- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Aerospace & Defence, Chemicals and Oil & Gas industries

Indian economy | 2025

Snapshot of key indicators

CAPITAL MARKETS &SECURITIES LAW

Updates from the Securities and Exchange Board of India

SEBI revises Related Party Transactions compliance Framework

SEBI (Listing Obligations and Disclosure Requirements) (Fifth Amendment) Regulations, 2025

In implementation of its consultation paper recommendations issued in August 2025, on November 18, 2025, the Securities and Exchange Board of India (SEBI) introduced a series of substantive amendments to its Listing Obligations and Disclosure Requirements Regulations, 2015 (LODR Regulations), impacting the scope and compliance pertaining to Related Party Transactions (RPTs).

Key changes

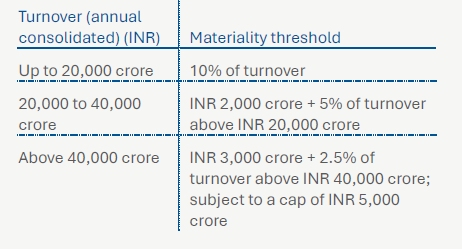

- Scale-based materiality thresholds: The current materiality threshold for RPTs – INR 1000 crore or 10% of a listed entity's annual consolidated turnover, whichever is lower – has been replaced by a turnover-linked threshold mechanism, aimed at reducing unnecessary shareholder approvals:

- Clarification on exemptions from the definition of RPTs: The retail purchase exemption under the proviso to Regulation 2(1)(zc) will now be limited to directors, Key Managerial Personnel (KMPs), and their relatives, subject to uniform terms and no business relationship, explicitly excluding employees, as they are not classified as related parties.

- Payment modes: The provisos to Regulation 12, providing for payment of dividend, interest, redemption, or repayment by 'payable-at-par' warrants or cheques in lieu of the methods of payment listed in Schedule I, have been removed.

- Disclosure requirements under Regulations 53 and 58 of LODR Regulations: In addition to the disclosures listed under Regulation 53 and the Companies Act, 2013, the annual report must also contain disclosures as specified in the statute under which the company has been constituted. A web-link including the exact path where complete details of the annual report are available must also be shared with the holders of non-convertible securities under Regulation 58.

SEBI broadens the scope of insider trading regulations

Amendment to the definition of Unpublished Price Sensitive Information

The Securities and Exchange Board of India (SEBI) has recently broadened the scope of insider trading regulations by amending the definition of Unpublished Price Sensitive Information (UPSI) under the SEBI (Prohibition of Insider Trading) Regulations, 2015 (PIT Regulations).

UPSI refers to exclusive/sensitive information (such as financial results, change in capital structure, and mergers) related to a company that could substantially influence its stock prices if revealed, and constitutes a fundamental element of insider trading. Listed entities would often adopt a restrictive interpretation of the existing definition of UPSI that was limited to the specific events expressly mentioned as illustrations below its broad and generic description under Regulation 2(1)(n) of the PIT Regulations, resulting in significant disclosure gaps, inconsistencies in compliance practices, and a lack of clarity in the application of the PIT Regulations. To address these issues and enable informed investor-decisions, the revised definition incorporates 17 additional material events from the 27 listed under Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations).

Events recommended by SEBI for inclusion in the definition of UPSI

- Changes in ratings, excluding ESG ratings.

- Fundraising activities proposed by the company.

- Management or control agreements, regardless of nomenclature.

- Fraud or defaults by the company, promoters, or key personnel, including arrests.

- Key personnel changes, excluding superannuation or end of term, and resignation of statutory/secretarial auditors.

- Resolution plans and one-time loan settlements related to borrowings.

- Admission of winding-up petitions and insolvency resolutions under the Insolvency and Bankruptcy Code, 2016.

- Initiation of forensic audits and related reports.

- Regulatory or judicial actions against the company or key personnel.

- Award or termination of contracts not in the normal course of business.

- Litigation outcomes impacting the company.

- Issuance or withdrawal of guarantees or indemnities outside normal business operations.

- Grant or cancellation of licenses or regulatory approvals.

For the identification of these events, SEBI has applied the existing threshold limits prescribed under Schedule III of the LODR Regulations.

Other recent changes to insider trading laws

- Structured Digital Database (SDD) flexibility: Entries for events originating outside the company can now be made on a deferred basis within two days, removing the requirement for mandatory trading window closures.

- Expanded definition of 'connected person': The term now includes 'relatives' instead of just 'immediate relatives', widening the scope of individuals subject to the PIT Regulations.

- Reduction in trading plan cooling-off period: The mandatory cooling-off period for trading plans has been reduced from 6 months to 4 months, and a 20% price range for buying or selling shares under such plans has been introduced.

- Price range flexibility: According discretion to insiders to defer trades if execution prices exceed preestablished limits, provided they notify the company's compliance officer within 2 trading days and furnish justifications.

- Adjustments to trading plans: Trading plans can now be adjusted for corporate actions such as stock splits or bonus issuances, with transparent disclosures required to stock exchanges.

- Application to Asset Management Companies (AMCs): Insider trading regulations now extend to AMC employees managing mutual funds to ensure transparency.

SEBI's move signals its commitment to balancing investor protection with market dynamics by strengthening disclosure practices and enhancing safeguards against insider trading.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.