- within Insurance topic(s)

Overview

- What is Disbursement Quota

- Timeline of DQ

- New changes to DQ on January 1, 2023

- DQ Rate

- Calculate DQ obligation

- Meet DQ obligation

- Track DQ shortfall and excess

- Track DQ in T3010s

- DQ obligation reduction

- Accumulation of property

- Administration and management expenses

- Comply anti-avoidance rules

- Challenge to meet 5% DQ

What is the Disbursement Quota?

- Disbursement Quota ("DQ") is the minimum amount that a charity must spend on its charitable activities or qualifying disbursements (including gifts to qualified donees and grants to non-qualified donees)

- DQ is to ensure that charitable funds are used for charitable purposes and are not simply accumulated indefinitely by charities

- A requirement under the Income Tax Act ("ITA")

- DQ applies to all charities but is of particular relevance to foundations and other healthcare charities that have investment assets that are not being used directly in charitable activities or administration (such as endowments or portions of buildings that are surplus and are rented out)

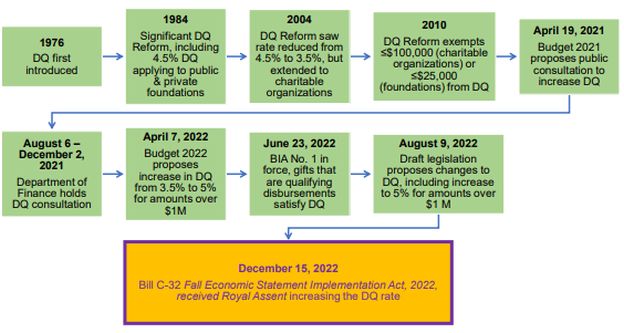

Timeline of DQ

New Changes to DQ on January 1, 2023

- As a result of sector wide consultations in 2021, the 2022 Federal Budget announced that DQ would be increased to 5% for amounts in excess of $1 million

- Economic Statement Implementation Act, 2022 ("Bill C-32") received Royal Assent on December 15, 2022

- Amended the ITA to increase the DQ rate from 3.5% to 5% for property held by a charity in excess of $1 million that is not used directly in charitable activities or administration

- Increased DQ applies to taxation years beginning on or after January 1, 2023

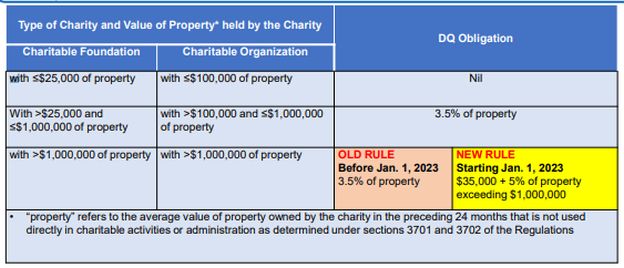

DQ Rate

Charitable organizations with average value exceeding $100,000 or foundations with average value exceeding $25,000, DQ is 3.5% for property up to $1 million, and 5% for property over $1 million

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.