- within Corporate/Commercial Law topic(s)

- in United Kingdom

- with readers working within the Environment & Waste Management industries

- within Law Practice Management topic(s)

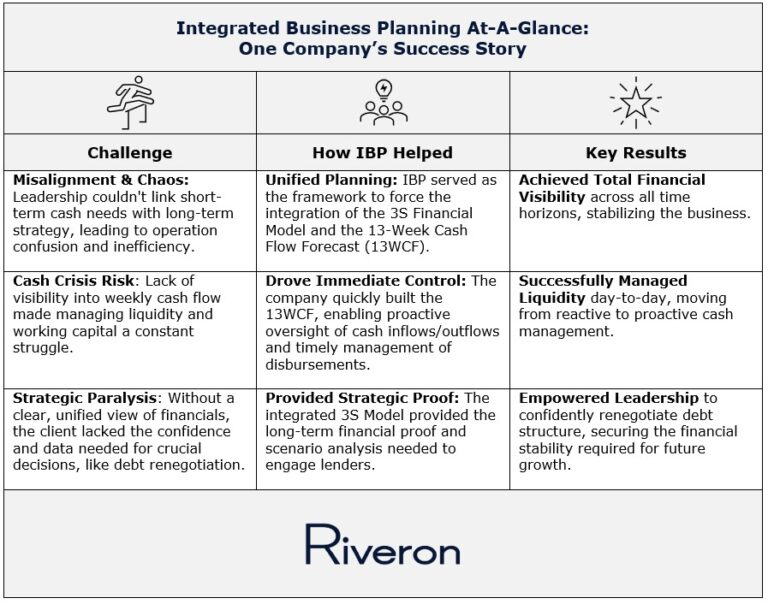

Finance and operations leaders are navigating complexity through Integrated Business Planning (IBP). IBP helps leaders connect long-term strategy to daily financial and operational decisions.

Finance and operations leaders are facing an increasingly chaotic and complex business environment where converting long-term strategy into effective action is a constant challenge. This difficulty arises because core functions often fail to communicate, leading to costly inefficiencies and slow, poor decisions. Integrated Business Planning (IBP) solves this by unifying planning across all key business areas into one cohesive vision. While concepts and core processes / data models used in IBP aren't new, they are frequently overlooked or used only partially without this vital integrated approach. Examining one Company's success story shows how IBP transforms complexity into a single focus, helping leaders stop guessing and drive powerful results.

Client Success Story: Why IBP Matters and How to Apply It

Many business leaders struggle because there's a widening gap between long-term strategy and daily working capital and cash management. It's possible to guide success, and we'll examine a client story that shows how Integrated Business Planning connected finance and operations planning horizons. The Company was able to solve its immediate financial challenges while setting itself up for long-term growth.

You can apply this approach by ensuring your team links common tools like a Three-Statement Financial Model (your intermediate to long-term view of profitability) directly to your 13-Week Cash Flow Forecast (your week-to-week money plan). Doing this gives you complete financial visibility across your entire business. The ultimate goal is simple: You'll be able to make faster, smarter decisions and prevent financial surprises, giving you the confidence to manage debt, invest in growth, and increase your company's overall resilience.

Navigating Complexity with Integrated Business Planning

To enable IBP success, leaders need to establish consistent data models that are integrated across functions, with shared data elements and standardized definitions. Typically, five core data models underpin an effective IBP process:

Annual Processes:

- Strategic Plan (Long-term, 3-5 years)

- Annual Budget (Intermediate, 1 year)

Monthly Processes:

- Three-Statement Financial Forecast (Short- to Intermediate focus)

- Operational Forecast (Short- to Intermediate focus)

Weekly Process:

- 13-Week Cash Flow Forecast (Short-term focus)

Client example: The Challenge

A vertically integrated manufacturing company recently engaged Riveron to help define a unifying planning framework. The company's leadership lacked a consistent process to align short-term liquidity needs with longer-term strategic priorities. This led to inefficiencies and confusion across functions, revealing the need to adopt Integrated Business Planning.

Short-Term Cash Planning: Managing Liquidity with a 13-Week Cash Forecast

The 13-Week Cash Forecast (13WCF) is a short-term financial planning tool that projects the company's weekly cash position over the next 13 weeks. It's typically used by the Treasury or FP&A function to ensure that the company can meet its immediate cash needs. Depending on the current state of liquidity, the 13WCF can be rolled forward weekly or biweekly. To build and maintain an accurate 13WCF, all cash inflows and outflows over the forecast period must be accounted for. Examples of each include:

- Cash Inflows: Expected collections from sales (AR) and any other sources of income.

- Cash Outflows: Payroll, operating expenses (AP), capital expenditures, debt repayments, one-time items, taxes and insurance.

Biggest challenges faced in the 13WCF:

- Comprehensive cash visibility: Depending on the size of the business, it can be difficult to account for and forecast all major cash movements to avoid surprises.

- Timing of inflows: Timing of AR collections and cash inflows are more difficult to forecast than disbursements, as inflows are not directly controlled by the company.

- Outstanding check float: Disbursements paid via check have an added layer of complexity as checks are dependent upon a courier and timing of the vendor deposit.

Client example: How we helped

Riveron partnered with the client's finance organization to rapidly develop a 13-week cash flow forecast. The model provided critical and predictive visibility into the company's liquidity position, enabling proactive oversight of financial health. It also empowered the finance team to effectively manage working capital by tracking outstanding receivables and optimizing the timing of disbursements.

The Strategic Value of the Three-Statement Financial Model in Forecasting & Planning

A critical enabler of effective medium- to long-term forecasting is the development of an integrated Three-Statement Financial Model (3S model)—a comprehensive framework that links the income statement, balance sheet, and cash flow statement into a single, cohesive structure.

This integration ensures that changes in key operational assumptions—such as sales volumes, production levels, or capital expenditures—are automatically reflected across all financial statements. The result is a more accurate, real-time view of financial performance that enhances transparency and decision-making.

The 3S model plays a central role in Integrated Business Planning by aligning operational activities with strategic financial outcomes. It allows organizations to simulate and evaluate multiple business scenarios, assess trade-offs, and make informed decisions based on profitability, liquidity, and capital efficiency.

Client example: Real-world results

In the client example, Riveron collaborated closely with senior leadership to build a monthly financial forecast model that delivered both a three-year strategic liquidity view and a near-term monthly forecast. Beyond strategic planning, the model also supports core financial processes such as budgeting, forecasting, and long-range planning

Driving Strategic Clarity Through Forecast Integration

For the client, integrating the three-statement model with the 13-week forecast transformed financial planning. This integration provided both a long-term strategic view and a near-term liquidity outlook, which proved invaluable during debt renegotiations with lenders.

Linking the Three-Statement Financial Forecast to the 13-Week Cash Forecast creates a robust financial planning framework that enhances accuracy and strategic insight.

- Enhanced Accuracy: The 3S model provides a detailed long-term view, while the 13WCF offers precise short-term liquidity insights. Integrating them ensures that short-term cash needs are aligned with long-term financial goals.

- Improved Decision-Making: A linked forecast allows management to make informed decisions by understanding the interplay between profitability, financial stability, and liquidity. This holistic view supports better resource allocation and risk management.

- Proactive Cash Management: By connecting these forecasts, companies can anticipate cash shortages or surpluses and take proactive measures. This reduces the risk of liquidity crises and enhances financial resilience.

- Strategic Planning: Integration helps in aligning operational activities with strategic objectives. It ensures that the company's growth plans are financially sustainable and supported by adequate cash flow.

Client example: Key takeaways

These insights highlight the experience of a vertically integrated manufacturing company. By adopting IBP, building a three-statement model, and linking it with a 13-week cash forecast, the company gained critical visibility across planning horizons. These tools empowered leadership to renegotiate its debt structure with confidence, while also ensuring day-to-day liquidity. This case demonstrates how integrating financial models within IBP translates directly into strategic clarity and operational resilience.

Turning Visibility into Victory

By adopting Integrated Business Planning, building a comprehensive Three-Statement Model, and crucially linking it with a 13-Week Cash Flow Forecast, leaders will be able to achieve the visibility necessary for both big-picture financial needs and addressing more immediate liquidity matters.

The powerful simplicity of the 3S Model and the 13WCF might make them seem like obvious financial tools, but, in practice, it's surprising how often they are entirely overlooked or severely underutilized in isolation. The full value isn't in the models themselves, but in their integration within an IBP framework, which is an essential approach for finance and operations leaders facing complexity. IBP moves your organization past planning paralysis by creating a unified source of truth, directly translating strategic intent into operational action, and ultimately driving better financial results and long-term stability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.