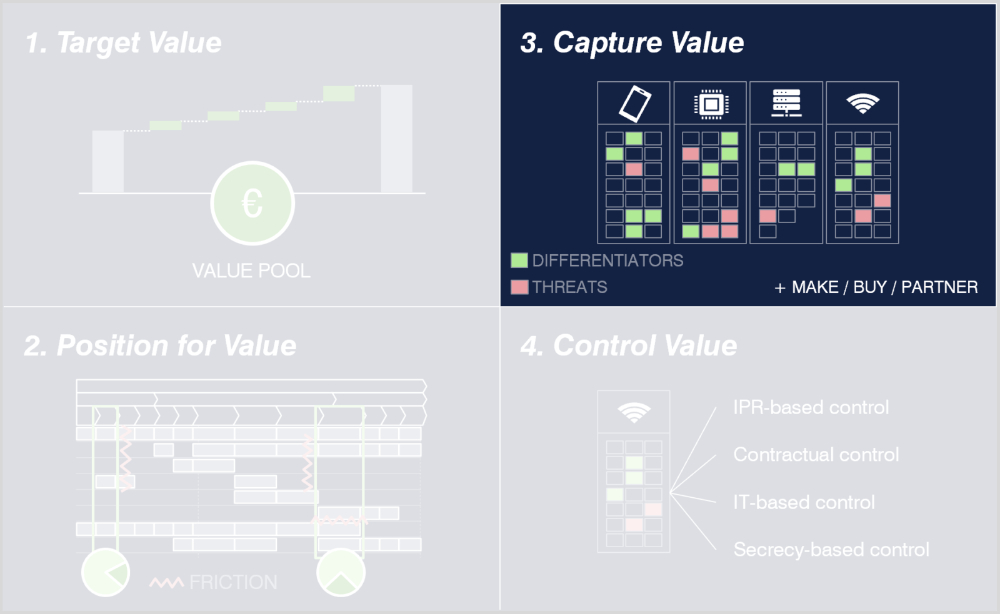

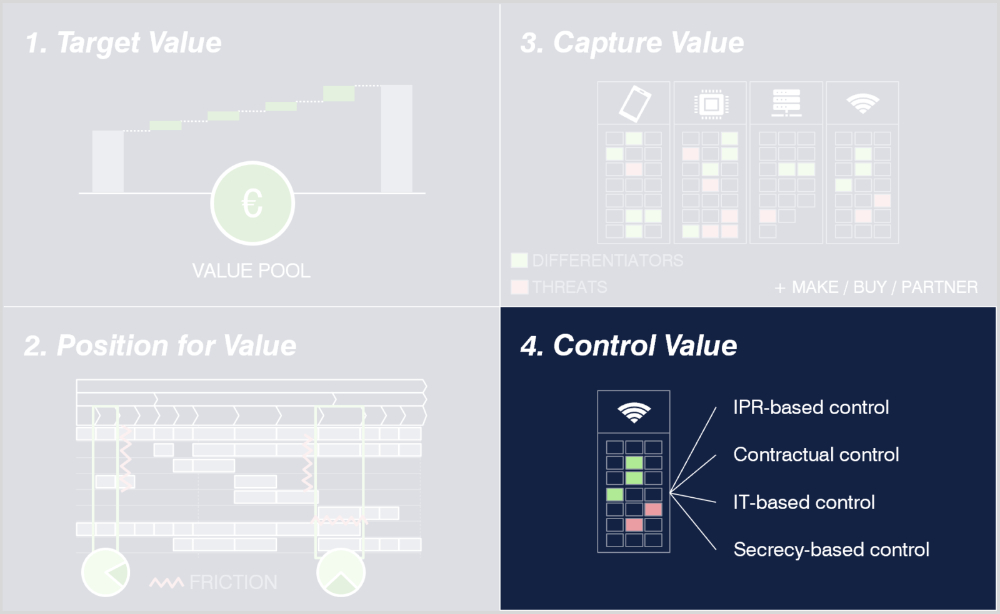

Figure 1: Tech Differentiation Strategy overview

* For brevity, we refer to the approach as the Tech Differentiation Strategy, though in practice it is as much about data as technology, and as much about risk mitigation as differentiation.

Four competitive situations proving the value of a Tech Differentiation Strategy

Before diving into how SynthCo developed its Tech Differentiation Strategy, let's first fast forward to the outcomes and examine four defining situations where the company tested its new competitive positioning – and proved its value.

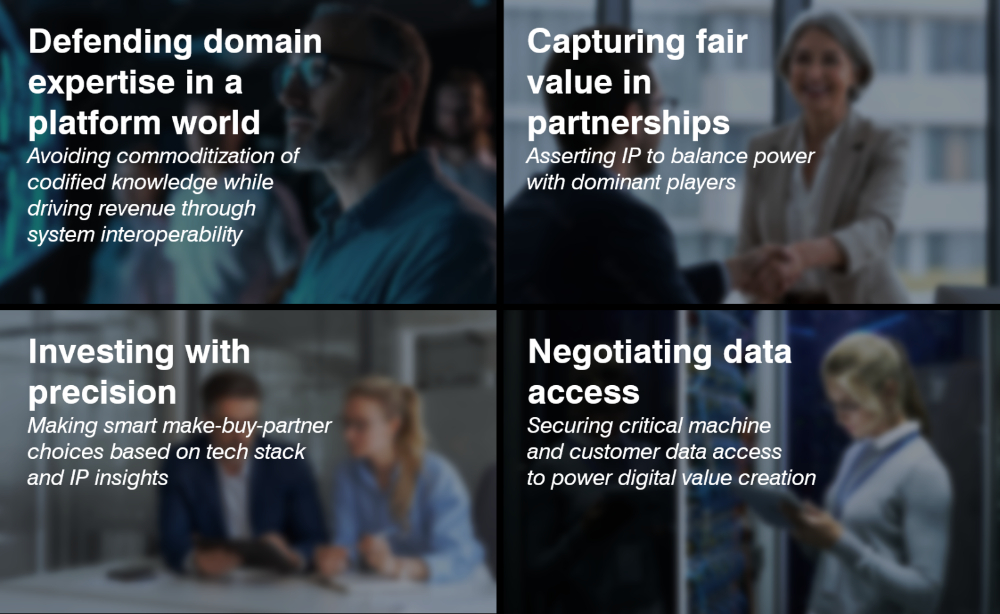

Figure 2: Four competitive situations proving the value of a Tech Differentiation Strategy

Defending domain expertise in a platform world – avoiding commoditization of codified knowledge while driving revenue through system interoperability

As SynthCo began developing digital services, the company found itself competing not just with traditional rivals, but also with system-level giants like Rockwell Automation and Honeywell, as well as platform players such as AWS and Palantir that were expanding into the industrial space. To succeed, SynthCo needed to establish a defensible edge while remaining interoperable within these broader ecosystems.

A central risk lay in the nature of SynthCo's differentiation: its domain expertise. Turning that expertise into software and data meant codifying proprietary, often tacit, knowledge. Once embedded in digital services, this know-how risked being exposed to and replicated by larger players. The company faced the threat of commoditization and being pushed out of high-value, high-margin positions in the value chain.

To avoid this outcome, SynthCo made deliberate choices about where to differentiate within the technology stack and how to ensure seamless interoperability with broader platforms. It also focused on protecting its most valuable knowledge, along with the critical connectors that enabled plug-and-play integration, through intellectual property. The objective was clear: to remain a vital, plug-in partner rather than a replaceable component in the systems.

In ecosystem negotiations with both customers and system players, SynthCo reinforced its value-adding role in the digital solution stack. Even dominant players recognized the advantage of SynthCo's tools, which integrated smoothly into existing environments and contributed meaningful differentiation – and acknowledged that SynthCo's positioning and IP made them indispensable. As a result, SynthCo has begun to unlock recurring revenue streams at higher price points for services rooted in its domain expertise.

Capturing fair value in partnerships – asserting IP to balance power with dominant players

To accelerate its digital offerings, SynthCo identified the need to collaborate with one of a few major software players specializing in manufacturing execution systems and shop-floor integration. A shortlist of potential partners was drawn up, and after initial discussions, one stood out as the clear favourite.

However, as negotiations progressed, it became clear that the dominant player intended to claim the majority of the value. Early proposals suggested a 20/80 revenue split in favour of the larger partner.

But SynthCo came prepared. Anticipating this dynamic, the company had built IP portfolios around critical choke points in the joint solution. Roughly 10 patent applications covering the key building blocks for superior performance, the system-level architecture for how those blocks were arranged and interacted, and the use cases and domain-specific configurations that drove end-user value.

Armed with this foundation, SynthCo challenged the default assumption and stated: "We control the choke points. Without us, this doesn't work."

The result was a roughly equal revenue split, despite the partner's scale and broader patent portfolio. More importantly, the IP-backed negotiation shifted the relationship dynamic. The larger partner gained confidence in SynthCo's uniqueness and value, becoming a more committed development partner and investing more R&D resources into the joint solution.

Investing with precision – making smart make-buy-partner choices based on tech stack and IP insights

Informed by a granular understanding of the technology stack, SynthCo applied a structured Make-Buy-Partner. They prioritized R&D in areas where core competencies offered a true competitive edge, while expanding their capabilities and ability to differentiate through targeted M&A and strategic partnerships. M&A and partnership decisions were guided by IP analysis, which served as a signal for innovation intensity and potential defensibility in key technology areas. This approach helped address time-to-market pressures, bridge capability gaps, and reduce technical uncertainty, while avoiding unnecessary reinvention and poor-fit acquisitions.

For example, to gain advanced sensing capabilities (important for performance-optimized control algorithms) SynthCo acquired a European specialist firm with proprietary sensor technology and deep expertise in material science. The acquisition accelerated the product roadmap by 18 months and gave SynthCo a set of unique technical assets and key competences that competitors couldn't easily replicate.

In another case, to enhance its cognitive analytics capabilities (focused on real-time decision support and adaptive system behaviour) SynthCo partnered with a leading US-based software provider. Rather than investing heavily in building and maintaining in-house analytics capabilities, SynthCo integrated the partner's proven building blocks into its offering. This move avoided millions in upfront development and recruitment costs, and enabled smarter automation across diverse customer environments.

Negotiating data access – Securing access critical machine and customer data to power digital value creation

While the first three situations centred on technology, SynthCo's success increasingly depended on access to data. In many cases, data was equally or even more critical than the technology itself.

For example, SynthCo's predictive maintenance services required real-time data from process control systems embedded in third-party machinery. However, machine manufacturers were often reluctant to allow access to data flowing from their controllers. This created friction and uncertainty that risked delaying or derailing promising digital offerings.

SynthCo responded with a carefully structured approach to data negotiations. The goal was not to claim data ownership, but to guarantee consistent, secure, and timely access. Granularity was key. SynthCo developed a detailed understanding of the types of data required and the mechanisms by which data access and consumption would occur. In the end, access arrangements proved mutually beneficial as customers gained more value from the equipment, and SynthCo's digital services could deliver their intended impact.

By successfully navigating these negotiations, SynthCo also began to shift market perceptions. Once seen primarily as a hardware provider, SynthCo demonstrated its capability as a serious software and data player. The ability to engage credibly in data partnerships helped secure market acceptance, customer success, and a sustainable position in the emerging ecosystem.

The basis for success

Tech Differentiation Strategy

SynthCo's ability to win in all the four competitive situations described had one common denominator: the creation and execution of a Tech Differentiation Strategy.

At its core, SynthCo's Tech Differentiation Strategy was an execution plan for accelerating value by systematically acting on opportunity and mitigating risk. It provided a shared taxonomy and a canvas for strategic dialogue and decision-making. Most importantly, it enabled deliberate and coordinated action across commercial, technology, data, and legal domains.

The strategy was built around four steps: Target, Position, Capture, and Control value. These were not sequential but were applied iteratively, each informing and influencing the others over time. The strategy itself was also not static. It was continuously refined and adapted as SynthCo's business evolved, and it was designed to support action even before all answers were in place. In dynamic environments, waiting for complete certainty means falling behind.

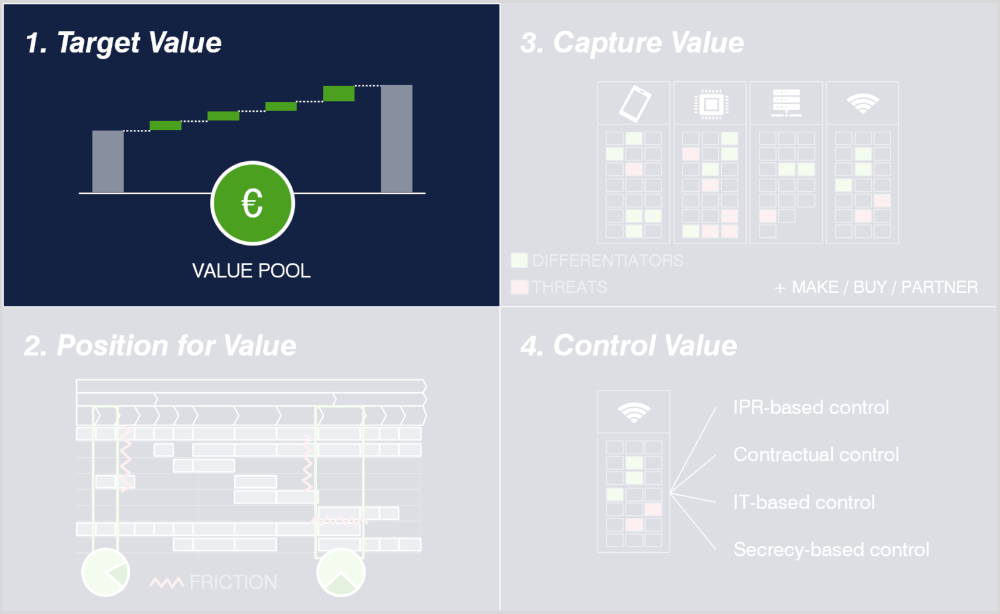

Exhibit 1

Simplified Tech Differentiation Strategy development process

1. Target Value

SynthCo recognized the need to reshape its business model, go-to-market strategy, and product portfolio to enable digital services. Continuous improvements alone would not be enough. More transformative moves were required, but these came with many options and a high degree of uncertainty. The question was where to begin.

The starting point was the Target Value step, focused on selecting high-value customer use cases. This involved identifying attractive value pools and defining how to capture a fair and substantial share of them.

SynthCo systematically assessed market attractiveness based on customer needs such as operational efficiency, cost savings, the shift from CAPEX to OPEX, and carbon footprint reduction. These insights were combined with evaluations of offering evolution and scalability, risk considerations, and SynthCo's ability to differentiate. This approach laid a solid foundation for the company's future business direction. Use cases with the greatest economic and strategic potential – and where SynthCo could establish a competitive edge – were prioritized. This approach laid a solid foundation for the company's future direction.

Exhibit 2

Select high-value customer use cases to target

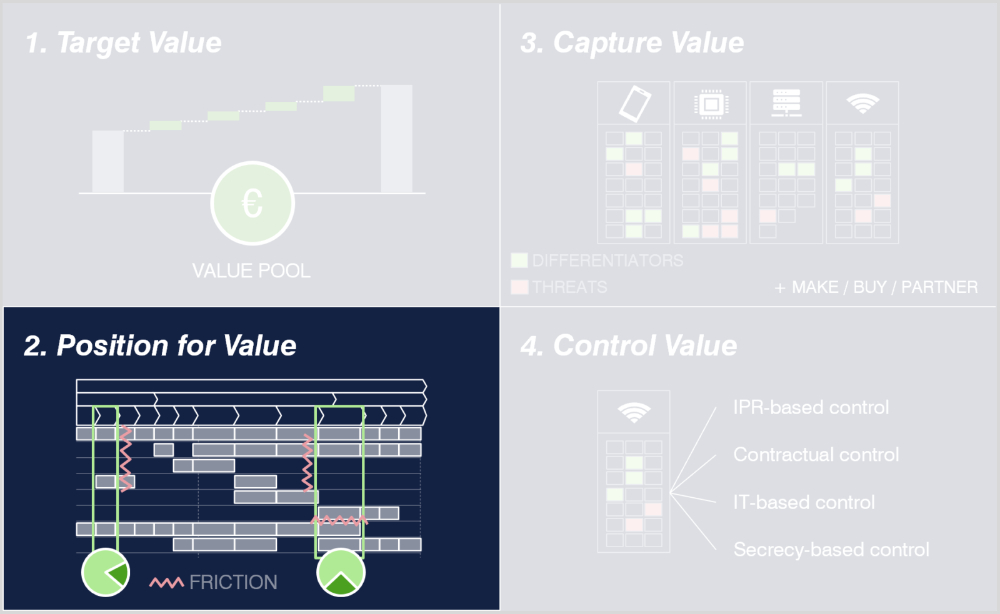

Step 2. Position for Value

In parallel with the Target Value step, SynthCo conducted Position for Value analyses to identify where in the value chain it would have a right to win. By analyzing the attractiveness of different value chain positions, along with the current positioning and anticipated moves of customers, competitors, new entrants, suppliers, and partners, SynthCo was able to select high-value positions where it could compete effectively.

The analysis also identified potential frictions that SynthCo's digital services and strategic repositioning might create with other actors in the ecosystem. These insights informed the subsequent Capture and Control Value steps and helped guide how to defend selected positions and proactively mitigate technology and data-related risks.

Exhibit 3

Select positions in the value chain with a right-to-win

Step 3. Capture value

Arguably the most fundamental element of the Tech Differentiation Strategy is the Tech & Data Map. This is a granular reference architecture outlining the technology stack and data required to develop and deliver the intended products and services over time. It enables a shared taxonomy and serves as a canvas for strategic dialogue and decision-making, allowing teams to systematically act on opportunities and mitigate risks.

SynthCo built a high-resolution tech and data reference architecture for its digital services and roadmap. This became the foundation for strategic choices, helping the company identify where to innovate and, equally important, where not to invest time and resources. It pinpointed the technology and data areas that contributed disproportionately to customer value. This clarity also informed key make-buy-partner decisions, including the acquisitions and partnerships that secured differentiating sensing and cognitive analytics capabilities.

Exhibit 4

Assess the tech stack, define critical control points, focus investments, and mitigate risks

Step 4. Control value

The final step in the iterative strategy development process is Control Value. Building on the Tech & Data Map, this step focuses on planning how to build and use intellectual property to strengthen differentiation and mitigate risk.

Rather than treating IP as a box-ticking, after-the-fact exercise, SynthCo made it a core component of its technology and business planning from the outset. The company identified key control points—critical technology and data building blocks that enabled superior performance, the architecture that defined how those components interacted, and the use cases and configurations that delivered customer value. To protect and control these points, SynthCo applied a combination of mechanisms: intellectual property rights (primarily patents), contractual safeguards, and IT-based control measures.

Importantly, SynthCo did not just build IP portfolios. It also planned and prepared how to use them strategically. The results were tangible, as demonstrated in the four competitive situations—for example, securing a more favorable revenue split with a major software partner through patent-backed positioning, and gaining access to valuable operational data through negotiations with machine manufacturers.

IP played a dual role. It enabled near-term value capture in high-stakes situations and helped build a lasting competitive advantage that supported long-term growth and profitability.

Exhibit 5

Plan for how to build and use IP for sustained advantage

Based on the four steps – Target Value, Position for Value, Capture Value, and Control Value – SynthCo consolidated its Tech Differentiation Strategy into a clear and actionable direction. The strategy was operationalized by defining concrete solution starting points to guide execution. These starting points translated the strategic intent into value acceleration plans across the teams responsible for delivery. Commercial, innovation and development, and legal/IP functions were each equipped with aligned, execution-ready plans tailored to their role in implementing the strategy.

Conclusion

The Target-Position-Capture-Control Value approach underpinned every real engagement that inspired the synthetic SynthCo narrative. In each case, the Tech Differentiation Strategy gave leadership a shared strategic canvas, a common vocabulary and granular insight into technology, data and intellectual property. This alignment enabled coordinated and deliberate action to deliver the wanted results:

- Shift to managed services. One client moved from billable hours to a high margin managed-services model, addressing customer savings in a value pool of about €500 million.

- Software-driven valuation lift. A second client raised the software share of total revenue, reshaping market perception and adding billions to enterprise value.

- Outcome as a Service. A third client faced an imminent commoditisation threat by launching an Outcome as a Service offer that protected a €3 billion legacy business from new entrants.

- Right to play with proprietary analytics. A fourth client asserted analytics capabilities and proved unique value-add beyond what customers could achieve in-house or with any other provider.

Across these and other engagements, the Tech Differentiation Strategy sharpened competitive edges, reduced risk and positioned businesses for sustained growth and profitability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.