- with Inhouse Counsel

- with readers working within the Banking & Credit and Healthcare industries

Ireland's economy bounced back remarkably strongly in 2021 from the Covid-19 disruption of the previous year. The European Commission estimates that Irish GDP grew by 14.6% over 2021, making Ireland the best-performing economy in the European Union by some distance. Although the EC expects growth to moderate to 5.1% in 2022, this is still comfortably ahead of the 4.3% it anticipates across the EU as a whole.

Ireland's resurgence reflects both booming exports as the global economy rebounded from the significant number of multinational companies that have chosen to locate in the country, and a very strong performance from the domestic economy, with consumer spending sharply up compared with 2020.

Moreover, Ireland's businesses were well-placed to capitalise on recovery following good progress on vaccinating the population against Covid-19. By mid-December, 76.8% of Ireland's citizens had received two vaccinations, compared with only 67.3% across the whole of the EU.

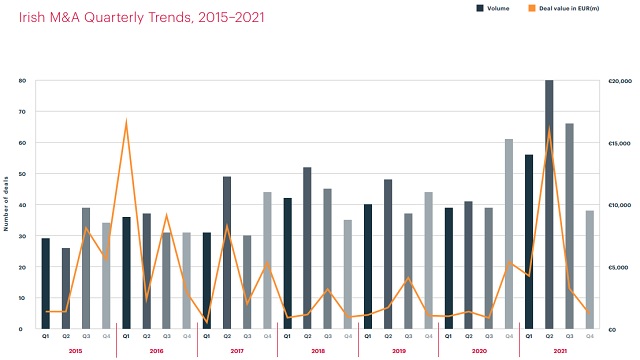

Against this backdrop, the Irish M&A market recorded a busy year, building on the recovery that began in the fourth quarter of 2020 following the lull prompted by the outbreak of the Covid-19 crisis. Over the whole of 2021, Ireland saw 240 significant transactions, a 33% rise on the previous year and the highest deal volume on Mergermarket record (since 2006). Total M&A value also recovered significantly, rising by 185% to €24.6bn.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]