- within International Law topic(s)

- within Antitrust/Competition Law, Technology and Insurance topic(s)

In January 2026, the Defence City regime entered its full implementation phase, following the adoption of the relevant regulations by the Cabinet of Ministers of Ukraine.

This alert provides an overview of the adopted regulations, with a focus on the key procedures and implications for defence industry companies.

General Overview

The Defence City legal regime is a dedicated framework for Ukrainian defence companies designed to support the growth of Ukraine's defence industry, attract investment, and facilitate the supply of modern equipment and technologies to the Armed Forces of Ukraine.

The regime was introduced in August 2025 and became fully operational in January 2026, remaining in force until 1 January 2036 or until Ukraine joins the EU (whichever comes first).

Benefits for Defence City residents ("Residents")

- Taxincentives (exemptions from income, environmental, land and real estate taxes);

- Simplified customs procedures and export controls (e.g., the export of military goods without the need for prior government authorization);

- Information protections (e.g., restricted public access to information regarding locations, ownership structures, and other data in key electronic registers); and

- State support for relocations and enhancing the security of production.

Eligibility Criteria

- Ukrainian residency;

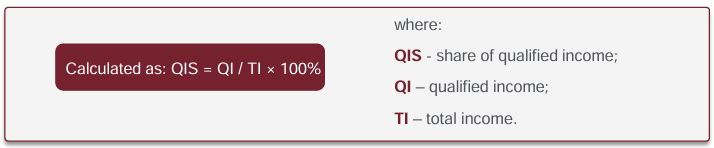

- Qualified income for the previous calendar year of at least 75% of the company's total income (50% for aircraft manufacturers); and

- The absence of "red-flags" defined by law such as including tax debts, insufficient UBO disclosure, relations with the "aggressor state", etc.

For more details, please refere to our alert

Defence City: New Opportunities for the Defence Industry

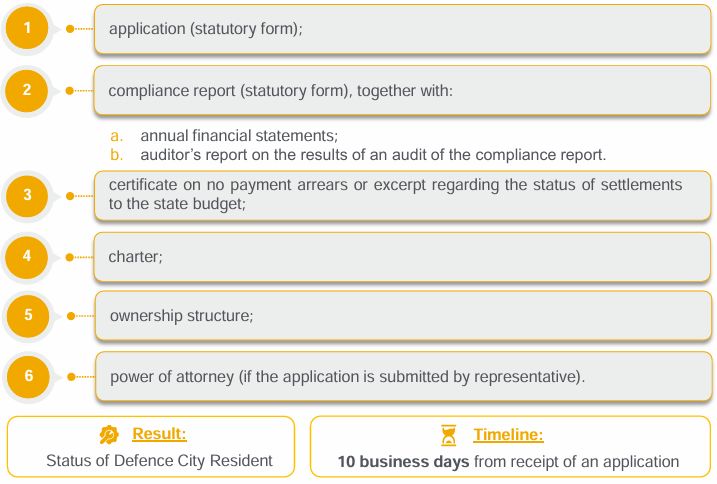

Newly established companies cannot apply for Resident status, as such applications include a requirement for annual financial statements supported by an auditor's report to affirm the given company is in full compliance with all applicable criteria.

Defence City legal regime: Full implementation phase begins

Defence City & Diia City

Qualifying residents may also be residents of Diia City. However, in case of "double" residency, the tax exemptions available under both regimes cannot be combined:

- Residents of Dіia City are not eligible for the tax incentives available under Defence City, including an exemption from corporate income, environmental, land, and real estate taxes.

- Conversely, residents of Defence City will not Critical company status qualify for the Dіia City tax regime with respect to a reduced personal income tax rate and preferential social security contributions treatment.

Defence City residency (unlike Diia City) is not, in itself, a criterion for obtaining critical company status. However, such a status may, in practice, be obtained by defence companies supplying to the Armed Forces of Ukraine.

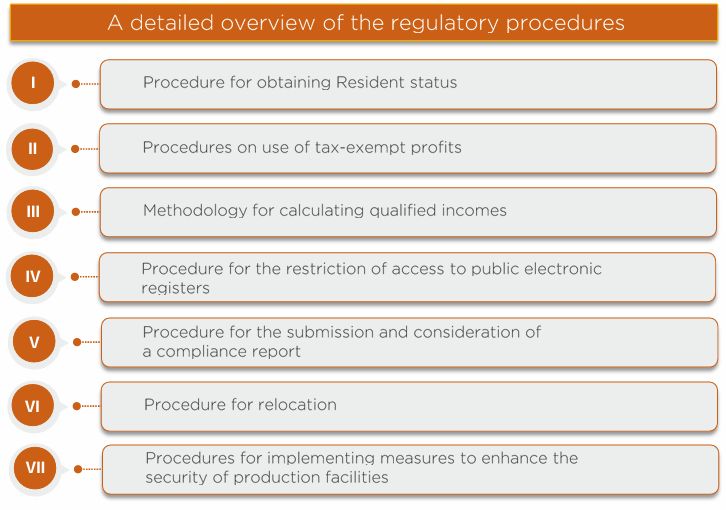

Implementing regulations overview

In late December 2025, the Cabinet of Ministers of Ukraine adopted two resolutions implementing the Defence City legal regime, namely:

- Resolution No. 1745 dated 17 December 2025 "On Certain Issues Regarding the Defence City Legal Regime"; and

- Resolution No. 1746 dated 17 December 2025 "On the Approval of Procedures for Relocation and Measures to Enhance the Security of Production Facilities of Defence City Residents".

In particular, the resolutions:

- establish procedures for obtaining Resident status;

- introduce mechanisms for monitoring the use of tax exempt profits;

- define rules for calculating a qualified income;

- provide procedures for restricting access to public registers;

- approve relocation mechanisms for state support to Residents; and

- introduce state-approved measures to enhance the security of production facilities.

The adoption of the implementing regulations formally led to the launch of the Defence City legal regime. Defence companies now have a clear legal basis and the necessary procedures to benefit from the available incentives in challenging conditions.

Against the backdrop of ongoing government changes in Ukraine, the appointment of a new minister signals a potential reboot of the MoD. It remains to be seen whether these developments will affect Defence City regulations.

Detailed overview of the regulatory procedures

I. Procedure for obtaining Resident status

To obtain Defence City residency, a company must submit the following documents to the Ministry of Defence of Ukraine ("MoD"):

II. Procedure on use of tax-exempt profits

- Tax-exempt profits must be used exclusively for the purposes defined by the law (e.g., the improvement of production processes, introduction of new technologies, etc.).

- The tax authorities monitor the targeted use of tax-exempt profits based on reports and within the scope of tax audits.

- If tax-exempt profits are not used (in full or in part) for the purposes prescribed by law, corporate income tax must be paid on the unused (or misused) portion of such profits by 31 December of the year following the relevant reporting period.

- If non-targeted usage is identified, the tax authorities will notify the MoD.

- The MoD evaluates notifications from tax authorities and factors-in Resident feedback and responses.

- The deadline for the submission of such responses is 10 business days from the receipt of a request.

- Confirmed non-targeted use of tax-exempt profit results in loss of Resident status.

III. Methodology for calculating qualified incomes

IV. Procedure for the restriction of access to public electronic registers

- A Resident may apply to the MoD to request a restriction of access to its information in public electronic registers.

- The application must specify the public electronic registers in which such access to information is to be restricted.

- Following a review of the application, the MoD notifies the relevant register holders.

Result : Access to information on the Resident is restricted in public electronic registers.

Timeline: 1 business day from the date of receipt of an MoD notice by the register holder.

Access restrictions do not apply to:

- the Diia City register;

- electronic data exchange between state authority registers;

- authorized access by officials of state authorities and local self-government bodies, banks, etc.; and

- access by individuals and entities to registered information regarding themselves.

V. Procedure for the submission and consideration of a compliance report

- Each year, by 1 June following the reporting year, Residents must submit a compliance report to the MoD together with annual financial statements and an auditor's report.

- If the MoD identifies non-compliance or discrepancies, it notifies the Resident accordingly.

- Deadline for the submission of responses: 15 business days from receipt of a notice.

- Confirmed non-compliance results in loss of Resident status.

VI. Procedure for relocation

State support measures for a change of location and the transfer of place of actual business activity or production facilities by the Resident or its separate subdivision within Ukraine.

- Relocation may be applied for by a Resident or its separate subdivision.

- To initiate a relocation, the Resident (or its subdivision) submits an application (in statutory form) to the MoD.

Eligible Residents:

- production of defence goods for at least one reporting year;

- at least 30 employees.

Eligible Separate subdivisions:

- production of defence goods for at least one reporting year;

- at least 20 employees; and

- status as a personal income tax agent

Result: MoD decision on the approval of relocation.

Timeline: Approximately 2 months. Relocation is completed upon registering the new location.

The MoD decision serves as a basis for funding a given relocation from allocated local budget funds, in coordination with the Resident.

VII Procedures for implementing measures to enhance the security of production facilities

State support measures to enhance the security of production facilities implemented by the Resident through new constructions, reconstructions, or capital repairs of production, auxiliary, or storage facilities.

To obtain state support, the Resident submits to the MoD:

- an application (in statutory form);

- design and cost documentation; and

- the required approvals (for state or municipal properties).

Result: MoD decision on the approval of measures to enhance the security of production facilities.

Timeline: Approximately 3 weeks. Within 3 business days, the adopted decision is communicated to the Treasury, the relevant regional state (military) administration, the local self-government body, and the Resident.

The MoD decision serves as the basis for funding applicable measures enhancing the security of the production facilities from allocated local budget funds, in coordination with the Resident. In addition, the MoD decision serves as the basis for regional state (military) administrations and local self-government bodies to facilitate the implementation of measures, including:

- coordination of permitting and approval procedures;

- organizational support and coordination with infrastructure and utility network operators; and

- the performance of the relevant works on state or municipal property.

To view the article in Ukrainian click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]