- with readers working within the Property industries

- within Environment topic(s)

In this edition, we look at some of the forthcoming legislative changes of interest to the UK's real estate sector: the reinvigoration of commonhold, the Renters' Rights Bill, and the proposed ban on upwards-only rent reviews. We give a brief update on some of the transparency rules regarding the ownership of UK property, highlight some consumer protection rules of interest to the real estate sector and offer a reminder about the new corporate 'failure to prevent fraud' offence. Finally, we touch on some recent changes to the carried interest rules for real estate executives, and give an overview of the real estate projects that the Law Commission plans to undertake in 2026.

1 Commonhold reinvigoration – where are we now?

What is commonhold?

Commonhold is an already-existing tenure in which each owner owns the freehold of their unit. They are also the members of the commonhold association (the "CA"), which owns the freehold of the common parts of the building (such as the reception, roof, lift, corridors and garden) and is obliged to organise the repair, maintenance and insurance of these areas.

What is happening with the proposed re-introduction of commonhold?

As set out in more detail in our commonhold hub, the Government published a White Paper in March, and plans to publish draft legislation and a consultation later this year. Its proposals include mandating commonhold for new flats and making it easier to convert existing leasehold flats to commonhold. It will also implement the majority of the Law Commission's recommendations in its 2020 report to make the tenure more workable. However, these recommendations still leave several unanswered questions, some of which we explored in a recent briefing.

Where does this sit with leasehold reform?

The Government has said that it plans to press ahead with leasehold reform, particularly the implementation of the Leasehold and Reform Act 2024 because, realistically, leasehold flats will remain part of the housing market for a long time to come. This year, it has consulted on proposals to increase transparency on building insurance fees and on measures to strengthen leaseholder protections over charges and services.

What happens next?

The industry is waiting to hear from the Ministry of Housing, Communities and Local Government with draft legislation. In the meantime, it is a good idea for real estate investors, operators and lenders to familiarise themselves with the Government's proposals so that they are ready to respond to the consultation.

2 The Renters' Rights Bill

Overview

The implementation of the Renters' Rights Bill has been long-awaited. Starting life as the Renters (Reform) Bill under the previous administration (discussed in a previous briefing), the Bill will return to the House of Lords on 14th October 2025 for consideration of the House of Commons' amendments.

What are the Bill's main terms?

Abolition of section 21 of the Housing Act 1985

Landlords will no longer be able to use the "no-fault" notice procedure and will instead have to establish one of the grounds in section 8 of the Housing Act 1985 in order to regain possession of their property. This will make court procedures a much more common part of the property management process.

Abolition of assured shorthold tenancies

All tenancies will be converted to periodic tenancies, with no minimum term and no fixed end date. Tenants will be able to terminate a tenancy by giving two months' notice whereas landlords will need to establish one of the specified grounds in section 8 to regain possession.

Private Rented Sector Database and Landlord Ombudsman Scheme

Landlords will be obliged to sign up for a new online database and provide data including their name, their rental properties, and details of any financial penalties or enforcement notices. Landlords will also be governed by a new Private Rented Sector Ombudsman to which tenants can complain about landlord breaches. Unfortunately, landlords will not be able to raise complaints about tenant behaviour.

Awaab's Law and the Decent Homes Standard

These housing standards were initially put in place to set minimum standards for social housing, and will henceforth also apply to the private rented sector. The Decent Homes Standard is currently under review.

Limitations on rent increases

Landlords will only be able to increase rent payable under an ongoing tenancy once a year, and must do so by serving a written notice on the tenant in a prescribed form. Tenants can challenge increases through the First-tier Tribunal.

No rental bidding

Letting agents and landlords will be prohibited from accepting rental bids above the advertised rent. This is intended to end the "bidding wars" that are thought to drive up rents and disadvantage lower-income applicants.

No discrimination

The Bill prohibits discrimination against tenants with children or those who receive benefits.

Right to request repairs

Tenants will have a statutory right to require landlords to carry out necessary repairs and/or deal with hazards within a reasonable time of a request.

What proposed amendments are still being explored?

- Landlords to be permitted to demand an additional pet damage deposit as a condition of consenting to a pet.

- Student accommodation exemptions should apply not only to university-provided accommodation but also to all private providers which follow a code of practice approved under the Housing Act 2004, regardless of size of property.

- The Decent Homes Standard should apply to Ministry of Defence housing used by military families.

- The burden of proof required to be established by councils enforcing the Act should be raised from 'balance of probabilities" to 'beyond reasonable doubt'.

Conclusion

It is likely that the Bill will be passed in the Autumn. Although landlords have opposed some of its measures, and remain concerned about whether the courts will have capacity to cope with the increased workload that the new regime will generate, the industry will welcome some stability once the new regime is at last in place.

3 Banning upwards-only rent reviews

Background

In July 2025, the real estate sector was startled to discover, buried at the back of the English Devolution and Community Empowerment Bill, provisions that would replace contractually-agreed upwards-only rent review provisions in commercial leases with upwards-and-downwards provisions. The Government's explanatory notes state that these changes will "end upwards only rent review clauses in commercial leases to prevent vacant shops and regenerate high streets in communities across the country". However, there is concern across the industry that this ban could have the opposite effect.

What sorts of review provisions would be impacted?

- Upwards-only rent reviews in new leases or renewal leases

- Index-linked or turnover reviews with a minimum figure

- 'Day one' reviews in renewal agreements or put options

What sort of reviews would be unaffected?

- Upwards-only rent reviews in ongoing leases or those entered into pursuant to agreements for lease or options which pre-date the ban

- Index-linked or turnover reviews that do not have a minimum figure

- 'Day one' reviews in agreements for lease or put options with new tenants, as opposed to renewal arrangements

- 'Day one' reviews in call options or reversionary leases

- Upwards-only rent reviews in licences to occupy or transitional services arrangements

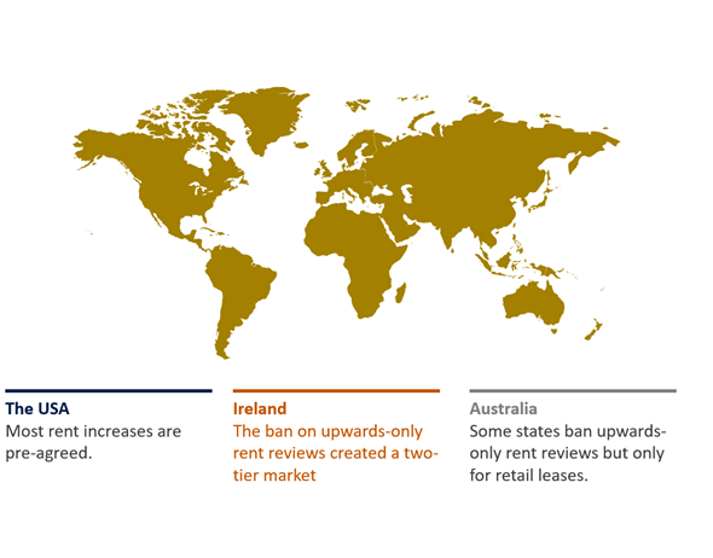

International perspectives

England and Wales are not the only jurisdiction to consider such a move – our earlier briefing explores the experiences of similar provisions in the US, Australia and Ireland.

What next?

The Bill is currently at Committee Stage whereby evidence is given to Parliament by various affected parties as to how the Bill is likely to impact on the UK's real estate sector.

4 An update on transparency rules around property ownership in the UK

Updates to the Overseas Entities Regime

Background

The Register of Overseas Entities ("the Register") launched on 1 August 2022 and the transitional period ended on 31 January 2023. As described in our previous briefing, pursuant to the Economic Crime (Transparency and Enforcement) Act 2022, overseas entities which own a freehold or grant a lease of more than 7 years in England and Wales are obliged to register on the Register and thereby disclose their registrable beneficial owners. An Overseas Entities ID is issued upon successful registration. Failure to do so, the submission of false or misleading information, and/or failure to submit annual updates could lead to criminal liabilities.

What has changed?

The Economic Crime and Corporate Transparency Act 2023 and subsequent regulations have introduced some extensions to the original regime, as follows:

- Both on first registration on the Register and in its annual updates, an overseas entity must also disclose the title numbers of all the Qualifying Estates of which it is the registered proprietor.

- When updating the Register or applying to be removed from it, an overseas entity must now provide details of any changes in certain trust beneficiaries since its last update. Companies House has recently issued guidance about how to submit a request to Companies House to get trust information for an overseas entity, and what details they may share about that trust - the applicant must identify the overseas entity and the name of the trust, which should prevent purely speculative applications from being made.

- Any overseas entity that was the registered proprietor of a Qualifying Estate in the pre-registration period (28 February 2022 to 31 January 2023) must now provide Companies House with further information about pre-registration period changes to their beneficial owners, trust beneficiaries and trustee beneficial owners in the first annual update that falls 3 months after this requirement takes effect. Any overseas entities that failed to register before 31 January 2023 must also provide this information, as must any overseas entities that have been removed from the Register. More information can be found in Government guidance.

- Companies House's enforcement powers have been boosted in several ways, including a prohibition on overseas entities registering certain dispositions at HM Land Registry unless they have complied with any notice sent by Companies House requiring the provision of further information. The Government's enforcement guidance sets out more details.

The proposed register of contractual controls

Background

As we explored in an earlier briefing, one of the initiatives recently designed to increase transparency in the real estate sector is the proposed register of contractual controls, which would provide a more transparent picture of controls on land through the creation of a freely accessible dataset.

What is the statutory regime?

This is enshrined in section 221 of the Levelling Up and Regeneration Act 2023 which allows for the collection of information which would be useful for the purpose of understanding relevant contractual rights (ie those that arise under a contract; relate to the development, use or disposal of land in England or Wales; and are held for the purposes of a business, charity, public authority or other undertaking.) This includes identifying the persons holding them and understanding the circumstances in which they were created or acquired.

Timeline

The Government published a Call for Evidence on data on land control in 2020, and then in 2024 it carried out a fuller consultation seeking views on the time, cost, and market impact implications of collecting and publishing information about contractual control agreements. It is understood that MCHLG is currently exploring how best to implement such a system and whether this will be a standalone register or whether it will form part of the existing Land Registry infrastructure.

Which agreements will be affected?

The following agreements are likely to be caught: option agreements, conditional contracts, pre-emption rights, promotion agreements or any other contracts that prevent landowners from making a disposition of their land or that regulate the circumstances in which they can do so. This means that restrictive covenants, overage and clawback agreements, agreements to facilitate finance and loan agreements will not be included, if the original proposals are followed.

The registration process

It is envisaged that the conveyancer acting for the beneficiary of the contractual control will register it. There appears to be some uncertainty as to whether this will be a one-off registration or whether the register will need to be updated like the Register of Overseas Entities.

Conclusions

The Overseas Entities regime seems to have become an established part of the real estate regulatory landscape, and the requirement to give more information about trust beneficiaries has closed a loophole discussed here.

As for the proposed register of contractual controls, there has been some concern about whether there is sufficient public interest in the commercial data that will be revealed to justify the potential harm it may cause to legitimate businesses, particularly smaller developers who have good commercial reasons to keep their option agreements private.

5 Revised 'carried interest' tax regime for real estate fund executives

Background

'Carried interest' is a form of performance-related reward received by fund managers, particularly in private equity funds. Currently, it can be taxed at capital gain tax rates which are lower than income tax rates. The Government intends to replace this regime with new rules which it considers simpler and fairer.

The new rules

HMRC has published the draft legislation for the UK's new carried interest tax regime, the final version of which will be contained in the Finance Bill 2026. The new carried interest regime will apply to individuals who receive carried interest where either the individual is UK tax resident or the carried interest relates to investment management services performed in the UK, from 6 April 2026.

Under the new rules, all carried interest will be treated as trading profits subject to income tax (up to 45%) and Class 4 NICs (2% on profits above the Upper Profits Limit). The amount of 'qualifying' carried interest subject to these taxes will be adjusted by applying a 72.5% multiplier, resulting in an effective tax rate of 34.075%. Whilst more executives will be brought within the scope of the UK's carried interest tax rules, the 34.1% rate may lead to lower tax liabilities for those working for funds pursuing an income-based return strategy.

Conclusions

It will be important for real estate fund executives to understand the implications of this new regime. More information can be found in our earlier briefing and in the Government's policy paper.

6 The new corporate 'failure to prevent fraud' offence in the real estate context

Overview

As reported in our previous briefing, a new statutory offence of a corporate 'failure to prevent fraud' took effect on 1 September 2025. This was introduced in the Economic Crime and Corporate Transparency Act 2023 and, broadly, is intended to hold large organisations criminally liable if an employee, agent, subsidiary, or other "associated person" commits a fraud intending to benefit the organisation. Large real estate companies should take steps now to ensure that they have put 'reasonable procedures' in place. This strategy will help prevent fraud by their associated persons, and could establish a potential defence to liability under the 'failure to prevent fraud' regime if fraud were to take place despite such procedures.

Which real estate entities are in scope?

The offence applies only to large organisations which meet two or three of the following criteria:

- more than 250 employees;

- more than £36 million turnover; and/or

- more than £18 million in total assets.

These conditions apply to the financial year that precedes the year when the base fraud offence occurred, and apply to the whole organisation (including subsidiaries) regardless of jurisdiction.

What kinds of activities count as 'fraud' for the purposes of this offence?

- False representation (section 2 of the Fraud Act 2006) for example if a seller or agent provides inaccurate or misleading information about a property that influences a buyer's decision to purchase it.

- Failing to disclose information that should be disclosed (section 3 of the Fraud Act 2006) for example if a purchaser fails to disclose crucial financial information when applying for financing, which they are legally required to disclose.

- Abuse of position (section 4 of the Fraud Act 2006) for example if an agent, valuer or solicitor dishonestly misuses their position of trust, such as by embezzling client funds or mismanaging property in order to enrich themselves.

- Participating in a fraudulent business (section 9 of the Fraud Act 2006) where for example a development company is aware that a joint venture counterparty is defrauding creditors.

- Obtaining services dishonestly (section 11 of the Fraud Act 2006) for example using false paperwork to persuade a cleaning agency to supply services without payment.

- False accounting (section 17 of the Theft Act 1968) for example inflating a company's financial health to secure loans, hide losses, or attract investors.

- False statements by company directors (section 19 of the Theft Act 1968) for example making untrue representations to potential investors or customers.

- False accounting (section 17 of the Theft Act 1968) for example inflating a company's financial health to secure loans, hide losses, or attract investors.

- Fraudulent trading (section 993 of the Companies Act 2006) for example failing to recognise unpaid loans as bad debts thereby not providing a true and fair value of a company's financial position, as explored in our briefing about Bouchier v Booth.

- Cheating the public revenue (a common law offence) for example deliberately defrauding HM Revenue and Customs by concealing rental income.

These offences all require dishonest intent but could be committed in a range of contexts, including giving warranties and representations in property transactional documents; setting out false statements in financial documents or insurance claims; or by sales agents misrepresenting the quality of real estate products to increase prices.

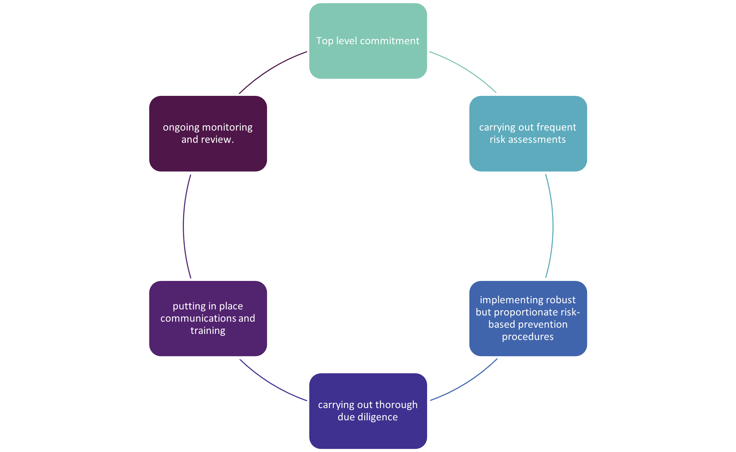

What would 'reasonable procedures' look like?

As set out in the recent Government guidance, reasonable procedures might include:

A robust corporate compliance package should therefore address all of the above (in a proportionate manner) including an internal fraud prevention plan, a policy, the implementation of internal controls, supporting documents (e.g. employee onboarding procedures and enhanced supplier checks), senior management buy-in, training and regular reviews and monitoring. Contact us for further advice.

7 Impact of new consumer laws on the real estate sector

Most of the provisions of the Digital Markets, Competition and Consumers Act 2024 ("DMCC Act") came into force in April 2025. The legislation gives the Competition and Markets Authority a raft of game-changing enforcement powers, including the ability to impose fines of up to 10% of global turnover on businesses found to have infringed UK consumer law. It also introduces stricter requirements on presentation of prices and new rules on fake and misleading consumer reviews. Investors and operators in sectors such as retirement housing, care homes, student and other residential accommodation should ask themselves the following questions:

- The big picture: do we need to re-assess our risk? The risk profile for B2C businesses has increased very significantly. As well as imposing substantial fines, the CMA can order infringing businesses to pay compensation to consumers, further increasing the potential financial exposure (to take an example from another sector, financial services required to compensate consumers following the PPI scandal paid out over £38 billion). In some circumstances, individual directors or managers could also face sanctions. Meanwhile, the real estate sector is no stranger to CMA investigations (as discussed last year, the CMA has recently looked at housebuilding and its predecessor, the Office of Fair Trading, investigated retirement homes). Against this background, consumer-facing businesses may want to take another look at whether they are taking appropriate steps to mitigate these risks, particularly on issues that the CMA is known to be concerned about such as the presentation of pricing information to consumers and sales practices more generally.

- Pricing practices: do we comply with the new requirements? The DMCC Act includes new provisions outlawing "drip" or "partitioned" pricing – which essentially involves promoting an attractive "headline" price to get consumers' attention, without disclosing additional charges that most consumers are likely to end up having to pay. Although this practice was already caught by existing UK consumer law, the DMCC Act makes it significantly easier for regulators to enforce it. The pricing of real estate "products" sometimes consists of a number of different elements (e.g. monthly rent plus service charges and other fees), which can make it challenging to present clearly – particularly where the expectation of regulators is that wherever possible, businesses will present consumers with a single "total" price (comprising all fees which most consumers would have to pay). For more on this aspect, see our briefing: Are you at risk of misleading consumers on price?.

- Consumer reviews: have we put in place appropriate policies and procedures? The DMCC Act imposes new requirements on businesses to prevent the publication of fake reviews or misleading review information. It also prohibits the commissioning of fake reviews and the publication of "concealed incentivised reviews" (where the consumer was e.g. given the product for free in return for providing a review - but the incentivisation has not been made clear). Our view is that most B2C businesses will need to take at least some steps to comply with these new rules – even if they don't host reviews on their own website but typically rely on third parties such as Google, Trustpilot or specialist platforms such as carehome.co.uk. For more detail, see our briefing: Fake or misleading consumer reviews: time's running out to put your house in order.

Government gets tough on late payment: implications for the real estate sector

The UK Government is consulting on major changes to the law on late payment, which could have a significant impact on the real estate sector. Whilst the most headline-grabbing measure is a new power for the Small Business Commissioner to fine businesses which fail to pay suppliers on time, the package also includes proposals for a new arbitration system and restrictions on customers' ability to withhold payment in the event of a dispute.

Those involved in the construction sector will be familiar with compulsory adjudication for payment disputes, but this only applies to "construction contracts" as defined in the relevant legislation. If these latest proposals are implemented, we could see a similar compulsory arbitration scheme being applied to disputes between larger businesses and suppliers with fewer than 50 staff – regardless of the type of contract involved. Other proposals include:

- requiring customers to dispute invoices within 30 days should they wish to withhold payment (they could still raise a dispute after that date, but this would have to be on a "pay now, argue later" basis);

- prohibiting payment periods of longer than 60 days (reducing to 45 days after say, 5 years); and

- making the statutory late payment interest rate of 8% above the Bank of England base rate mandatory (i.e. no "contracting out", as at present.

For more detail, see our briefing: UK gets tough on late payment | Travers Smith

8 The Law Commission's 14th programme of law reform

In September the Law Commission announced its forthcoming set of ten new law reform projects. Four of these are real estate related, and a fifth is of interest to the real estate sector:

- Agricultural tenancies: there are currently two forms of agricultural tenancy, and the Commission will explore whether they correctly balance the interests of landowners and tenants. In particular, they seek to understand whether the lack of security of tenure and often short-term nature of many tenancies is a barrier to investment and the viability of some tenanted farm businesses. The goal is to enable tenant farmers to have sufficient security to invest in and maintain viable farm businesses, to facilitate opportunities for new entrants to access farming opportunities, and ensure that landlords have the confidence to continue letting their land.

- Commercial leasehold: alongside the ongoing project into commercial security of tenure, the Commission plans to review:

- issues with the Landlord and Tenant (Covenants) Act 1995, focussing on the complex workings of the Act's anti-avoidance provisions regarding guarantees, Authorised Guarantee Agreements and their sub-guarantees. Applying the caselaw in this area can result in unfortunate and unforeseen impacts on commercial transactions and intra-group restructurings.

- rights of first refusal under the Landlord and Tenant Act 1987 (in so far as the law relates to commercial premises). This is described as a scoping project, focusing on the law governing the maintenance, repair and upgrading of leased commercial buildings, including the law relating to dilapidations, service charges, and the interaction between environmental frameworks and commercial leasehold law.

- Management of housing estates: the Commission will consider the creation of a new right for freeholders on housing estates to take over the management of their estates, akin to the rights of qualifying leaseholders of flats to take control of the management of their block of flats under the statutory 'right to manage'. They plan to publish a consultation paper on this topic in 2026. This topic is aligned to ongoing legislative change regarding leasehold reform and the reinvigoration of commonhold.

- Ownerless land: this project will involve a review of the laws of bona vacantia and escheat. This will include an analysis of the Crown's liability shield for ownerless land, consideration of whether some types of ownerless land should pass to a body other than the Crown, a review of the powers of certain parties to obtain vesting orders, an examination of the rights of leaseholders where the landlord's title escheats, and clarification of the law (such as the survival of derivative interests that affect ownerless land and the impact of bona vacantia and escheat on the land registration system).

- Deeds: some of the laws regarding the creation and interpretation of deeds are outdated and the Commission will look at broad issues about their efficacy, including whether the concept remains fit for purpose. They will consider whether there should be amendments to the existing requirements of deeds, including witnessing, attestation, and delivery. They will also think about whether these laws should be amended to ensure successful integration with smart contracts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.