- within International Law topic(s)

- in United States

- within Employment and HR, Corporate/Commercial Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Accounting & Consultancy and Retail & Leisure industries

Anti-dumping duties can drastically impact the profitability of cross-border trade. While these tariffs are designed to protect the European market from unfairly priced imports, they often leave importers facing high costs, uncertainty, and supply chain disruptions.

But not all duties are unavoidable. With proper preparation, many Polish businesses can legally reduce, mitigate, or even avoid the application of anti-dumping measures altogether.

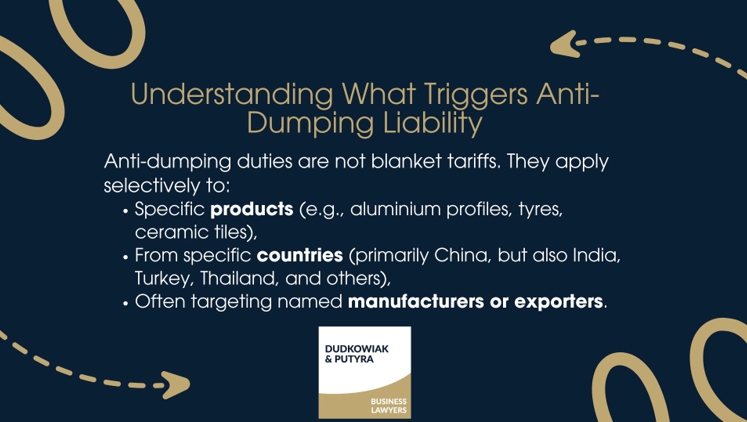

Understanding What Triggers Anti-Dumping Liability

Anti-dumping duties are not blanket tariffs. They apply selectively to:

- Specific products (e.g., aluminium profiles, tyres, ceramic tiles),

- From specific countries (primarily China, but also India, Turkey, Thailand, and others),

- Often targeting named manufacturers or exporters.

The key legal issue is whether your product, as declared to Polish customs, matches the items listed in European Commission implementing regulations or the regulations which can also be searched in the Taric database.

Strategy 1: Verify the Customs Classification

The first and most effective strategy is to confirm the product's tariff code before importing.

Use the Binding Tariff Information (BTI) system to obtain a legally binding ruling on your product's classification. This ensures your goods are declared under the correct customs code-and not mistakenly matched to a duty-covered item.

Misclassification is one of the most common causes of unnecessary duties and audit disputes.

Strategy 2: Confirm the Origin with a BOI

When anti-dumping duties apply only to goods from certain countries (e.g., China), proving that your shipment originates elsewhere is essential.

Through Binding Origin Information (BOI), importers can obtain an official customs decision confirming the declared country of origin. This is especially useful for:

- Goods partially manufactured in multiple locations,

- Disassembled products or semi-finished components,

- Suppliers that operate across several countries.

A BOI protects your company in case of customs inspections or future audits.

Strategy 3: Determine If the Duty Applies to Your Supplier

Some anti-dumping measures apply only to specific exporters or manufacturers, while others impose general duties on entire industries.

Check whether:

- Your supplier is named in an EU regulation,

- A company-specific duty rate has been applied,

- Your source is covered by a country-wide residual tariff.

Importers that can demonstrate sourcing from exempt or lower-rate suppliers may significantly reduce their customs burden.

Strategy 4: Legal Opinion Before Import

If the duty status of your product is unclear, request a legal opinion from customs and trade counsel. This is particularly valuable in complex cases such as:

- Product modifications,

- Technical classifications,

- New suppliers not listed in prior EU decisions.

A legal memo can guide your internal compliance procedures, help avoid delays at clearance, and prepare your company for potential audits.

Strategy 5: Monitor Regulatory Changes and Exemptions

Anti-dumping duties are often time-limited (usually 5 years) and may be lifted, renewed, or modified based on EU trade policy.

Examples:

- In 2018, the EU lifted duties on Chinese solar panels, changing pricing dynamics overnight.

- In 2022, duties on Ukrainian steel were removed to support the Ukrainian economy.

Smart importers monitor updates through:

- TARIC database,

- European Commission's Official Journal,

- Professional advisory alerts.

This allows you to adjust your sourcing strategy before tariffs affect your costs.

Strategy 6: Prepare for Customs and Tax Audits

Even if duties are avoided at import, your documentation must support your declarations. This includes:

- BTI/BOI confirmations,

- Supplier contracts and shipping documentation,

- Technical product specifications,

- Evidence of manufacturing processes or assembly location.

Without this, Polish customs may retroactively apply duties-or impose penalties for misdeclaration.

Prevention Is Cheaper Than Correction

Anti-dumping duties are not just a policy issue-they're a legal and financial risk for importers. Fortunately, businesses that act early and strategically can often avoid being caught in the net.

By using tools like BTI, BOI, and legal analysis, Polish importers can maintain control over costs and compliance-without jeopardizing their international trade plans.

For tailored support on classification, origin rulings, and supplier risk analysis, our customs law team is ready to assist.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.