- with readers working within the Retail & Leisure industries

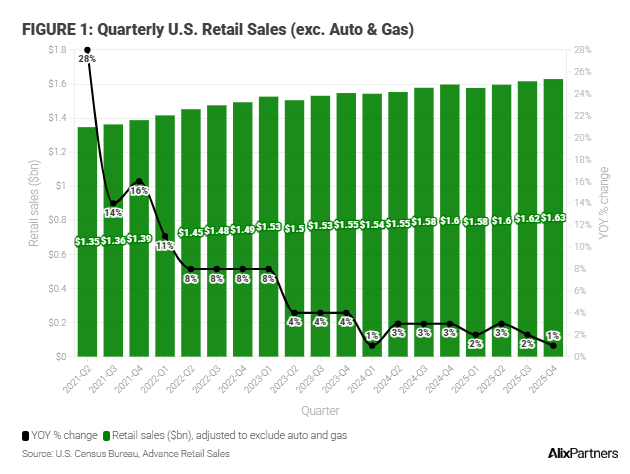

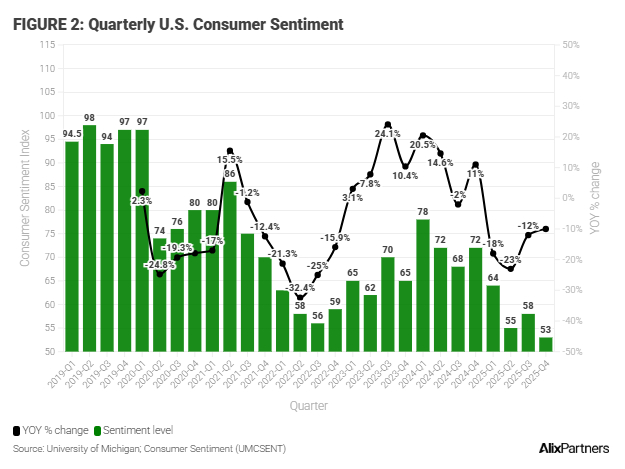

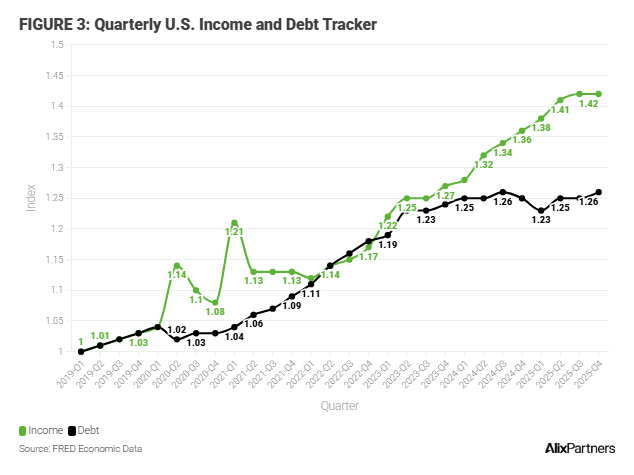

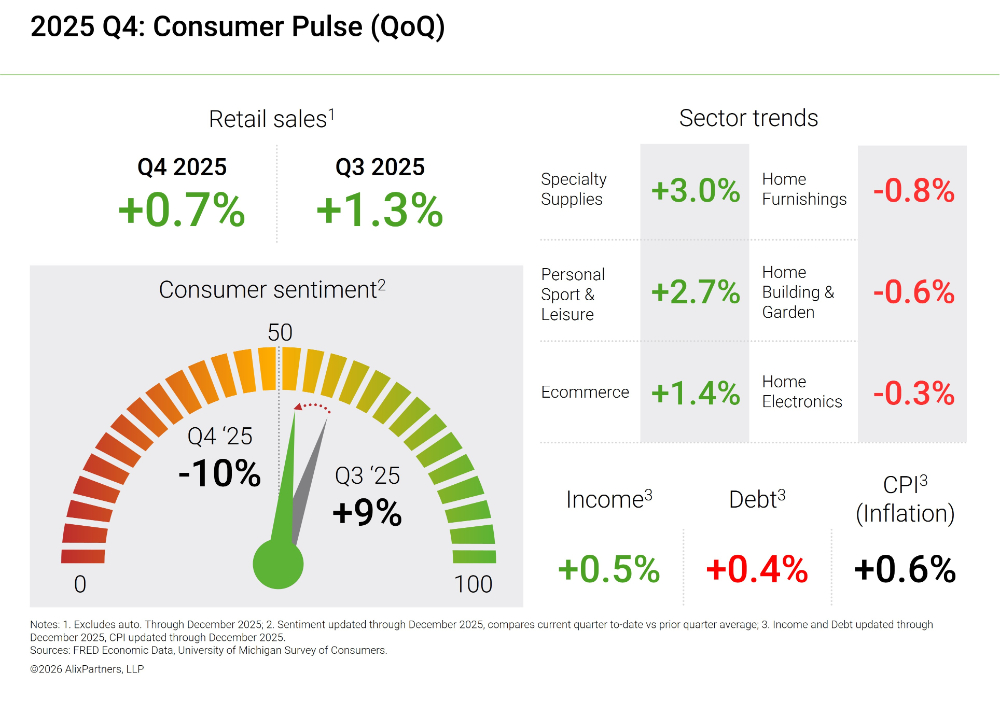

Retail sales climbed in Q4 2025 compared to Q3 2025, driven by growth in sports, leisure, clothing, and specialty retailers, while the home building and furnishings sectors contracted amid soft demand. Consumer sentiment took a significant hit, signaling a sluggish start to Q1 2026, as inflation crept higher and disposable income saw only a modest 0.5% uptick. Heightened geopolitical uncertainty and diminishing consumer confidence pose substantial challenges for consumer companies as the new year begins. Furthermore, the current "low-hire, low-fire" labor market, coupled with sustained core inflation, is anticipated to exert ongoing pressure on consumer purchasing power, resulting in a slower annual growth rate relative to 2024 and 2025.

On a monthly basis, AlixPartners charts sales, sentiment and supply chains in consumer-facing businesses. Learn more about the Consumer Products Corner newsletter and read previous articles, here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.