- within Food, Drugs, Healthcare and Life Sciences topic(s)

- within Food, Drugs, Healthcare, Life Sciences, Government, Public Sector and Finance and Banking topic(s)

- with readers working within the Banking & Credit, Healthcare and Retail & Leisure industries

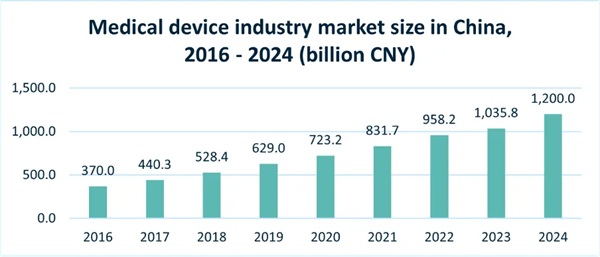

China's medical device industry has emerged as one of the most dynamic and rapidly expanding sectors within the global healthcare landscape. As the world's second-largest healthcare market after the United States, China is experiencing a transformative shift driven by demographic changes, technological innovation, policy reforms, and rising healthcare consumption. With a market size surpassing CNY 1,200 billion in 2024 and a compound annual growth rate of 18.2% since 2015, the industry has consistently outpaced national GDP growth.

This issue of our newsletter will provide a comprehensive overview of the development, segmentation, driving forces, and emerging opportunities within China's medical device market, offering valuable insights for stakeholders and foreign investors navigating this evolving landscape.

Medical device industry development overview

China is the world's second-largest healthcare market after the United States. As of 2024, China's medical device industry's market size exceeded CNY 1,200 billion in 2024, which has nearly doubled compared with CNY 629 billion in 2019 (before COVID). In 2020, the COVID-19 pandemic drove a surge in demand for medical devices like masks and test kits, resulting in industry revenue exceeding USD 100 billion, accounting for about 20% of the global market. With an annual growth rate of 18.2% since 2015, the industry has consistently outpaced GDP growth during recent years.

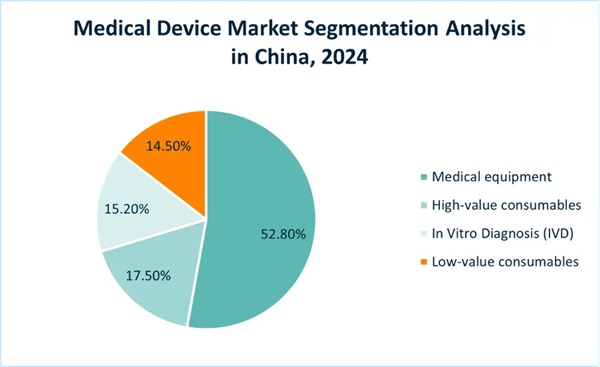

According to the definition from China's Medical Device Research Institute, the medical device market can be divided into four segments:

- Medical equipment

- High-value consumables

- Low-value consumables

- In Vitro Diagnosis (IVD)

The size of China's medical equipment market accounts for 52.8% of the overall medical devices market in 2024, driven by hospital infrastructure upgrades and imaging technologies; the market shares of IVD, high-value consumables, and low-value consumables are not very different, at 15.2%, 17.5%, and 14.5%, respectively.

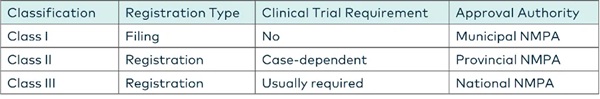

From 2017 to 2024, the number of medical device enterprises and products in China has also increased in consecutive years. As of June 2024, there were 32,700 medical device manufacturing enterprises, an increase of 8.54% compared with 2022. Among them, 26,800 enterprises can produce Class I medical devices, 18,650 enterprises can produce Class II medical devices, and 2,670 enterprises can produce Class III medical devices, with a year-on-year increase of 3.8%, 8.50%, and 21.5%, respectively.

*Medical equipment in China is classified into three risk categories: Class I (least risky), Class II, and Class III (most risky). To produce medical devices, companies must obtain a production license and register their products. Operating these devices also requires an operation qualification. Class I registration is relatively straightforward, while Classes II and III involve a more rigorous process, often necessitating local testing and clinical trials before registration.

Opportunities to tap into the Chinese healthcare market

Expanded pilot policies

The policy regarding biotechnology allows foreign-invested enterprises to engage in the development and application of human stem cell and gene diagnosis and treatment technologies within specific regions: the Beijing Pilot Free Trade Zone, Shanghai Pilot Trade Zone, Guangdong Pilot Free Trade Zone, and Hainan Free Trade Port.

This means that foreign companies can conduct advanced biotechnology research and development in these areas, enabling them to register, market, and produce related products. Once registered and approved, these products can be distributed nationwide, creating significant market opportunities for foreign enterprises.

However, due to the specialized and innovative nature of stem cell and gene therapies, which often involve sensitive data and ethical considerations, pharmaceutical companies must prioritize several key areas when investing in this field. These include:

- Data protection

- Management of cross-border data flows

- Governance of human genetic resources

- Intellectual property rights

- Compliance with technology import and export regulations

By addressing these regulatory requirements, foreign companies can navigate the complexities of this emerging market successfully.

Wholly foreign-owned hospital

The formation of a wholly foreign-owned hospital (excluding traditional Chinese medicine hospitals and not by a merger or acquisition of a public hospital) is to be permitted in Beijing, Tianjin, Shanghai, Nanjing, Suzhou, Fuzhou, Guangzhou, Shenzhen, and Hainan, including the entire Hainan Island. Further notice will be issued regarding the specific conditions, requirements, and procedures for forming a wholly foreign-owned hospital.

At the same time, the commerce, health, human genetic resources, and medical products administrative departments of the areas covered by the pilot program shall redouble their efforts to publicise the policy within their respective purviews, proactively approach interested foreign-invested enterprises, and improve services.

Negative list adjustments

China's 2025 Market Access Negative List continues to push toward economic liberalisation, with a notable reduction in restricted sectors. The updated list eases limitations on private investment in healthcare and pharmaceuticals. Although "development and application of human stem cell and gene diagnosis (CGT) and therapy technologies" are still restricted, these activities are permitted within the designated pilot zones in Beijing, Shanghai, Guangdong, and the Hainan Free Trade Port, indicating a significant policy breakthrough in specific regions.

Optimising production of imported medical devices

The Notice on Further Adjusting and Optimising Matters Related to the Production of Imported Medical Devices by Enterprises within China was released on 18 March 2025. It indicated several preferential policies for foreign-invested enterprises:

- Encouragement of foreign investment: The announcement promotes foreign-invested enterprises to set up production bases in China, particularly for imported medical devices that meet national needs or address market gaps. Local production is highly encouraged.

- Equal treatment: Foreign-invested enterprises will receive the same benefits as domestic companies, including government funding, land supply, tax reductions, licensing, and project applications under Article 6 of the Foreign Investment Law.

- Streamlined approval procedures: The approval process for local production of imported medical devices will be optimized, making registration and filing simpler. This will help foreign companies accelerate market entry.

- Intellectual property protection: The intellectual property rights of foreign medical device manufacturers in China will be protected equally, with stronger enforcement against infringements and fast-track mechanisms for rights protection.

- Encouragement of collaboration: The announcement encourages foreign enterprises to partner with local companies, universities, and research institutions for technology development and joint R&D, facilitating the adoption of advanced medical technologies in China.

Key issues for foreign-owned enterprises to focus on

Strict regulations have long governed the healthcare industry due to the direct impact that medical services and products have on people's health and safety. In recent years, reforms have aimed to reduce bureaucratic complexity and promote efficiency, encouraging private and foreign investment to support a broader range of healthcare services. Despite these efforts, businesses in the sector must obtain specific certifications and complete various registration and approval processes to prove their technical competence and regulatory compliance.

Pre-market entry Ppreparation

- Product classification: Before entering the Chinese market, foreign entities should determine whether their product falls under Class I, II, or III medical devices according to the Medical Device Classification Catalogue and Classification Rules. This classification affects the registration path, clinical trial requirements, and approval process.

- Establishing a legal entity: Foreign investors can set up a Wholly Foreign-Owned Enterprise (WFOE) or a Sino-foreign joint venture. Establishing in Free Trade Zones (FTZs) such as Beijing, Shanghai, or Hainan can offer policy advantages.

- Foreign investment filing: To comply with the Foreign Investment Law, submit investment information and complete enterprise registration. Special approval is required if the business falls under the Negative List.

Medical device product registration and approval arocess

Class I medical devices, which are considered low risk, follow a filing process with the National Medical Products Administration (NMPA). Once the application is submitted, the administrative review and issuance of the Medical Device Record Certificate (MDRC) typically take around four weeks.

Class II (medium risk) and Class III (high risk) medical devices require a formal registration process. Applicants must submit detailed documentation to the NMPA, including product testing reports from an NMPA-accredited laboratory. In most cases, local clinical trial data are also mandatory for these higher-risk categories.

It is worth noting that foreign medical device companies must register medical devices with a domestic registration agency in China.

Localisation mandates and market access barriers

China's medical device sector is accelerating domestic substitution, creating opportunities but more complex barriers for foreign investors. New policies like the 2021 Procurement Guidelines mandate over 40% local content for 178 critical devices, while 2025 NMPA rules incentivize onshore manufacturing through fast-track approvals – yet require establishing Chinese entities and retooling supply chains. For multinationals, this translates to procurement exclusion from ¥100B+ hospital tenders, 18+ month product registration delays, and 15-25% cost disadvantages versus local competitors.

Navigating this landscape exposes four operational fault lines: regulatory complexity (70% of applications fail due to mismatched clinical data formats), supply chain fragmentation (critical component sourcing delays exceeding 6 months), digital compliance burdens (ERP/UDI system integration costing ¥2M+), and hidden incentive traps (30-40% tax breaks lost through suboptimal site selection). These compound into market entry timelines stretching 2-3 years, eroding first-mover advantage.

This is where Acclime transforms localization from obstacle to accelerator. We provide a comprehensive range of services for foreign medical device companies, including business registration, site selection, and factory setup. Additionally, through our extensive partner network, we offer assistance with product registration, ensuring a smooth entry into the Chinese market. Our goal is to help you establish operations successfully in China, enhance production efficiency, and achieve digital transformation in sales and management.

Regulatory compliance requirements

Foreign-invested enterprises entering the medical device and related sectors must comply with regulations concerning:

- Human genetic resource management;

- Clinical trials for drugs and medical devices (including international multicenter trials);

- Product registration and approval;

- Ethical review;

- Data protection and cross-border data transfer;

- Intellectual property rights;

- Technology import and export controls.

Unique Identification of Medical Devices (UDI)

UDI serves as an ID card for medical devices, providing a unique code that identifies the license holder, model, and packaging information. The UDI system enhances transparency and traceability throughout the device lifecycle. In 2019, the National Health Commission launched China's UDI pilot program, selecting 69 varieties across 9 categories, including osteosynthesis and joint replacement implants. The first trial involved 108 hospitals and 23 companies, such as Wego and AK-Medical. China's phased UDI implementation includes:

- First batch (2021): High-risk Class III medical devices (69 types),

- Second Batch (June 1, 2022): All Class III medical devices.

- Third Batch (June 1, 2024): 15 categories of key Class II devices, including single-use products.

Starting July 1, 2024, distributors must ensure full-process traceability through barcode tracking for warehousing, distribution, and returns, marking a move towards standardized supply chain management.

China's medical device industry is poised for significant growth, driven by an ageing population, rising disposable incomes, and supportive government policies. This dynamic environment offers ample opportunities for innovation and investment, especially for foreign enterprises in biotechnology and digital health. However, success hinges on navigating regulatory compliance, product registration, and localization. As China modernizes its healthcare system and fosters global collaboration, the medical device sector will be crucial in shaping the future of healthcare delivery.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.