- within Corporate/Commercial Law topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Banking & Credit and Business & Consumer Services industries

- within Law Department Performance topic(s)

Overview

Direct lending issuance has experienced a slowdown in the latter half of 2025 and is anticipated to continue this trend into 2026 as the landscape gets increasingly saturated. Competition in direct lending remains intense, with new issuance spreads tightening to approximately S+4.5% in the last quarter of 2025.

Although M&A activity has seen increased volume in the fourth quarter, it is not at a level to offset demand for private credit. US companies are facing pressure on growth due to rising costs from tariffs, economic uncertainty, and cautious consumer spending. Companies are struggling to pass on higher input costs to consumers due to weaker demand and competitive pressures, which strain profit margins. This has also led to a more cautious approach to hiring and investment, contributing to slower job growth. Many companies across various sectors including technology, retail, logistics, media and healthcare are being impacted by AI through adoption, disruption and workplace changes. Market participants are having a reduced appetite for certain loans deemed as having AI displacement risk.

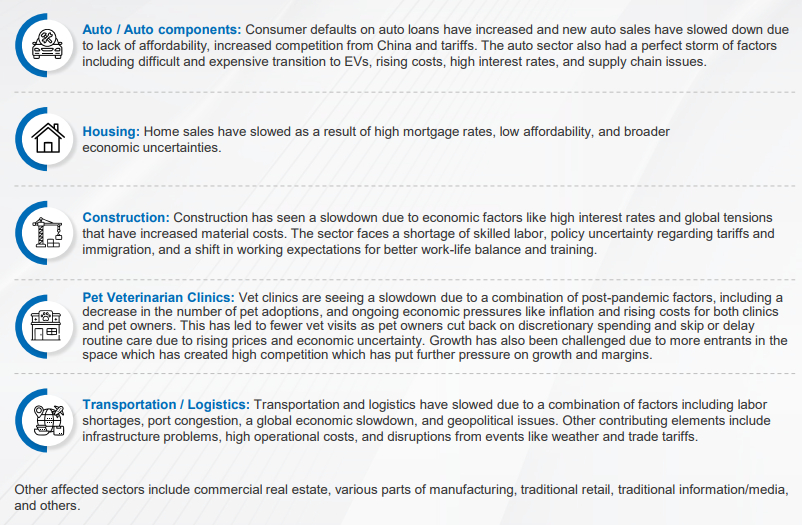

Sector Headwinds

Several sectors face headwinds driven by persistent inflation, high interest rates, slowing consumer spending, and geopolitical uncertainties such as trade tensions.

Other affected sectors include commercial real estate, various parts of manufacturing, traditional retail, traditional information/media, and others.

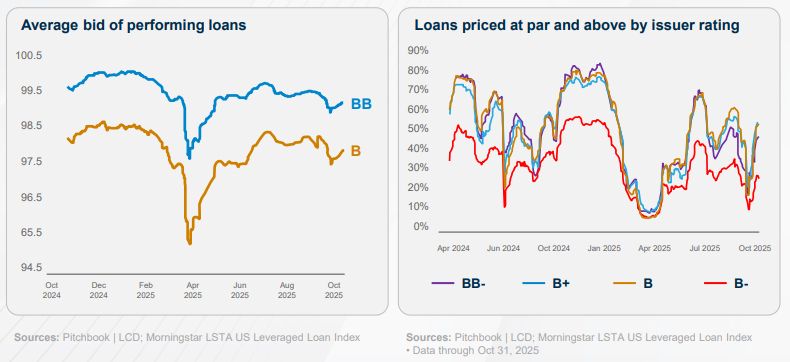

US Leveraged Loan Bids and Pricing

As a result of sector-specific headwinds, weakness in AI-exposed loans, and other issuer-specific problems, the average bid price for B rated loans in the LSTA US index decreased from 97.06 as of September 30th to 96.35 as of October 14th (the five month low) and then rebounded up to 96.67 by October 31st.

First Brands had an impact on the LSTA US leveraged loan index. It filed for Chapter 11 on September 29th. With $4 billion in outstanding leveraged loans, First Brands ranks 39th out of 1,130 names. Automotive Components was the worst performing sector followed by Chemicals. Macroeconomic drivers of sector weakness included soft end market demand particularly in housing and construction. Elevated energy costs, tariff uncertainty and increased import competition from Asia all added to pressure to bid prices.

Roughly three-quarters of the market has been at 99 or above over the past few months. However, the lower end has not shown the same improvement — the share of loans priced below 90 continued to edge higher, to 9.2% on October 31, its highest level since early May. The bulk of this sub-90 cohort consists of borrowers rated B-minus (41%) or CCC plus (31%), while the most represented sectors are Software (21%) and Chemicals (11%).

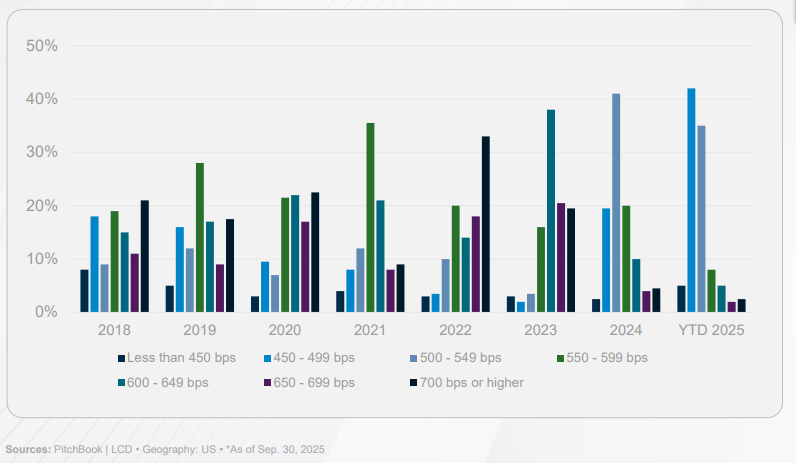

New-Issue Spreads

The following shows the new-issue spread distribution of LBOs financed in the direct lending market. Per Pitchbook, spreads have decreased from their 2022 highs with many borrowers priced at approximately S+450. The main theme of 2024 and 2025 was significant spread repricings. The continued spread compression is a result of supply and demand imbalance continuing to persist as M&A remains below expectations. In the second quarter, the majority of spreads were in the S+500 range. As of September 2025, that has come down to S+450, representing 50 bps compression in six months. Nearly half of new issuances are below 500 bps spread as of September 2025.

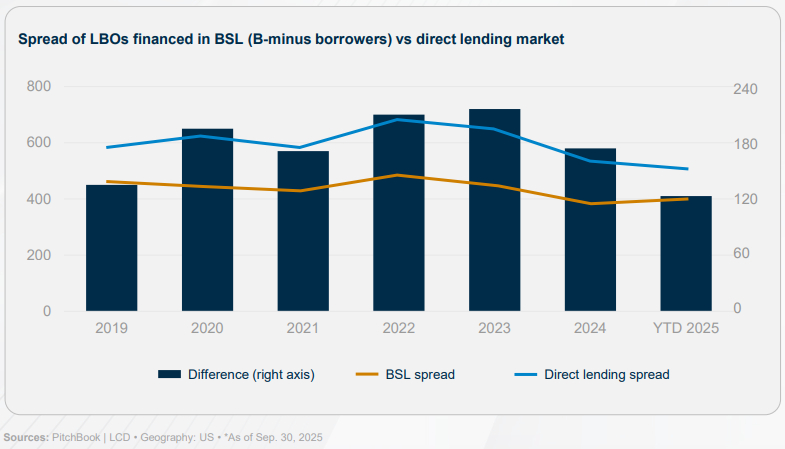

Spread Differential between Private Credit and BSLs

The gap between spreads for private direct credits and for BSLs is on track to narrow for the second straight year according to Pitchbook. This is indicative of the enormous investor demand for income. This is partially fueled by weak LBO activity in both the BSL and private credit markets. Given the dry power available in private credit with limited supply of deals, direct lending spreads in the upper middle market have become very competitive to BSL pricing. We have seen a number of BSL deals taken up by private credit and vice versa in 2024 and 2025. We expect the upper middle market to resemble the BSL market, particularly in terms of being covenant-lite and more susceptible to LMEs. As private credit funds have grown over time, direct lenders have also been able to provide large checks and execute large deals. The premium of private credit over BSL is currently 50 to 100 basis points.

To view the full article click here

Originally published December 8, 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.