- within Tax topic(s)

- with Finance and Tax Executives

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Media & Information industries

1. EXECUTIVE SUMMARY

The Supreme Court of India's judgement in the matter of the Authority for Advance Rulings (Income Tax) & Ors. v. Tiger Global International Holdings marks a decisive turning point in India's approach to treaty-based tax planning, particularly under the India–Mauritius Double Taxation Avoidance Agreement ("DTAA"). The ruling significantly recalibrates the balance between treaty protection and anti-avoidance enforcement, reinforcing the primacy of substance over form in cross-border investment structures.

By overruling the Delhi High Court's decision, the Supreme Court has held that reliance on a valid Tax Residency Certificate ("TRC") is no longer sufficient, by itself, to claim treaty benefits. The Court has held that the General Anti-Avoidance Rules ("GAAR") override treaty protections where arrangements lack commercial substance or are primarily designed to obtain tax benefits, even in respect of investments made prior to April 1, 2017.

This judgement has far-reaching implications for foreign investors, particularly private equity and venture capital funds operating through layered offshore structures. While the decision reflects legislative intent post the Vodafone case, it raises concerns regarding certainty, grandfathering of past investments, and India's attractiveness as a long-term investment destination. Going forward, investors will need to ensure that governance, control, and economic substance are demonstrably aligned with treaty claims to withstand GAAR scrutiny.

2. INTRODUCTION

The Supreme Court of India's decision in the matter of the Authority for Advance Rulings (Income Tax) & Ors. v. Tiger Global International II Holdings, Tiger Global International III Holdings and Tiger Global International IV Holdings represents a significant paradigm shift in the interpretation and application of the Convention between the Government of the Republic of India and the Government of Mauritius1, commonly referred to as the India–Mauritius Double Taxation Avoidance Agreement ("DTAA"), with respect to cross-border transactions involving indirect transfers of shares of Indian companies by non-resident investors.

While setting aside the judgement of the Hon'ble Delhi High Court, the Supreme Court permitted the Revenue Department to raise additional grounds involving questions of law for the first time before it. The Court held that non-resident investors cannot claim treaty benefits merely by establishing formal tax residency in Mauritius through reliance on Tax Residency Certificates ("TRCs") issued by the Mauritian authorities.

The ruling reaffirms that the General Anti-Avoidance Rules ("GAAR") under Chapter X-A of the Income-tax Act, 1961 (the "Act") apply to transactions that qualify as 'impermissible avoidance arrangements', thereby empowering tax authorities to look beyond form and examine the real substance of cross-border investment structures.

3. BACKGROUND

Before analysing the Supreme Court's judgement, it is necessary to briefly outline the factual and legal background that culminated in this landmark ruling.

The Assessees

- Tiger Global International II Holdings, Tiger Global International III Holdings, and Tiger Global International IV Holdings (hereinafter individually referred to as an "Assessee" and collectively the "Assessees"), are private companies limited by shares, incorporated under the laws of Mauritius.

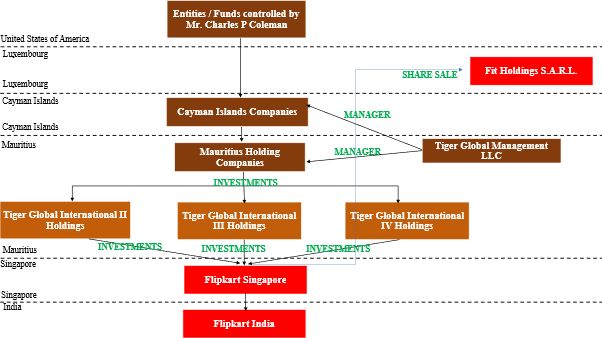

- Based on publicly available information, the principal

shareholders of the Assessees were Mauritius-based private

companies, which were in turn owned by Cayman Islands-based

funds/investment companies. Tiger Global Management LLC, a company

incorporated in the United States of America, acted as the

investment manager of these Cayman Islands based funds. We

understand that the ultimate beneficial owner and promoter of the

Tiger Global group ( which included the Assessees as well as Tiger

Global Management LLC) is Mr. Charles P. Coleman, a resident of the

United States.2

- The Assessees had similar governance structure:

- Each Assessee had a three-member board of directors, comprising two Mauritian residents and one US resident.

- The Assessees maintained, and continue to maintain, their principal bank account and accounting records in Mauritius.

- The Assessees held and continue to hold office premises in Mauritius since incorporation.

- The Assessees have two employees at their office premises.

- Each Assessee was granted a Category I Global Business Licence under Section 72(6) of the Mauritius Financial Services Act, 2007, and were regulated by the Financial Services Commission of Mauritius.

- The Assessees held valid Tax Residency Certificates ("TRC") issued by the Mauritius Revenue Authority, certifying them to be residents in Mauritius for the purposes of income tax.

- Between 2011 and 2015, the Assessees acquired shares in Flipkart Private Limited ("Flipkart-SG"), a company incorporated under the laws of Singapore which, in turn invested in Flipkart group companies in India and hence, the value of shares of Flipkart-SG was substantially derived from assets located in India.

- In 2018, as part of a broader transaction involving the majority acquisition of Flipkart-SG by the global retail giant, Walmart Inc., a company incorporated in the United States of America, the Assessees sold their shares in the Flipkart-SG to Fit Holdings S.A.R.L., an entity incorporated in Luxembourg (an acquisition vehicle of, Walmart Inc.). This broader transaction resulted in Walmart Inc. acquiring the majority stake in Flipkart group companies in India.

4. APPLICATION TO TAX AUTHORITIES BY ASSESSEES CLAIMING 'NIL' WITHHOLDING OF TAX IN INDIA

- Prior to the consummation of the aforesaid transfer, the Assessees filed application under extant provisions of the Section 197 of the Act before the Indian tax authorities, seeking certification of 'nil' withholding of tax.

- On August 17, 2018, the tax authorities informed the Assessees that they would not be eligible to avail the benefits under the DTAA on the grounds that they were not independent in their decision-making and that the control over the decision-making of the purchase and sale of shares in Flipkart-SG did not lie with the Assessees. Accordingly, the tax authorities issued certificates dated August 17, 2018 to the Assesses prescribing the withholding rate applicable to each Assessee in respect of the shares transferred by them to Fit Holdings S.A.R.L.

5. APPLICATION BY THE ASSESSEES TO THE AUTHORITY FOR ADVANCE RULING

- Thereafter, the Assessees filed applications under Section

245Q(1) of the Act before the Authority for Advance Rulings

("AAR") and sought ruling on the following

question:

"Whether, on the facts and circumstances of the case, gains arising to the assessees (private companies incorporated in Mauritius) from the sale of shares held by them in Flipkart Pvt. Ltd (a private company incorporated in Singapore) to Fit Holdings S.A.R.L. (a company incorporated in Luxembourg) would be chargeable to tax in India under the Act read with the DTAA between India and Mauritius?" - The AAR came to the conclusion that the applications preferred

by the Assessees relate to the transaction/issue which is prima

facie designed for avoidance of income-tax and therefore rejected

the same as being hit by the threshold jurisdictional bar to

maintainability under section 245R(2)(iii) of the Act and on the

ground stated that it "relates to a transaction or issue

which is designed prima facie for the avoidance of

income-tax".

The AAR held that the Assessees were mere conduit companies, lacking commercial substance, and were disentitled to claim DTAA benefits.

The AAR also held that it was not obliged to render findings on the merits of the question whether the Assessees were entitled to the benefits of the DTAA in respect of the sale of shares of Flipkart-SG (since it was a private company incorporated under the laws of Singapore) or on the taxability of capital gains arising therefrom. - Below are the findings in support of orders passed by the

AAR:

- Control and

Management of the Assessees

It was observed that, although the decisions for investment or sale were formally taken by the Boards of Directors of the Assessees, the major financial decisions (transactions exceeding USD 250,000), was wielded to Mr. Charles Coleman, an individual resident in the USA, who was also the ultimate beneficial owner of all the holding companies under the Tiger Global group. AAR concluded that the head and brain of the Assessees and consequently, their control and management was situated, not in Mauritius, but outside Mauritius, particularly in the United States of America where Mr. Coleman was based.

It was further observed that the only significant activity of the Assessees was that of holding investment in Flipkart-SG. Hence, it was determined that the Assessees were mere "see-through entities" or conduits of the ultimate beneficiary, and that the Assessees served no real commercial purpose other than to act as a pass-through vehicle to claim benefits under the DTAA.

Though the Assessees contended that the shares of the Flipkart-SG derived their value substantially from assets located in India and that they were eligible to claim benefit under Article 13(4) of the DTAA, AAR was of the view that the fact remained that what was transferred were shares of a Singapore company and not that of an Indian company.

The objective of the DTAA was to allow exemption of capital gains only on the transfer of shares of an Indian company, and any such exemption in respect of shares of a company not resident in India was never intended by the legislature.3 - Rejection of

grandfathering provisions

The Assessees contended that, since the shares were acquired prior to April 01, 2017, the transaction was protected under grandfathering provisions for the pre-2017 investments.

The AAR rejected this contention, holding that grandfathering presupposes that the transaction is otherwise eligible for treaty benefits. Further, AAR held that, since the Assessees were conduit entities and the asset transferred was not shares of an Indian company, the grandfathering protection was not available.

- Control and

Management of the Assessees

6. WRIT BEFORE DELHI HIGH COURT

- Aggrieved by the order(s) dated March 23, 2020, passed by the AAR, the Assessees filed the writ petitions before the Delhi High Court (the "High Court").

- The High Court, vide its judgement and common order dated August 28, 2024 in the three writ petitions, allowed the writ petitions and quashed the AAR's order and held that the Assessees were entitled to benefits under the DTAA and that the capital gains arising from the sale of shares by the Assessees in Flipkart-SG, were not chargeable to tax in India under the Act read with the DTAA.

- Below are the findings in support of orders passed by the High

Court:

- Commercial and

Economic Substance

The AAR had observed that the Assessees were structured as pooling vehicles for investments and held valid Category I Global Business Licences issued under Section 72(6) of the Financial Services Act, 2007 enacted by the Parliament of Mauritius.

The High Court took note of the fact that:

- The Assessees' investor base comprised more than 500 investors from over 30 jurisdictions;

- The consolidated financials reflected total liabilities and shareholders' equity exceeding USD 1.76 billion; and

- The net increase in shareholders' equity from operations exceeded USD 267 million.

- Control,

Decision-Making and Board Autonomy

The High Court observed that:

- A holding or parent entity may exercise supervisory control over subsidiaries without rendering the subsidiary a mere puppet;

- Such influence does not justify piercing the corporate veil in the absence of fraud, sham or complete lack of independence;

- Decisions were taken collectively by the Boards, and that authority conferred on Mr. Coleman to approve high-value expenditures flowed from Board resolutions, which also required countersignature by Mauritian-based directors.

The High Court held that the minutes of Board meetings, read holistically, evidenced deliberative and collective decision-making and not unilateral control, and that mere presence of directors connected with the Tiger Global group, including Mr. Charles P. Coleman and Mr. Steven Boyd, could not justify the inference that the Boards of the Assessees were subservient or lacked independence. - Evidentiary Value of

Tax Residency Certificates

The High Court held that a valid TRC was sufficient evidence of tax residency and creates a presumption of legitimate tax residence and beneficial ownership. It observed that Indian tax authorities are not entitled to go behind the TRC unless they are able to discharge a high burden of establishing fraud, sham transactions, or complete lack of economic substance. - Treatment of Treaty

Shopping and Reliance on Supreme Court Precedent

Relying on the decisions of the SC in Union of India v. Azadi Bachao Andolan and Vodafone International Holdings B.V. v. Union of India, the High Court held that:

- The mere fact that an entity is incorporated in Mauritius or that investments are routed through Mauritius does not, by itself, justify an adverse inference that the Assessees are conduit entities designed for avoidance of tax.

- Mauritius has long been recognised as a favourable investment destination and treaty shopping per se is not impermissible, unless it is demonstrated that the arrangement is a device for tax evasion or is contrary to the intent of the treaty.

- Treaty Abuse and New

articles on Limitation of Benefits

The High Court held that the article on Limitation of Benefits ("LOB") introduced in the DTAA constitutes a specific anti-abuse rule agreed upon by the Contracting States. Once the objective criterias under the LOB clause are satisfied, the Revenue cannot impose additional subjective tests or invoke vague suspicions of abuse.

High Court further held that any attempt to deny treaty benefits despite satisfaction of the LOB clause would require compelling evidence of fraud or abuse, which was absent in the present case. - Interpretation of

Article 13(3A) of the DTAA read against provisions of General

Anti-Avoidance Rules under the Act

The High Court held that Article 13(3A) of the DTAA clearly reflected the intent of the Contracting States to ring-fence and exempt capital gains arising from shares acquired prior to April 01, 2017.

The High Court noted that:

- Article 13(3B) of the DTAA prescribed tax rates only for shares acquired after April 01, 2017.

- The absence of any tax rate for pre-2017 acquisitions demonstrated a conscious intent to exempt such gains from taxation.

- Application of DTAA

to indirect transfer

The High Court held that:

- The shares sold by the Assessees derived substantial value from Indian assets.

- Accepting the AAR's interpretation would render the grandfathering clause nugatory and otiose.

- Conclusions of the

High Court

The High Court concluded that:

- The AAR's order dated March 26, 2020 suffered from manifest and patent illegalities.

- The conclusion by AAR that the transaction was designed for tax avoidance was arbitrary and unsustainable.

- The transaction was duly grandfathered under Article 13(3A) of the DTAA.

- Commercial and

Economic Substance

7. SPECIAL LEAVE PETITION BEFORE THE SUPREME COURT OF INDIA

- Aggrieved by the order of the High Court, the Tax Department

appealed to the Supreme Court (the "SC"), by way of a

special leave petition for which the leave was granted. It is

important to note that the Additional Solicitor General appearing

on behalf of the Tax Department submitted that the AAR had

expressed only a prima facie view of the matter and submitted

several points of law before the Supreme Court (which were not

raised by the AAR in its own ruling or before the High

Court).

Based on the submissions made by the parties, the Supreme Court overruled the judgement of the Delhi High Court and held that the transfer of the equity shares of Flipkart SG from which the Assessees derived capital gains, was in fact an arrangement impermissible under law. Therefore, as per the SC the Assessees were not entitled to claim exemption under Article 13(4) of the DTAA. Consequently, GAAR becomes applicable and the transaction under question tantamount to tax avoidance under Section 245R(2). Accordingly, the capital gains arising therefrom are taxable in India under the Act r/w DTAA. - Grounds on which the Supreme Court based its judgement:

- Evolution of law

which resulted in dilution of earlier judicial

precedents

The Supreme Court acknowledged that till the Vodafone judgement, the tax regime under the principal DTAA and the circulars of the Central Board of Direct Taxes facilitated the 'Mauritius Route' which allowed the investors to plan their investment route through Mauritius as the DTAA prevailed to the extent that it was more beneficial to the assessee. In the aftermath of the Vodafone case, the Indian Government introduced significant amendments to the Income Tax Act, which aimed at overriding the implication of the Vodafone judgement by removing its basis and addressing tax avoidance concerns.

The Supreme Court identified Vodafone judgement as a turning point that led to decisive legislative intervention. It held that the amendments to the Act and the DTAA post the Vodafone judgement represented a foundational change and not just a marginal adjustment in India's approach to aggressive tax planning. In particular, the SC emphasised the retrospective amendment to Section 9 of the Income-tax Act, 1961, which statutorily incorporated the "look-through" principle for indirect transfers; and the introduction of General Anti-Avoidance Rule ("GAAR") under Chapter X-A of the Act empowering tax authorities to disregard arrangements lacking commercial substance and those primarily entered into to obtain a tax benefit.

The SC held that these measures collectively diluted the continued applicability of earlier treaty-centric jurisprudence and marked a transition from formalism to substance-based analysis. - TRC – No Longer

sufficient

The SC held that, following the insertion of Sections 90(4)4 and 90(5)5 in the Income-tax Act, 1961, a TRC is not conclusive proof of residence or beneficial ownership. The SC clarified that considering the aforementioned statutory amendments made to the Income Tax Act, reliance cannot be placed solely on TRC to claim benefit under the DTAA.

It observed that earlier judicial pronouncements and the circulars of the Central Board of Direct Taxes which treated TRCs as conclusive proof to claim the benefits under the DTAA were based on legislation before the introduction of GAAR and thus, such judicial pronouncements and circulars could not override statutory amendments which came into effect subsequently. The SC affirmed that, as a consequence, tax authorities are now entitled to look beyond the TRC and also pierce the corporate veil in order to examine the real substance of the arrangement. - Decisive Application

of GAAR in the present case

Prior to the Finance Act, 2012, Section 90(2) of the Income Tax Act provided that where a DTAA exists, the provision of the Income Tax Act or the DTAA, whichever is more beneficial to the taxpayer, shall apply. However, the new amendment to this section clarified that GAAR provisions would apply even if they result in tax consequences that take away any benefit under the existing DTAA. Accordingly, the benefit of DTAA overriding the Income Tax Act were curtailed by making the DTAA subject to GAAR. As such the tax payer friendly DTAA provisions would not be available if GAAR is invoked.

The SC held that the present case deviated from the earlier matters of Vodafone and Azadi Bachao Andolan squarely on the application of GAAR, and it expressly rejected the Assessees' claim of grandfathering protection of the transaction from the applicability of GAAR. - Investment vs

Arrangement

The SC drew a clear distinction between an 'investment' and an 'arrangement'. While Rule 10U(1) of the Income-tax Rules, 1962 protects investments made prior to April 01, 2017, the SC held that GAAR requires an examination of the entire arrangement holistically.

In the present case, the relevant arrangement was not merely the acquisition of shares between 2011 and 2015, but the entire scheme, which included setting up conduit companies in Mauritius, routing funds through them into a Singaporean entity and structuring an exit in 2018 designed to achieve a tax-free gain. - Effect of Rule

10U(2)

The SC held that the grandfathering protection under Rule 10U(1)(d) of the Income Tax Rules, 1962 is limited by Rule 10U(2), which provides that, without prejudice to grandfathering under Rule 10U(1), GAAR applies to 'any arrangement' from which a tax benefit is obtained on or after April 01, 2017. It held that the phrase 'without prejudice' makes it clear that grandfathering does not grant immunity to arrangements, irrespective the date on which it has been entered into, in respect of that tax benefits obtained from such arrangement post-2017.

Since the sale transaction and capital gains arose in 2018, the Supreme Court held that GAAR was fully applicable, thereby inferring that the transfer in question was categorised as 'arrangement' under Rule 10U(2). - Impermissible

Avoidance Arrangement

Applying the provisions of the GAAR framework, the SC affirmed AAR's findings that the present structure lacked commercial substance and was designed primarily to obtain a tax benefit. The SC further held that the objective of achieving double non-taxation was contrary to the purpose of the DTAA, which is intended to prevent double taxation, not facilitate tax avoidance.

In view of the foregoing analysis, the SC concluded that the High Court had erred in extending treaty protection to the Assessees and accordingly set aside its judgement and upheld the decision of the AAR in rejecting the applications at the threshold, holding that the impugned transaction formed part of an impermissible avoidance arrangement within the meaning of provisions of GAAR under Chapter X-A of the Act. Consequently, the Assessees were held not entitled to claim benefits under the DTAA, and the capital gains arising from the transaction were liable to tax in India.

- Evolution of law

which resulted in dilution of earlier judicial

precedents

8. ANALYSIS

As mentioned at the start, the decision of the SC in this matter of Tiger Global is a paradigm shift from earlier stand taken by the SC as well as various tax authorities with regard to the taxability of capital gains tax arising out of indirect transfer of shares of Indian companies by the non-resident investors under the DTAA. The main reason for this shift is that post the Vodafone judgement, the Indian Government made very significant changes to the then existing taxation laws with an intention to override the implication of the Vodafone judgement. The three significant amendments include:

- amendment to Section 9 – indirect transfer provisions;

- introduction of GAAR provisions;

- amendment to Section 90 – treaty override and TRC requirements.

Analysis the above changes in detail:

(i) Amendment to Section 9 – indirect transfer provisions

The amendments to Section 9 inserted new explanations to Section 9(1)(i) vide the Finance Act 2012 with retrospective effect from 1st April, 1962-

"Explanation 4. —For the removal of doubts, it is hereby clarified that the expression "through" shall mean and include and shall be deemed to have always meant and included "by means of", "in consequence of" or "by reason of".

Explanation 5.—For the removal of doubts, it is hereby clarified that an asset or a capital asset being any share or interest in a company or entity registered or incorporated outside India shall be deemed to be and shall always be deemed to have been situated in India, if the share or interest derives, directly or indirectly, its value substantially from the assets located in India."

This amendment expanded the application of Section 9 and codified the principle of source-based taxation, wherein the State where the actual economic nexus of income exists has the right to tax such income, irrespective of the place of residence of the entity deriving it. Correspondingly, Section 195 (which mandates deduction of tax at source) was also amended, to explicitly provide that a non-resident person was also required to deduct tax at source before making payments to another non-resident if the payment represented income chargeable to tax in India in the hands of the payee non-resident.

In view of this amendment, the SC while asserting the importance of source-based taxation, held that it is natural and imperative that it is a right of a nation whose soil or source stands used or exploited for generating or earning an income to get the right to tax it. The place, location or the source of earning should also by default become the jurisdiction of taxation. Any arrangement to the contrary is nothing but compromise.

(ii) Introduction Of GAAR Provisions

Post the Vodafone judgement, in order to monitor the increasingly aggressive and complex tax structure, GAAR provisions were introduced to the Income Tax Act, 2012 under Chapter XA with the objective of codifying the doctrine of substance over form. Though initially introduced vide the Finance Act of 2012, the provisions were made effective after several deliberations only w.e.f. 1st April, 2017.

The overriding effect of GAAR provisions is established from the fact that Section 95(1) provides that 'Notwithstanding anything contained in the Act, an arrangement entered into by an assessee may be declared to be an 'impermissible avoidance arrangement' and the consequence in relation to tax arising therefrom may be determined subject to the provisions of this Chapter'.

'Impermissible avoidance arrangement' has been defined as an arrangement which lacks commercial substance and where the main purpose or one of the main purposes is to obtain tax benefits and which satisfied at least one of the conditions prescribed therein.

With the introduction of GAAR, the tax authorities are now empowered to go behind any commercial arrangement which claimed tax benefits to determine whether such arrangement would fall within the ambit of 'impermissible avoidance arrangement'. Further, by insertion of Section 90(2A), the GAAR provisions would apply even if it would result in tax consequences that take away any benefit under the existing DTAA.

Rule 10U(1)(d) under the Income Tax Rules, exempts and grandfathers income from the transfer of "investments" made before April 1, 2017, from the applicability of GAAR. However, Rule 10(U)(2) dilutes this exemption and provides that notwithstanding Rule 10U(1)(d), GAAR provisions shall apply to any 'arrangement' irrespective of the date on which it has been made, in respect of the tax benefit obtained from that 'arrangement' on or after 1st April, 2017. The SC held in this case that this ensured that while pre-existing investments were safeguarded, 'arrangements' that continued to yield tax benefits beyond the specified date remained within the ambit of GAAR, preventing abuse of grandfathering provisions. The use of word 'any arrangement' is exhaustive enough to include any benefit arising out of the sale of shares.

Accordingly, while interpreting that the manner of holding the shares of Flipkart India through multiple layers of companies / funds tantamount to 'arrangement' under the newly inserted GAAR provisions, the SC held that GAAR provisions were applicable to the instant case and the investment in Flipkart SG is not grandfathered due to the overriding effect of Rule 10(U)(2).

(iii) Amendment to Section 90 of the Income Tax Act – Treaty override and TRC requirements

Post Vodafone, Section 90 underwent substantial change in the way in which a tax treaty would be interpreted. Prior to the amendment, Section 90(2) of the Income Tax Act provided that where a DTAA exist, the provision of the Income Tax Act or the DTAA, whichever is more beneficial to the taxpayer, shall apply. However, the insertion of Section 90(2A) clarified that notwithstanding Section 90(2) the GAAR provisions would apply even if it would result in tax consequences that take away any benefit under the existing DTAA. Accordingly, the benefit of DTAA overriding the Income Tax Act were curtailed by making the DTAA subject to GAAR.

Further, new sections 90(4) and 90(5) provided that while TRC is necessary requirement for claiming benefit under a DTAA, it is not the sole requirement. The assessee is under an obligation to provide such other documents and information as prescribed by the tax authorities. This new amendment implied that existence of a TRC alone cannot be treated as sufficient to claim benefit under DTAA.

In Vodafone's case, the SC had held that TRC cannot be pierced except in cases involving fraud, sham transactions etc. However, in the instant case while applying the new provisions of Section 90, the SC held that the Revenue Authority was justified in its stance in piercing the corporate veil to determine the real nature of the transaction under question notwithstanding the fact that the Assessees were holding the TRC issued by the Mauritius authority.

It is pertinent to note that post the SC's judgement in Vodafone's matter, the DTAA was also amended by way of a Protocol signed on 10th May, 20216. The SC observed that main aim of this amendment was to stop the back door that was available to the residents of the Contracting States to evade tax and for non-residents to take wrongful access to tax benefits under the erstwhile DTAA through evasive practices such as treaty shopping, establishing conduit structures, round-tripping, shell companies etc.

Infact the above amendments to the existing tax laws, including the insertion of GAAR and the amendment to the DTAA has changed the basic principle of taxation of capital gains arising out of direct or indirect transfer of shares of Indian companies by non-resident under the DTAA. Benefits under the DTAA can be claimed by the non-resident only subject to it complying with these new provisions inserted in the IT Act and Rules framed thereunder.

9. Our Analysis

The Tiger Global judgement represents a clear departure from earlier treaty-centric jurisprudence, driven not by judicial inconsistency but by fundamental statutory changes post-Vodafone. The Supreme Court's reasoning underscores India's sovereign right to tax income arising from its economic base and reflects a policy shift towards combating treaty abuse and aggressive tax structuring.

As stated by Justice Pardiwala in his concurring opinion, the SC in Tiger Global reconfirmed that it is a fundamental rule of international taxation that every nation has a sovereign right to impose tax on the global income of its residents and on the income that accrues or arises within its territorial limits.

However, the denial of grandfathering protection to legacy investments structured through multilayered offshore entities may generate investor concern, particularly among global funds accustomed to jurisdiction-neutral pooling vehicles. The ruling introduces heightened uncertainty around exit taxation and may hinder future foreign direct investment flows into India.

Going forward, foreign investors will need to ensure demonstrable economic substance, autonomous governance, and clear alignment between control, management, and treaty claims. Investment structures must be capable of withstanding rigorous GAAR scrutiny, not merely at the time of entry but throughout the lifecycle of the investment.

Further, we advert you attention to the fact that the Delhi High Court had found error in the AAR's conclusion that Tiger Global Management LLC was the holding or parent company of the Assessees. The Assessees in their contention had clarified that they were part of the alternative investment fund structure with its investor base comprising of more than 500 investors spread across 30 jurisdictions, and that Tiger Global Management LLC was not the investor or shareholder of the Assessees but was the investment manager of the Assessees. The High Court observed that AAR could not rebut the consistence stance of the Assessees that Tiger Global Management LLC functioned merely as an investment manager. No evidence was presented to show that Tiger Global Management LLC had contributed any funds to the Assessees, or that monies were repatriated to it by the Assessees. The SC in its judgement has not analysed this observation of the Delhi High Court. Whilst the SC has held that AAR had rightfully contended that the management and control of the Assessees was not based in Mauritius, but it has failed to take into consideration the fact that the management of an alternative investment fund is always managed by an investment manager which is a distinct entity separate from the fund itself. Had the SC taken into consideration this aspect of the Assessees' structure, perhaps it would not have agreed with the AAR's contention that the management and control of the Assessees was not based in Mauritius, which was one of the seminal points of its decision.

The foreign funds have regularly supported the Indian start-ups, with Tiger Global group itself investing in nearly 20-30 start-up companies. This judgement may hinder future investments by foreign investors, especially off shore funds for whom the exit after certain period of time is crucial to derive return on investments, and which always have multiple layered investment structure routed through tax friendly jurisdictions.

Footnotes

1. Convention between the Government of the Republic of India and the Government of Mauritius for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital gains and for the encouragement of mutual trade and investment signed at Port Louis on August 24,1982. The same came into effect in India, in respect of income and capital gains assessable for any assessment year commencing on or after April 1, 1983

2. This understanding and the diagrammatic representation of the group structure of the Assessees is based on the publicly available information. We have not undertaken any independent due diligence/investigation to verify the investment structure of the Assessees.

3. We advert your attention to the fact that this contention was later not submitted by the ASG before the SC and infact the ASG contented that due to the amendment to Section 9 of the Act which expanded the application of Section 9 with retrospective effect and codified the principle of source-based taxation, the income from capital gains earned by the Assessees from the indirect transfer of shares of Flipkart India, was infact deemed to accrue and arise in India accordingly subject to taxation in India.

4. An assessee, not being a resident, to whom an agreement referred to in sub-section (1) applies, shall not be entitled to claim any relief under such agreement unless a certificate of his being a resident in any country outside India or specified territory outside India, as the case may be, is obtained by him from the Government of that country or specified territory.

5. The assessee referred to in sub-section (4) shall also provide such other documents and information, as may be prescribed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.