- within Finance and Banking topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Law Firm industries

- within Environment, Criminal Law and Transport topic(s)

Introduction

Blended finance is a structuring approach that uses catalytic capital from public or philanthropic sources to improve the risk–return profile of investments, thereby mobilizing private capital for projects that advance sustainable development. In practice, blending is most often achieved through concessional debt or equity, guarantees/risk insurance, and grant-funded technical assistance. The defining characteristics commonly referenced by standard-setters (e.g., IFC/DFI Working Group; OECD) are:

| Goals / impact: | A particular transaction would utilize the blended finance structure where it aims to deliver a measurable developmental impact with targeted social, environmental, or economic outcomes. |

| Economic returns: | Different investors / participants with different return levels, ranging from concessional to market-rate are blended together with the aim to achieve target returns. |

| Catalytic public/ philanthropic support: | One or more investors / participants in the structure constitute the concessional layer (such as multilateral development banks, development finance institutions or other sovereign-linked entities) that reduces risk and/or cost thereby making it attractive for private sector capital to participate that would otherwise have not participated in the target opportunity. |

Blended finance, simply put, is a mechanism to structure capital stacks to facilitate investors with different objectives to invest side-by-side yet each meeting their own risk, return, and impact goals.

Indian context

India's climate and developmental financing needs are substantial, with estimates of USD 10.1 trillion required to achieve net zero by 2070. Hence, blended finance structures could play a significant role in bringing concessional and commercial capital together to meet national priorities and sustainability objectives. Both, Securities and Exchange Board of India ("SEBI"), the securities market regulator for onshore India and International Financial Services Centres Authority ("IFSCA"), the securities market regulatory for offshore India, have taken certain measures to align their respective regulatory framework. These measures have been summarized in this article.

Blended Finance Framework: onshore India

With respect to alternative investment funds ("AIFs") set up under SEBI (Alternative Investment Funds) Regulations, 2012 ("AIF Regulations"), the issue of stacking layers of risks came to the attention of SEBI in mid-to-late 2022. In November 2022, SEBI issued its Circular 157 stating that it is examining "priority distribution waterfall" structures that have come to its attention.

In the said circular, SEBI took the view that (a) AIF Regulations do not prescribe ratio of sharing losses between investors and (b) AIFs being pooled investment vehicles the sharing of losses must not be less than pro rata to their holding in the AIF vis-à-vis other classes of investors/unit holders. Hence, as per SEBI, distribution waterfalls involving one class of investors (other than sponsor/manager) sharing loss more than pro rata to their holding in the AIF vis-à-vis other classes of investors/unit holders due to the latter having priority in distribution over the former constitutes a "priority distribution mode;" are not permissible under the extant AIF Regulations. SEBI directed AIFs that have adopted such priority distribution models to not accept any fresh commitment or make any new investments until final view from SEBI in this regard. However, one positive outcome from the said circular was that SEBI clarified that share of loss of a sponsor or manager of an AIF shall not be less than their pro rata holding in the AIF vis-à-vis other unit holders. In other words, SEBI recognized that sponsor or manager could subscribe to subordinate units and absorb disproportionate share of loss.

Thereafter, in January 2024, SEBI issued a consultation paper titled "proposal to enhance trust in the AIF ecosystem to facilitate ease of doing business measures". In the consultation paper, SEBI set out in detail its findings on use of priority distribution models primarily by regulated lenders for "ever greening of loans". As per SEBI, the modus operandi was:

A regulated lender would subscribe to a junior class of units of an AIF, and the AIF in turn would fund the lender's stressed borrower. The borrower would use these funds to repay the loan given by the regulated lender, without disclosure of any stress. The stressed asset in the books of the regulated lender would in effect be replaced with the investment in the junior class units of an AIF.

This structure allowed some regulated lenders to circumvent regulations of Reserve Bank of India ("RBI") relating to asset restructuring and recognition of non-performing assets thereby avoid classification, provisioning and other applicable regulatory requirements with respect to these loans.

Consequent to the consultation paper, both SEBI and RBI took a series of steps to stem the issue of regulatory arbitrage.

Actions by SEBI: Various amendments were introduced in the AIF Regulations.

- Regulation 20(20): insertion of anti-abuse obligation stating that every AIF, its manager and key management personnel of the manager shall exercise specific due diligence, with respect to their investors and investments, to prevent facilitation of circumvention of such laws, as may be specified by SEBI from time to time. Presently the term "laws" has been specific to mean the laws administered by a financial sector regulator and SEBI;

- Regulation 20(21): all investors (other than excused investors or defaulting investors) of an AIF shall have rights, pro-rata to their commitment to the scheme,

- Regulation 20(22): all investors of an AIF, other than Accredited Investors only Funds and Large Value Funds, shall be pari passu in all aspects. SEBI has permitted certain differential rights (such as, in relation to fund expenses, management fees, co-investment rights) subject to compliance with the implementation standards formulated by Standard Setting Forum for AIFs ("SFA") in this regard.

- Circular 135, issued in October 2024, imposes mandatory obligation for conduct of "specific due diligence" by AIFs whose sponsor or manager is regulated by RBI or whose investors are regulated by RBI. The said circular also imposes these obligations on a "look through basis" if the regulated investors were pooled in an offshore fund or a fund regulated by IFSCA.

- Circular 175, issued in December 2024, expands the scope of eligible investors to hold junior or subordinate class of units, viz. Multilateral or Bilateral Development Financial Institutions, State Industrial Development Corporations, entities established or owned or controlled by the Central Government or a State Government or the Government of a foreign country, including Central Banks and Sovereign Wealth Funds. SEBI clarified that such investors, including sponsor and manager, could hold junior or subordinate units to accept lower returns or share losses more than their pro-rata interest in the AIF.

The said circular 175 also stipulates that if a manager or sponsor of an AIF subscribes to junior / subordinate class of units, it shall be ensured that the amount invested by the AIF is not utilized by an investee company, directly or indirectly, to repay any of its obligations or liabilities towards the manager or sponsor of the AIF or their associates.

Actions by RBI: RBI through multiple circulars, has revised the framework for participation of entities regulated by it (such as banks, NBFCs) in AIFs which make investments in borrowers of such investors, including individual and cumulative cap on investments by regulated entities as well as provisioning norms in certain situations.

To recap, AIF Regulations, permit blended finance structures provided the junior / subordinate class of units are held by the permissible investors, specific due diligence is conducted and such structures do not facilitate circumvention of laws regulated by a financial sector regulator and SEBI. Last but not the least, in November 2025 SEBI has introduced the framework of "Accredited Investors only Funds" ("AI Only Funds"). Managers and investors focussed on participating in developmental goal / impact investing opportunities could consider blended finance structure under Large Value Funds and AI Only Funds framework.

Blended Finance Framework: offshore India

An Expert Committee on Sustainable Finance, set up by IFSCA, has recommended introducing a framework for blended finance. IFSCA issued the consultation paper in October 2025 setting out the following draft framework:

Eligibility

Venture Capital and Restricted Schemes to be permitted to issue multiple classes of units with differential distribution rights (see below), provided that such schemes adhere to the investment diversification norms. ESG Schemes are also intended to be permitted to issue such multiples classes subject to mandatory disclosure of alignment with UN Sustainable Development Goals (SDGs). Such ESG Schemes will also be permitted to accept funds in the form of grants not exceeding 20% of the corpus.

Units with differential distribution rights

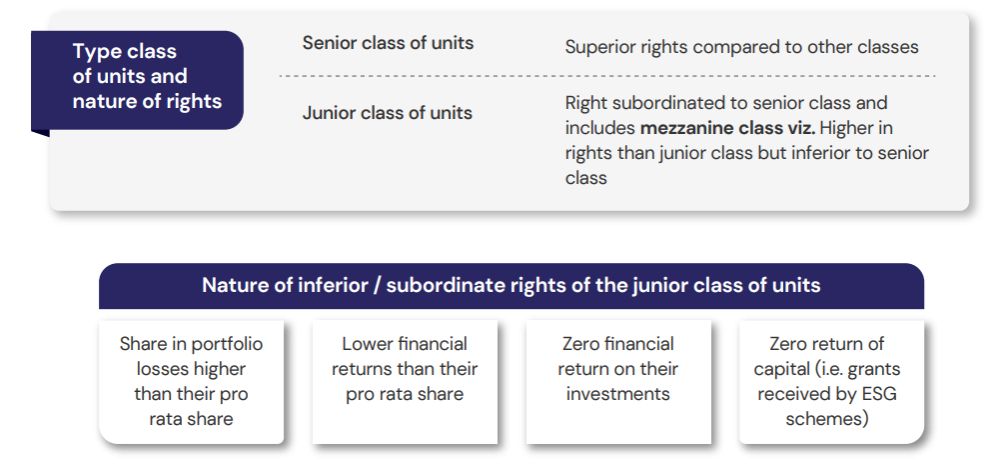

The multiple classes could comprise senior, sub-ordinate or mezzanine units consultation paper. A tabular depiction is provided below:

Investment Restrictions

A few anti-abuse checks proposed to be introduced are (a) eligible schemes issuing multiple classes must ensure that not more than 25% of their corpus is invested in a single investee company and its associates. This portfolio diversification must be achieved within two years of the first closing of the eligible scheme, and (b) the scheme funds shall not be used by the investee company to discharge its obligations to any investor in such scheme.

Minimum Investment

Investors in the junior/subordinate units to commit at least USD 2 million each. However, this minimum investment amount to be USD 1 million for investors that qualify as "accredited investors".

Disclosures

The private placement memorandum ("PPM") of the relevant scheme to prominently and adequately disclose (a) the multiple classes (b) their rights in distribution (c) tabular illustration of distribution waterfalls depicting the differential rights and (d) inherent risks as well as additional rights for each class of investors.

Valuation

The NAV for each class of units (junior and senior classes) to be determined by an independent valuer in accordance with IFSCA Fund Management Regulations, 2025 ("FM Regulations") and valuation policy disclosed in the PPM. This proposal, is another check against ever-greening of loans or mis-use of fund structures to avoid recognition of non-performing assets.

Compliance

Manager must ensure adherence to all applicable laws, rules and regulations in raising capital from investors and investments to be made by such eligible schemes.

As is evident from the consultation paper, IFSCA, taking into cognizance the concerns and mis-use of differential distribution models by AIFs, is adopting a proactive and pragmatic approach in the proposed framework for blended finance for implementation by funds regulated by IFSCA.

Conclusion

Global data indicates that blended finance has mobilized approximately USD 262 billion in developing countries, with each dollar of concessional capital attracting up to USD 5.46 in commercial / private sector capital for transactions in sectors such as energy and infrastructure that need large capital push. In other words, there is empirical data making a compelling case for permitting the use of blended finance structures in India by funds regulated by SEBI and IFSCA. SEBI's framework under AIF Regulations and IFSCA's proposed framework under the FM Regulations are definitely steps being taken towards this objective. Thus, a robust blended finance framework in onshore and offshore India could play a crucial role in bridging the funding gap in India to meet its social and development goals and realizing vision of a Viksit Bharat.

Originally published by AltLens .

Originally published 02 December 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.