- within Corporate/Commercial Law topic(s)

- in United Kingdom

- within Law Department Performance topic(s)

As 2025 draws to a close, European private equity (PE) investors are beginning to see some signs of recovery. M&A activity is at its most active in over two years, with large deals closing, previously delayed processes returning to the market, and a noticeable realignment in valuation expectations between both sellers and buyers.

The momentum follows a challenging start to the year, marked by rising geopolitical tensions across the globe and the shock of US tariffs. For an industry reeling from several years of subdued deal flow and limited exit opportunities, the recent uptick offers market participants a much-needed sense of stability.

Yet beneath the surface, PE firms continue to grapple with deeprooted challenges. Deal-making in the current cycle is much more complex than before. The macroeconomic and geopolitical backdrop remains incredibly uncertain, introducing new layers of risk to execution and making it harder for sponsors to find value in new transactions.

On top of that, funds are still holding a significant backlog of long-dated assets in their portfolios. Many of these businesses were acquired at high valuations during the Covid-era deal cycle and are now facing challenging operational issues that require attention. Enhancing value and achieving exits for this cohort of investments remain the top priority and will continue to be a defining feature of the market for years to come.

Accelerating portfolio transformation

At Alvarez & Marsal (A&M) Private Equity Performance Improvement (PEPI), we are seeing firsthand how this market recalibration is playing out.

This year, we have partnered with a growing number of PE clients to lead large-scale portfolio company (PortCo) transformations and carve-outs, helping them find new sources of growth, expand margins through operational efficiency, and navigate market volatility. We are also increasingly engaged in complex situations where interim leadership and hands-on support are needed to stabilise underperforming businesses.

Our focus on portfolio work is illustrative of a broader PE shift toward longer-term and transformation-oriented investments. In practice, this means funds and their operating teams are working harder across every line of the P&L – from supply chain and service delivery to pricing, go-to-market and SG&A – to find corners of outperformance, and engaging more closely with management teams to drive implementation on the ground. Our 2025 Value Creation report explores some of these challenges in detail, drawing on firsthand perspectives from around 200 PE funds and portfolio company leaders across Europe who participate in our annual survey.

We also observe that sponsors are increasingly seeking external partners like A&M to deliver on complex transformational agendas. That's because the challenges PortCos face today require senior, hands-on expertise – both at the industry and functional level – that can make tough judgement calls amid uncertainty, navigate multiple stakeholders, and focus on implementation over theory.

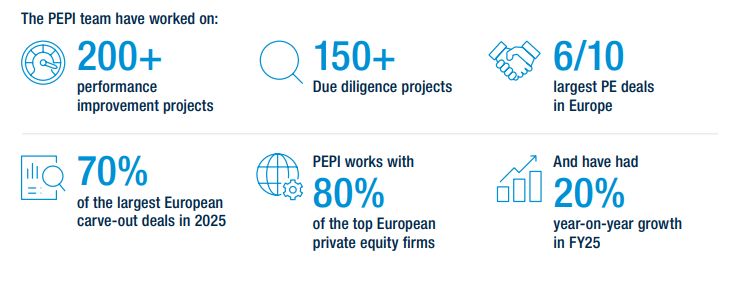

Since November 2024, our European team has successfully executed over 200 performance improvement projects for PEowned businesses. Additionally, we have completed more than 150 due diligence engagements across operational, carve-out, commercial and IT streams, including integrated (operational and commercial) due diligence services. Supporting 80% of the top European PE firms, we have participated in six of the 10 largest PE transactions and 70% of the region's most significant carve-outs.

This performance has propelled the A&M PEPI business in Europe to one of its strongest years, delivering 20% year-onyear growth and solidifying our position as the market-leading PE practice for transformation and diligence services.

Integrated due diligence

The breadth and scale of our diligence work in 2025 reflects the increased complexity of the deal market. Across all diligence streams, our multidisciplinary practice has delivered more than 150 projects since November 2024.

In carve-outs, our experienced team has played a leading role in two-thirds of the year's largest deals, including several large-scale divestments that showcased our cross-functional expertise in navigating the unique complexities these deals entail.

Similarly, our integrated due diligence group has had an exceptionally active year, building on the strategic expansion of last year when we welcomed 15 senior leaders from top commercial due diligence practices across Europe into our team.

Demand for integrated diligence is only increasing as investment theses change in response to rising geopolitical and trade risks. Deal teams must put a greater focus on ensuring target acquisitions are built on a cost-effective, scalable operational foundation that can endure tariff/regulatory shifts, support localised supply chains and adapt to more fragmented commercial models.

Our upcoming Due Diligence survey will provide an in-depth look at how these dynamics are affecting the work of PE deal and diligence teams on the ground, exploring key themes such as the rise of integrated due diligence, the role of AI in pre-deal, and more.

The state of play in AI

Across our work this year, we've seen a rise in interest in practical, results-driven AI use cases in both portfolio value creation and deal execution.

PE funds are now approaching AI use cases in a more thoughtful and structured way. In value creation, applications are expanding beyond back-office efficiency into more strategic domains like customer experience, pricing, and product portfolio strategies.

AI-driven tools have also augmented our diligence capabilities, allowing for faster data gathering and preliminary analysis, freeing our teams to focus on more complex problem-solving during the deal process. For example, GenAI tools now support trend analysis and can raise flags in specific metrics, often in hours rather than weeks.

In commercial due diligence, one of the most impactful use cases is in primary and secondary research, where our platform sifts through market reports, customer reviews and other unstructured data to surface trends and growth opportunities. This speeds up the process and augments the depth, comprehensiveness, and richness of the analysis we deliver.

SUCCESS STORIES: How we help PE clients realise value

Integrated Due Diligence

Background

A leading PE fund engaged our team to conduct commercial and operational due diligence on a multibillion global business being carved out from a major energy company. We were selected over incumbent advisors for our distinctive, integrated due diligence approach, which combines commercial and operational capabilities to uncover key value creation opportunities and related operational drivers, providing the client with a comprehensive, early understanding of the target.

The challenge

The due diligence required a detailed understanding of complex market dynamics affecting the target, which faced significant exposure to the decline of internal combustion engines (ICE) vehicles. Accurately forecasting the rate of ICE market contraction – where views diverged widely depending on factors such as global growth, country-specific regulations and carmakers' strategic moves – was critical to shaping the target's future operational model.

A&M's role

Leveraging our unique integrated CDD/ODD expertise, we delivered a robust, analytically based view of the market that withstood rigorous scrutiny from the transaction's stakeholders. Our team built a global demand model for the target's core product, incorporating a proprietary ICE vs. EV market evolution analysis informed by extensive field research, including a global survey of clients. This enabled us to assess the target's competitive position and identify opportunities for improvement. We uncovered several areas for value creation, particularly in procurement, G&A operating model and sales team structure.

Results

Working as one integrated team and leveraging the groundwork of our proprietary market analysis, we developed a consolidated P&L projection for the 2025-2030 period, demonstrating a clear trajectory of EBITDA margin improvement for the business. The insights validated the target's ability to stay competitive in the changing market environment and identified a number of top line value creation levers in conjunction with the ops value creation story.

"We developed a consolidated P&L projection for the 2025-2030 period, demonstrating a clear trajectory of EBITDA margin improvement for the business."

SUCCESS STORIES: How we help PE clients realise value

Finance transformation

Background

A&M was engaged by a leading global technology platform with revenues of over €2 billion globally after its acquisition by a consortium of private investors.

The challenge

Following an intense buy-and-build and consolidation strategy under the previous ownership, the company operated multiple businesses across several countries worldwide. The vast majority of its resources were centralised and operated by verticals, functioning independently of their physical location. The new owners sought to divest selected country business units, which required disentangling these units from the highly integrated, centralised structure.

A&M's role

We partnered with the client to deliver a comprehensive transformation across its back-office and the Finance functions. Leveraging both top-down and zero-based approaches, A&M designed a needs-based target operating model (TOM) covering all G&A and P&T functions. A major focus was Finance transformation, where we supported initiatives across all functional towers: order to cash (OTC), procure to pay (PTP) and record to report (RTR). Our work centred on process optimisation, including automation of previously manual activities to drive efficiency and accuracy, the streamlining of invoicing and collection, and efficient bad debt management to reduce days sales outstanding (DSO). To accelerate impact, we assumed interim leadership roles across OTC, PTP and RTR. Additional actions included the outsourcing of certain shared serviced teams to achieve significant cost savings as well as the restructuring of regional finance TOMs to create standalone finance functions.

Results

Through this transformation, we helped deliver run-rate EBITDA savings of approximately €180 million, of which €10 million were achieved from a reduction of over 110 FTEs within the shared services team. DSO improvement measures alone delivered €37 million of cash benefits. The streamlining of RTR activities helped lower the number of charts of accounts by 30% and manual balance sheet reconciliations by 30%.

SUCCESS STORIES: How we help PE clients realise value

Growth story

Background

A&M was engaged by a leading consumer electronics company to develop a set of strategic options to reposition the business in the marketplace. The engagement later expanded into full operating model design, cost optimisation, governance setup, organisational restructuring, and commercial support for deals with Big Tech companies.

The challenge

The client operated in a nascent industry, with minimal revenues but substantial R&D investments. The new management team and shareholders needed clarity on the financial and operational implications of future strategic options and sought to redesign the operating model to emphasise IP preservation and focus on sustainable growth.

A&M's role

The engagement began with baselining, identification of tactical cost-optimisation opportunities, development of business plans, and evaluation of financial and operational implications for each strategic option. A TOM and roadmap were created to guide the execution of the selected option. The scope of the work expanded to include a full review of the product roadmap and R&D proposals, and the design of a zero-based budgeting (ZBB) process. The ZBB, along with the actuals tracking process, provided investors with a new level of cost transparency and control. In addition, a structured project governance framework was implemented to track execution and accountability. Throughout 2024 and 2025, A&M provided financial and technical expertise to support two major deals with Big Tech firms.

Results

The client implemented a new operating model focused on its core capabilities and signed multiple deals with Big Tech companies. The transactions totalling around $500 million marked a transformative step in the company's turnaround and growth trajectory.

Originally published 2 December 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]