- in South America

- with Senior Company Executives, HR and Finance and Tax Executives

- in South America

- with readers working within the Property industries

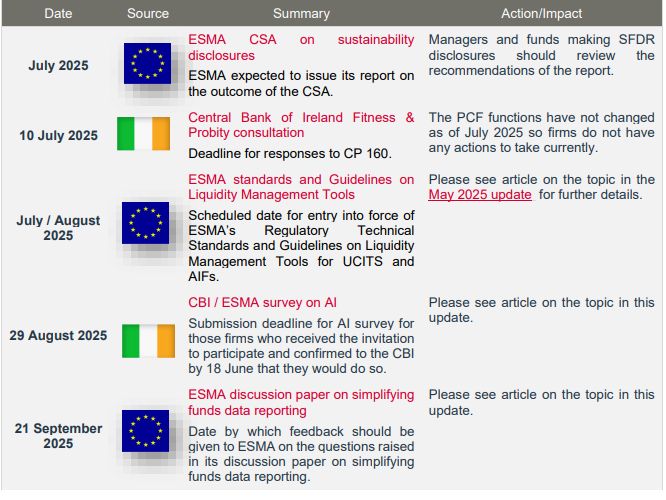

Key Dates & Deadlines: Q3 / Q4 2025

The following are key dates and deadlines in Q3 / Q4 2025 along with possible impacts and action items arising for fund managers.

UCITS eligible assets review: ESMA final report

ESMA released a final report on 26 June 2025 following its review of the UCITS Eligible Assets Directive (UCITS EAD). The report contains assessment of the feedback from respondents to the consultation process and suggested legislative changes to the UCITS Directive and the UCITS EAD. ESMA will now work with the European Commission in its review of the UCITS EAD.

Summary of key proposals

ESMA has proposed a look-through approach in the determination of eligible assets for UCITS. ESMA also proposes to permit some level of flexibility to gain limited indirect exposures (up to 10%) to alternative assets with a view to improving risk diversification and generating returns from uncorrelated asset classes. No additions are proposed to the list of eligible assets.

Transferable securities definition

ESMA has made proposals to clarify the eligibility criteria of transferable securities. In particular, the clarifications refer to criteria to be taken into account when assessing liquidity at asset level, what is meant by 'reliable valuation' being available, and linking the risk evaluation to the UCITS due diligence requirements in the selection and ongoing monitoring of investments.

UCITS exposures to alternative assets

ESMA's proposed amendments aim at ensuring a convergent application of a look-through approach to determine the UCITS eligibility of assets, while simultaneously broadening the 10% limit set out in the UCITS Directive to allow for some limited (up to 10%) indirect exposures to alternative assets.

ESMA sees one benefit of this as a clearer conceptual delineation between UCITS and AIFs. ESMA's analysis leads it to report that the proposals would concern a relatively small number of UCITS with large-scale exposures to alternative assets. For funds affected by this change, there will be a transition period to adapt portfolios or make other necessary changes. Investment funds with significant exposures to alternative assets (beyond 10%) will be subject to the AIFMD. The report contains in-depth analysis of the expected costs, benefits and implications of this change.

UCITS investment in closed-ended AIFs

Investment in units or shares of closed-ended AIFs shall be allowed when the AIFs prove to have the same characteristics as transferable securities, meet the criteria of having an equivalent supervision and the target AIF cannot invest more than 10% of their assets in units or shares of other funds. In application of the lookthrough approach, UCITS shall not invest in AIFs providing exposures to ineligible asset classes, regardless of whether they are of the open-ended or the closed-ended type.

Money market instruments

ESMA proposes some recalibration of the criteria set out in the UCITS EAD, notably the risk management criterion and liquidity assessments. ESMA is of the view that the money market provisions in the UCITS EAD should not be viewed as an obligation to automatically classify an instrument with a maturity of no more than 397 days as a money market instrument. An effect of the recalibration would be a partial reduction of the financial instruments which may fall within the definition of money market instruments.

Financial indices

ESMA proposes some legal clarifications, notably on the application of the look-through approach. UCITS will benefit from a greater alignment with the Benchmark Regulation. Where index providers and their indices are included in the ESMA register under the Benchmark Regulation, certain UCITS criteria for financial indices will be automatically met.

Ancillary liquid assets

ESMA advises the European Commission to clarify in the text of the UCITS Directive that ancillary liquid assets are subject to the counterparty limits set out in the UCITS Directive, without prescribing a maximum amount of ancillary liquid assets that UCITS may hold.

Efficient portfolio management

There are clarificatory changes proposed to EPM techniques. ESMA recommends to the Commission to consider providing further clarity on EPM-related costs and fees including on the fee split models with a view to ensuring investor protection.

Financial derivative instruments

ESMA makes proposals to clarify the assessment of financial instruments embedding a derivative. The proposals include criteria that can be considered by a UCITS to assess if a transferable security or money market instrument can be regarded as embedding a derivative, and whether the derivative component must be considered to be a separate financial instrument.

Irish Funds sectoral anti-money laundering guidelines

Irish Funds has prepared and published sectoral guidance on Anti Money Laundering, Countering the Financing of Terrorism and Financial Sanctions. (IF AML/CFT Guidance). The IF AML/CFT Guidance is supplementary to the Central Bank of Ireland's (CBI) Anti-Money Laundering and Countering the Financing of Terrorism Guidelines for the Financial Sector. Those CBI guidelines were published first in 2019 and updated in 2021. Funds and financial service providers are required to comply with AML/CTF legislation.

Funds and AML/CTF compliance

The guidelines provide funds-specific guidance on particular points of practice that arise for Irish regulated investment funds in complying with AML/CFT legislation. This is particularly useful as fund structures have certain legal, regulatory, contractual and product features where such guidance will support robust AML/CTF compliance. Fund structures make use of outsourcing and funds often rely on third parties or intermediaries to comply with regulatory obligations, while responsibility for compliance rests with the fund. The fund has the direct customer relationship with the fund investor. Often, it is the fund administrator who provides AML/CTF services to the fund to assist it to discharge its AML/CFT obligations. For ILPs, CCFs and Unit Trusts, responsibility for AML/CFT compliance rests with the board of the AIFM or UCITS Management company.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]