- within Finance and Banking topic(s)

- in United Kingdom

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

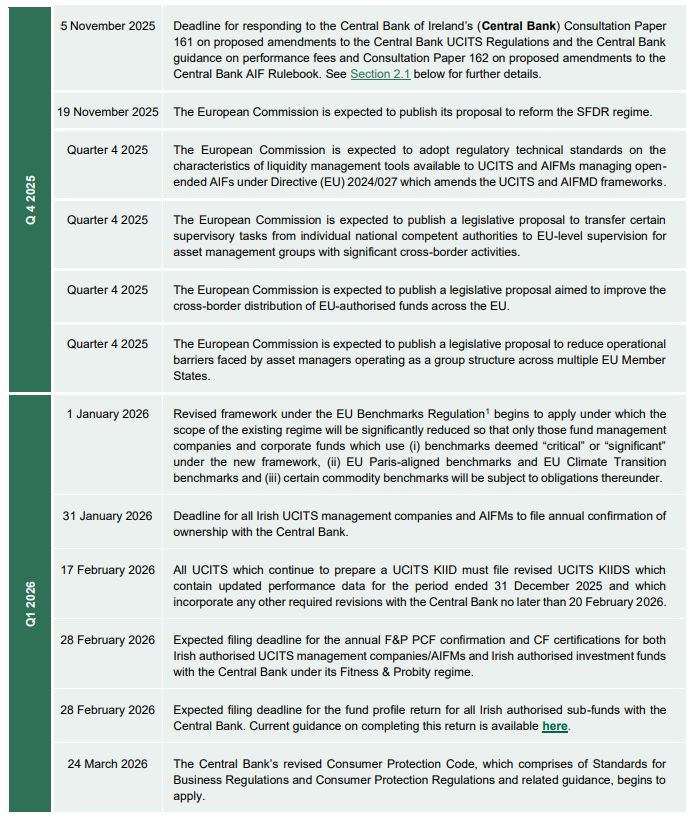

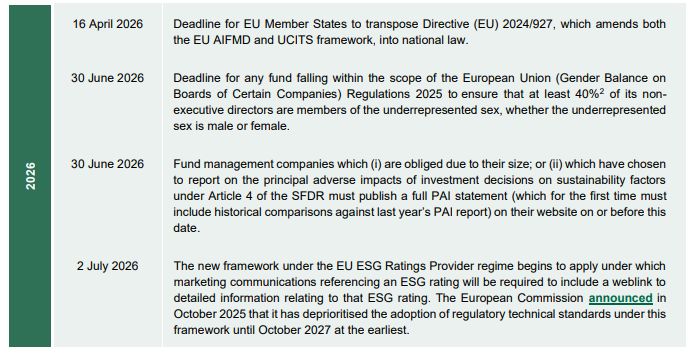

1 APPROACHING DEADLINES/DATES OF INTEREST

2 UCITS & AIFMD

2.1 Central Bank of Ireland publishes Consultation Paper 161 and Consultation Paper 162

On 9 September 2025, the Central Bank published two consultation papers in which it has outlined proposed changes to the Irish domestic AIFMD and UCITS frameworks.

The changes proposed by the Central Bank are intended to align the domestic frameworks with the revised EU rules set down in Directive (EU) 2024/927 which will apply from 16 April 2026.

The Central Bank has also proposed other changes to the domestic frameworks which are intended to:

- promote the establishment and operation of private asset funds in Ireland; and

- reduce regulatory burdens imposed on Irish fund management companies and Irish domiciled funds, consistent with the objective of the European Commission's Savings & Investments Union.

Consultation Paper 161 contains the Central Bank's proposed amendments to its Central Bank UCITS Regulations and the Central Bank's Guidance on performance fees for UCITS and certain types of retail AIFs.

Consultation Paper 162 contains the Central Bank's proposed amendments to its AIF Rulebook.

The deadline for responding to both consultations is 5 November 2025.

A copy of Consultation Paper 161 is available here.

A copy of Consultation Paper 162 is available here.

A Dillon Eustace analysis of the proposals put forward in both consultation papers is accessible here.

2.2 ESMA publishes Q&A on UCITS performance fees

On 15 July 2025, ESMA published a Q&A on the topic of payment of performance fees by UCITS feeder funds.

ESMA notes that the manager of a UCITS feeder fund does not exercise sufficient discretion over the asset allocation, selection and fund strategy to warrant a performance fee and that the performance fee, if any, should generally be charged at the level of the UCITS master fund.

This is unless:

- the master fund and the feeder fund are managed by the same manager or by managers belonging to the same group; and

- the only investor(s) of the master fund is(are) feeder fund(s);

in which case performance fees could be paid at the level of the feeder fund(s), and not at the level of the master fund, provided that this approach applies consistently to all feeder funds, if more than one.

A copy of the Q&A is available here.

2.3 ESRB publishes EU Non-Bank Financial Intermediation Risk Monitor 2025

On 1 September 2025, the ESRB published a report setting out the main risks and vulnerabilities associated with investment funds and other financial institutions in 2024 (Report).

The Report contains three special features investigating leverage in AIFS, highly leveraged UCITS and global hedge funds. It also considers interconnectedness between real estate funds and banks.

The Report notes that some UCITS using absolute VaR have high levels of gross leverage that exceed those of AIF hedge funds. The ESRB also notes that there are "pockets of vulnerabilities within UCITS using the Absolute VaR approach that need to be addressed" and that this albeit small cohort of UCITS funds have the potential to damage the "high reputation of the UCITS brand".

In the Report, the ESRB reiterates its call to the European Commission to revisit the metrics and limits prescribed under the UCITS Directive and the AIFMD in order to mitigate risks associated with excessive leverage.

A copy of the Report is available here.

2.4 ESMA publishes second report on trends, risks and vulnerabilities

On 9 September 2025, ESMA published its second report on trends, risks and vulnerabilities for 2025 (Report).

In it, ESMA identifies the key risk drivers currently affecting EU financial markets which include geopolitical and peripheral risks and uncertainty arising from a fundamental shift of the macroeconomic context and notes that in the first half of 2025, EU funds "experienced their highest episode of volatility since the COVID-19 outbreak but exhibited positive performance amid muted flows".

A copy of the Report is available here.

3 SUSTAINABLE FINANCE

3.1 ESAs publish revised Q&A on SFDR

On 4 August 2025, the European Supervisory Authorities3 (ESAs) published a revised edition of their Q&A on SFDR (Q&A).

The newly added Q&A confirm that the SFDR does not prescribe a single methodology (e.g. quarterly snapshots or year-end figures) for calculating top investments or shares of investments in periodic report disclosures required to be published by funds falling within the scope of Article 8 and Article 9 of the SFDR. The ESAs note that the appropriate methodology used by financial market participants should follow the applicable sectoral legislation referenced in Article 11(2) SFDR, and no uniform approach can be mandated across all regimes.

The Q&A also confirm that funds which fall within the scope of Article 8 and Article 9 of the SFDR may disclose minimum commitments to environmentally sustainable investments (X%) and socially sustainable investments (Y%) that do not necessarily add up to the total minimum commitment to sustainable investments (Z%). In such cases, the ESAs recommend that a clear explanation is provided in the asset allocation section of the relevant pre-contractual annex.

The ESAs also provide additional guidance on (i) PAI indicator 6 in Table 2 of Annex I to the SFDR Delegated Regulation4 which relates to water usage and recycling and (ii) how the phrase "per square meter" should be understood in the context of indicators applicable to investments in real estate assets.

A copy of the Q&A is available here.

To view the full article click here.

Footnotes

1. Regulation (EU) 2016/1011 as amended by Regulation (EU) 2025/914

2. This requirement will be deemed satisfied when the number of non-executive directors from the underrepresented sex on the board of directors of the relevant company aligns with the number set down in the schedule to the relevant regulations.

3. The European Supervisory Authorities comprise of ESMA, EIOPA and the ECB

4. Commission Delegated Regulation (EU) 2022/1288 as amended

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.