- within Corporate/Commercial Law topic(s)

- in Asia

- with readers working within the Banking & Credit and Law Firm industries

- within Corporate/Commercial Law topic(s)

- in Asia

- in Asia

- within Corporate/Commercial Law, Real Estate and Construction, Media, Telecoms, IT and Entertainment topic(s)

- with readers working within the Healthcare, Retail & Leisure and Law Firm industries

Introduction

In recent years, regulatory compliance concerning the disclosure of Significant Beneficial Owners (SBO) has gained increased importance under the Companies Act, 2013. Companies operating in India must adhere to stringent requirements to ensure transparency and accountability in their ownership structures. The following cases involving Samsung Display Noida Private Limited, Sunjin India Feeds Private Limited, Shree Digvijay Cement Co Limited, and LinkedIn Technology Information Private Limited illustrate the consequences of non-compliance with Section 90 of the Companies Act, 2013, and the rules pertaining to SBO disclosures. These cases highlight the critical role of compliance in corporate governance and the rigorous enforcement measures taken by the Registrar of Companies (ROC) to uphold these standards. Before moving to cases, Let's first delve into the key concepts and basics of significant beneficial ownership as defined in the Companies Act, 2013, and the rules thereunder.

What is SBO?

According to S. 90 of the Companies Act,,2013, a "significant beneficial owner" in a company is someone who, either alone, with others, or through other people or trusts, has one or more of these rights or entitlements in the company indirectly or along with directly:-

- at least 10% of the shares,

- Control at least 10% of the voting rights,

- has the right to receive or participate in at least 10% of the total distributable dividends or other distributions in a financial year,

- has the right to exercise, or actually exercises, significant influence or control in any way other than just through direct shareholding.If an individual does not hold any right or entitlement indirectly, he shall not be considered to be a significant beneficial owner. To grasp the concept of significant beneficial ownership, it is essential to first understand a few key terms, which we have explained below.

Direct Holding refers to an individual who holds shares in their own name, as recorded in the company's Register of Members, or who holds a beneficial interest in the company's shares under Section 89(2) of the Companies Act 2013 which states about making declaration to the company regarding beneficial interest if any, and has declared this in Form MGT-5, thereby being treated as a member of the company.

Beneficial interest in a share includes, directly or indirectly, through any contract, arrangement, or otherwise, the right or entitlement of a person, either alone or with others, to exercise or cause the exercise of any or all rights attached to the share, or to receive or participate in any dividend or other distribution in respect of the share.

Indirect Holding applies when an individual's name does not appear in the Register of Members but they still hold rights or entitlements indirectly through various means: holding a majority stake in a corporate member or its ultimate holding company; being the Karta of a Hindu Undivided Family (HUF); being a partner or holding a majority stake in a partnership entity or its corporate partner; being a trustee, beneficiary, author, or settlor of a trust; or being a general partner, investment manager, or CEO of the investment manager in a pooled investment vehicle.

Control refers to the definition provided in clause (27) of section 2 of the Companies Act, 2013, which includes the right to appoint the majority of the directors or to control the management or policy decisions of a company, either individually or collectively, directly or indirectly, through shareholding, management rights, shareholders agreements, voting agreements, or other means.

Significant influence means having the power to participate, directly or indirectly, in the financial and operating policy decisions of the company without having control or joint control over those policies.

Compliance requirements in case SBO is identified

The individual shall make a declaration to the company in e-form BEN-1, specifying the nature of his interest and other particulars, within thirty days of acquiring such significant beneficial ownership or any change therein.Every significant beneficial owner shall also file a declaration in Form No. BEN-1 to the Company in which he holds the significant beneficial ownership within thirty days in case of any change in his significant beneficial ownership.

Where any declaration is received by the Company, it shall file a return in Form No. BEN-2 with the Registrar in respect of such declaration, within a period of thirty days from the date of receipt of declaration by it.The Company shall also maintain a register of significant beneficial owners in Form No. BEN-3.

Consequences of Non-compliance

According to section 90(10), section 90(11), section 90(12) of the Companies Act, 2013,failure to make the required declaration under Section 90(1) of the Companies Act, 2013 results in a penalty of ₹50,000 and an additional ₹1,000 per day for ongoing violations, up to ₹200,000. If a company fails to maintain the register or file information, or denies inspection, it faces a penalty of ₹100,000 and an additional ₹500 per day, up to ₹500,000. Officers in default face a penalty of ₹25,000 and ₹200 per day for ongoing violations, up to ₹100,000. If any person willfully furnishes false information or suppresses material information in the declaration is subject to action under Section 447 of the Companies Act, 2013 (Punishment for fraud) . These penalties are adjudicated by the Registrar of Companies and cannot be compounded.

Below are the cases that illustrate the importance of corporate compliance concerning Significant Beneficial Ownership (SBO).

Samsung Display Noida Private Limited, ROC,Uttar Pradesh,

Order dated 12.06.2024

Samsung Display Noida Private Limited (SDNPL) was incorporated on July 5, 2019, in Noida, Uttar Pradesh. The company is majorly owned by Samsung Display Co. Ltd., Korea (99.99% shares), with a minor share held by Mr. Jin Suk Lee as a nominee. This ownership has remained consistent since its inception, with initial subscribers being Samsung Display Co. Ltd., Korea (99.99% through Mr. Jaeho Shin) and Mr. Jeeyong Chung (negligible share).

Facts of the Case

- Non-Compliance with Section 90: SDNPL, a wholly-owned subsidiary of Samsung Display Co., Ltd. (SDC Korea), failed to file e-form BEN-2, indicating non-compliance with the declaration of beneficial ownership under Section 90 of the Companies Act, 2013.

- Company's Defense: On February 22, 2024, SDNPL claimed it was entirely owned by SDC Korea, which in turn, is 84.8% owned by Samsung Electronics Co., Ltd. (SEC Korea) and 15.2% by Samsung SDI Co., Ltd. (SDI Korea), both listed on the Korean Stock Exchange. They argued that no individual holds a majority stake in these companies, thus no individual qualifies as a Significant Beneficial Owner (SBO).

Registrar of Companies Interpretation

- Upon reviewing SDNPL's submission, it was noted that their assessment did not consider indirect holdings (i.e. shares held by the person not directly but through one or more entities), rights of certain persons to receive distributable dividends, or the the ability of certain persons to exert significant influence or control over the management and policies of the company, either directly or indirectly. According to the ROC, the submissions by SDNPL completely disregarded these factors.

- Consequently, it was determined that SDNPL should have declared its SBOs according to the relevant regulations. A Show Cause Notice (SCN) was issued to SDNPL, its directors, and key management personnel on April 15, 2024, for non-compliance with Section 90 and the SBO rules.

Response to Show Cause Notice (SCN):

- The company reiterated its previous stance, denying non-compliance with Section 90 of the Companies Act, 2013, and the Significant Beneficial Owners (SBO) Rules.

- The defense was based on the shareholding pattern, claiming no individual holds 10% or more in the holding (SDC Korea) or ultimate holding company (SEC Korea).

- The company argued that the provisions of indirect control in Section 90 would not apply as it is managed independently by its Board of Directors.

Registrar's Observations:

The response was deemed unacceptable as it did not align with the essence of S. 90's requirements and the company failed to consider indirect holdings (i.e. shares held by the person not directly but through one or more entities), voting rights and rights of certain persons to receive distributable dividends, or the the ability of certain persons to exert significant influence or control over the management and policies of the company, either directly or indirectly, in its compliance efforts under Section 90(4A) and (5).

Further Actions:

- Another hearing was scheduled for May 10, 2024.

- The company was required to provide further clarifications and documents, including details of promoters, directors, KMPs, and shareholders of major Samsung companies.

- Additional information about the chairpersons of board meetings, Ultimate Beneficial Owners (UBOs) disclosed to Indian banks, and UBO details filed in the host country was also requested.

- In response to a request for clarifications SDNPL, submitted an incomplete reply on May 10, 2024, and did not attend the hearing. The company reiterated that SDC Korea and SEC Korea are professionally managed listed companies, and no individual holds significant beneficial ownership. They also provided inconclusive email correspondence with Citi Bank regarding the ownership structure, failing to disclose the Ultimate Beneficial Owner (UBO) as required by RBI regulations for opening an account.

- SDNPL shared Consolidated Financial Statements of SEC Korea, revealing its 100% ownership of Samsung Display Noida Private Ltd.

- Late Mr. Lee Kun Hee's family holds around 21.46% shares of SEC Korea, with additional stakes in Samsung Life Insurance Co. Ltd. and Samsung C&T.

- Mr. Lee Jae-Yong, the son of late Mr. Lee Kun Hee was appointed Executive Chairman of Samsung Electronics in October 2022, indicating significant influence despite existing board structures.

- Samsung Group controls over 80 subsidiaries globally, with the Lee family holding significant stakes in each, maintaining control through cross-ownership.

- Mr. Lee Jae-Yong's control over Samsung Electronics is indirect but substantial, influencing Samsung's subsidiaries globally.

- The Lee family's holdings enable them to maintain control over Samsung Group's subsidiaries. Mr. Lee Jae-Yong's potential influence over SEC Korea suggests he may qualify as an SBO.

The reporting company failed to provide all required information and documentary evidence. Despite claiming no SBO due to listed status of SDC and SEC Korea, this does not absolve the reporting company from its obligations.

The reporting company didn't serve Form BEN-4 to its immediate Holding Company as mandated. Failure to identify SBOs and serve Form BEN-4 violates Section 90(4A) of the Companies Act, 2013.

This lack of action constitutes a violation of regulatory requirements, indicating negligence on the part of the reporting company and its officers.

Despite opportunities, the reporting company failed to prove its lack of significant beneficial ownership in the Indian corporate entity.

Mr. Lee Jae-Yong's appointment as Executive Chairman of SEC, Korea, despite micro shares, suggests proxy-control vested through remote mechanisms.

The default under Section 90 of the Companies Act, 2013, stands established due to non-compliance.

Penalty Imposed

For Violation of Section 90(4A) of the Companies Act, 2013, ROC has levied heavy penalty on Company, its directors, EX Company Secretary, Current Company Secretary under section 90(10) and 90 (11) of the Companies Act, 2013. The total penalty amounting to Rs. 8,14,200/- (Rupees Eight Lakhs Fourteen Thousand Two Hundred only).

K S&Co Comment:

The Registrar of Companies found Samsung Display Noida Private Limited (SDNPL) non-compliant with Section 90 of the Companies Act, 2013, for failing to declare its Significant Beneficial Owners (SBOs). Despite SDNPL's defense citing no individual majority stake, indirect control by the Lee family was noted. This case highlights the importance of considering indirect ownership and control in SBO declarations.

Sunjin India Feeds Private Limited, ROC, Punjab and Chandigarh,

Order dated 27.05.2024

(i) Introduction:

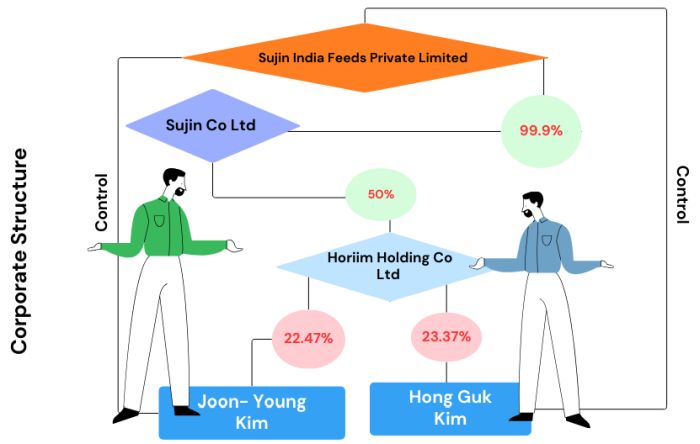

Sunjin Co Ltd is holding 99.9% shares in Sunjin India Feeds Private Limited and Harim Holdings Co Ltd is holding 50% shares in Sunjin Co Ltd. Also, it is observed that Joon-Young Kim and Hong-Guk Kim are holding 22.47% and 22.37% shares in Harim Holdings Co Ltd respectively and both are having control in Sunijin India Feeds Private Limited.

(ii) Facts of the case:

- It has been observed that the company has not filed e-form BEN-2, so notice under section 206(1) was sent to the company and its directors on 21.02.2024 with regard to issues pertaining to compliance pursuant to section 90 of the Companies Act, 2013 read with Rule 4 of the Companies (Significant Beneficial Owners) Rules, 2018

- Company vide letter dated 26.03.2024 has submitted reply which is not found satisfactory.

(iii) Registrar's Action: It is also pertinent to mention here that show cause notice dated 28.03.2024 was also issued to the company and its directors for violation of Section 90 of the Companies Act, 2013 and vide E-mail dated 26.04.2024 company was asked to furnish the copies of Board Resolutions passed by the company from 01.04.2018 onwards,

Company till date has not furnished the same. Further, company vide letter dated 29.04.2024 has sought more time to file the reply. Sufficient time has already been given to the company and its directors to submit the reply, which the company has not complied and reply to mail dated 26.04.2024 also not furnished till the date of this order.

Thus, it is evident that company has violated the provisions of Section 90(4) & 90(4A) of the Companies Act, 2013 as both Joon-Young Kim and Hong-Guk Kim were holding 22.47% and 22.37% shares in Harim Holdings Co Ltd respectively and thus both were having 'control' in Sunijin India Feeds Private Limited.

(iv) Penalty Imposed: For violation of Section 90(4) & Section 90(4A), the ROC levied heavy penalties on the Company, its directors, Company Secretary and KMP under Section 90(10)/90(11) of the Companies Act,2013. The total penalty imposed was 14,00,000/-(Rupees Fourteen Lakh) .

K S&Co Comment:

Despite multiple notices and sufficient time to respond, the company failed to file the required e-form BEN-2 and provide the necessary board resolutions.This action underscores the importance of adherence to statutory compliance requirements. The ROC has put light on 'control' as defined in section 2(27) of the Companies Act, 2013. As per Section 2(27), 'control' means and include right to appoint majority of directors or control the management or policy decisions of the Company. Along with direct and indirect holding, control also plays an important role in identifying SBO. It is essential to understand the significant influence of an individual over company's management and in taking decisions for the Company. Along with objective test i.e 10% holding criteria, Company needs to consider the subjective test of "control" to identify the SBO and comply with necessary requirements mentioned in the Companies Act, 2013 and rules made thereunder for SBO.

Digvijay Cement Co Limited, ROC, Gujarat,

Order dated 30.05.2024

(i) Introduction

This analysis pertains to the order of penalty for the default under Section 90 of the Companies Act, 2013, involving Shree Digvijay Cement Co Limited (hereinafter referred to as "the Company"). The case highlights the non-compliance with the provisions related to the disclosure of Significant Beneficial Owners (SBO), which led to adjudication proceedings by the Registrar of Companies (ROC).

(ii) Facts of the Case

- Shree Digvijay Cement Co Limited, incorporated in 1944 in Jamnagar, has undergone several changes in its shareholding structure.

- The key shareholders over the relevant financial years were Votorantim Cimentos and True North Fund VI LLP.

- On February 6, 2024, the ROC issued a notice to the Company for failing to file the E-Form BEN 2 on the MCA-21 portal as required under Section 90 of the Companies Act, 2013.

- The Company responded by claiming exemption under Rule 8(e) of the SBO Rules, 2018, due to its shareholder being a SEBI-registered Alternative Investment Fund (AIF). Despite this, the ROC proceeded with adjudication after finding the Company's explanations unsatisfactory.

(iii) Submissions by the Company

- Effective Date of Provision: The Company argued that the amendments to the SBO provisions and the format for BEN-2 were operationalized only from July 1, 2019, and hence were not applicable retrospectively.

- Shareholding Changes: The Company pointed out that Votorantim Cimentos, which held a significant stake until April 16, 2019, did not file a BEN-1 declaration. Post this period, True North Fund VI LLP, a SEBI-registered entity, acquired the shares and was exempt from the SBO disclosure requirements.

- Obligation of Declaration: The Company asserted that its obligation to file BEN-2 was contingent upon receiving a BEN-1 declaration from the SBO, which did not happen in this case.

(iv) Findings & Order

- For the Year 2018-2019: The ROC determined that the ultimate holding entity, HEJOSSU, indirectly owned by Ermirio Pereira and others, are SBOs in relation to the subject company for FY 2018 – 2019 in view of the threshold test for shareholding and by virtue of them acting together in exercising indirect ownership over the subject company. They failed to file Form BEN-1 within the stipulated period following the commencement of the Companies (Significant Beneficial Owners) Amendment Rules, 2019 and as required by 90(1) of the Act, leading to violation of Section 90(10) of the Act. The Company also failed to send the requisite notices under Rule 2A (2) of the SBO Rules, 2018, leading to a violation of Section 90(5) and Section 90(4A) of the Act.

- For the Year 2019-2020 and Onwards: It was acknowledged that the shares were held by True North Fund VI LLP, a SEBI-registered AIF, which is exempt from the SBO disclosure requirements. The ROC accepted the Company's reply for this period, and no penalties were imposed for the subsequent years.

(v) Penalties Imposed

ROC levied heavy penalties on Company and its directors under section 90(10), 90(11), 450 of the Companies Act,2013 of a total amounting to Rs. 24,98,400/- (Twenty four lakh Ninety-eight thousand four hundred only) for violating section 90(1), 90(4A) and 90(5) of the Companies Act, 2013

K S&Co Comment

The case underscores the importance of compliance with SBO disclosure requirements under the Companies Act, 2013. While the Company successfully argued its exemption for the period post-2019 due to its shareholder being a SEBI-registered AIF, it failed to meet the obligations for the year 2018-2019. The penalties imposed reflect the regulatory emphasis on transparency and the identification of significant beneficial ownership to prevent misuse of corporate structures. This case serves as a crucial reminder for companies to diligently follow statutory requirements and ensure timely disclosures to avoid legal repercussions.

Linkedin Technology Private limited, ROC, NCT of Delhi & Haryana,

Order dated 22.05.2024

(i) Introduction

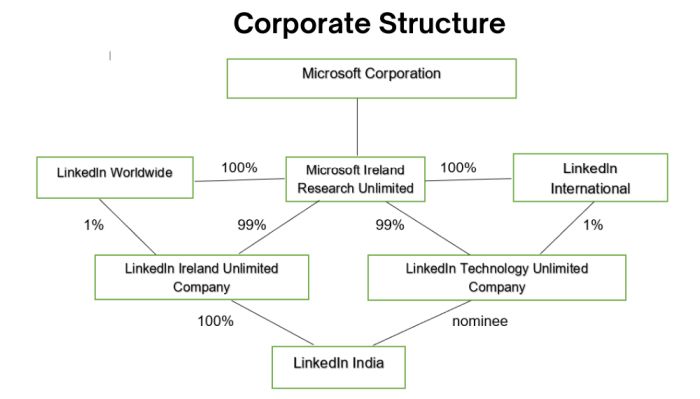

LINKEDIN TECHNOLOGY INFORMATION PRIVATE LIMITED (herein after known as 'company' or 'subject company' or 'LinkedIn India') was incorporated on 31.12.2009 and has its registered office as per MCA21 Register address at 16A/20, WEA MAIN AJMAL KHAN ROAD, KAROL BAGH, NEW DELHI , Delhi , 110005, India.

The Non-compliances has been observed in 2 parts i.e under section 89 and section 90 of the Companies Act,2013

(ii) Facts of the case- for Section 89 of the Companies Act,2013

- It was noted that the company had filed an e-form MGT-6 vide SRN F91257345 dated 29.01.2024 wherein it is reported that LinkedIn Technology Unlimited Company is a registered holder and LINKEDIN Ireland Unlimited Company is a beneficial owner in respect of 01 share of the subject company and date of creation of beneficial interest has been shown as 11.01.2024.

- This ran contrary to the filings made in the financial statements of the subject company which showed that the beneficial interest had arisen much earlier. The company had also not declared its significant beneficial owner as required under the provisions of section 90 of the Act.

- Accordingly, a Show Cause Notice (SCN) for Adjudication dated 15.02.2024 was issued to ascertain compliances of Section 89 and 90 of the Act.

(iii) ROC observations for non-compliance of section 89 of the Companies Act, 2013

Beneficial Ownership Declaration:

- LinkedIn Ireland Unlimited Company has always been the beneficial owner of the single share held by LinkedIn Technology Unlimited Company (the registered owner).

- The obligation to declare this beneficial ownership arose upon the company's incorporation in 2009.

- Both the registered owner and the beneficial owner were required to file declarations in Form 22B under section 187C of the Companies Act, 1956.

Erroneous Declaration: The company admitted that the date of creation of the beneficial interest was incorrectly stated as January 11, 2024, in Form MGT-4 and Form MGT-5 by both the registered and beneficial owners.

Non-Compliance with Filing Requirements

- There is no provision to withdraw the erroneously filed e-form as it was mandatory.

- The declarations do not comply with section 89(1) and (2) of the Companies Act, 2013, due to incorrect timelines and erroneous date of creation of the beneficial interest.

(iv) Penalties for Incorrect Declarations

ROC levied penalty on Linkedin India as well as Linkedin Ireland of a sum total amounting to Rs. 5,60,800/- (five lakh sixty thousand eight hundred only)

(v) Facts of the case -for section 90 of the Companies Act

- It is seen that Microsoft Corporation, USA (ultimate holding company) is regularly filing statements of changes in beneficial ownership of securities with the Security & Exchange Commission (SEC) .

- However, the Linkedin India has not filed any eform BEN-2 on MCA 21 portal as required under Section 90 of the Act and rules made thereunder.

(vi) Company's Response:

As far as Section 90 of the Companies Act is concerned, it is our understanding that it applies to cases: (1) when an individual directly or indirectly holds 10% of the shares of a company: (2) when the shares of a company are held by a body corporate, whether there exists an individual who holds majority stake in the member, being a body corporate, or holds majority stake in the ultimate holding company of the member of the company. In our case, there is no individual who is a shareholder of LinkedIn India. Secondly, the ultimate holding company is Microsoft Corporation, USA, a listed body corporate, where it is publicly reported that no individual holds a majority stake.

(vii) ROC observations for non-compliance of section 90 of the Companies Act, 2013

The RoC relied on 3 main factors to identify SBOs; the nature of the relationship between LinkedIn India and holding companies ('holding-subsidiary test'), the nature of the reporting channels ('reporting channel test') and the nature of financial control ('financial control test') exercised over LinkedIn India.

Beneficial ownership through Holding Subsidiary Relationship

LinkedIn India listed LinkedIn USA as its holding company in financial statements, despite LinkedIn USA having no direct shareholding in LinkedIn India. Both entities are subsidiaries of Microsoft Corporation. The RoC determined that LinkedIn USA could only be considered the holding company if it controlled LinkedIn India's Board of Directors (BoD).

Based on this holding-subsidiary test, the RoC concluded that Ryan Roslansky, CEO of LinkedIn USA, has the right to exercise control over LinkedIn India's BoD, making him liable to be disclosed as a Significant Beneficial Owner (SBO). The RoC also examined Microsoft's annual filings with the US SEC, finding that Roslansky is part of Microsoft's senior leadership and reports to Satya Nadella, CEO of Microsoft Corporation. Therefore, the RoC concluded that Nadella is also liable to be disclosed as an SBO of LinkedIn India.

Beneficial ownership through the reporting channel test

The RoC reviewed the executive structure of LinkedIn India and its holding and group companies. It found that the Board of Directors (BoD) of LinkedIn India consisted of Microsoft employees globally, concluding that these individuals were effectively Microsoft's 'nominees' on LinkedIn India's BoD, despite LinkedIn India's objections.

The RoC also examined Microsoft's Bye-Laws, noting that Satya Nadella, as CEO and Chairman, was responsible for supervising the business. Consequently, the RoC determined that the majority of LinkedIn India's directors were employees of Microsoft or the LinkedIn Group, ultimately reporting to Ryan Roslansky and Satya Nadella.

The RoC established that the majority of the directors of LinkedIn India are employees of LinkedIn Corporation or Microsoft Corporation, ultimately reporting to Ryan Roslansky or Satya Nadella. The relevant rules require only the "right to exercise" significant influence or control, not the actual exercise of it. Based on the reporting channels, the RoC confirmed that Roslansky and Nadella have the right to control the majority of LinkedIn India's directors.

Beneficial ownership through the test of financial control

In a board meeting held in Singapore on November 30, 2016, LinkedIn India's Board passed a resolution effective from the fourth day after the merger between LinkedIn Corporation and Liberty Merger Sub Inc., a Microsoft Corporation subsidiary.

The resolution authorized specific Microsoft executives (CFO, Treasurer, and Assistant Treasurer) to establish, operate, or close bank accounts, designate signatories, and sign agreements for banking services. Two signatories were required for transactions over USD 10,000 (or the equivalent in INR).

In a board meeting on May 2, 2022, the resolution was modified to appoint managing signatories, operating signatories, and bank guarantee signatories.The resolution clarified that it did not supersede previous resolutions by the Microsoft Corporation Board regarding the CFO and Treasurer's authority.

The financial control by Microsoft Corporation is evident from LinkedIn India's financial statements, which show related party transactions with other group entities. Microsoft Treasury controls numerous bank accounts across different entities, which may serve fraud prevention but also indicates significant control by Microsoft.

The resolution makes LinkedIn India's financial decisions subject to Microsoft's Board, undermining LinkedIn India's Board's authority. Microsoft employees designated as signatories are not accountable to LinkedIn India's Board.This analysis does not judge the merits of the financial arrangement but highlights the pervasive control exercised by Microsoft Corporation.

According to the rules, it is sufficient to establish the "right to exercise" significant influence or control, not the actual exercise of it.Since control over LinkedIn India's financial transactions rests with Microsoft employees under the CEO's supervision, Satya Nadella has the "right to exercise control" over LinkedIn India.

Thus, The RoC penalized LinkedIn Technology Information Private Limited ('LinkedIn India') and its directors for not disclosing their Significant Beneficial Owners (SBOs) as required under the Companies Act 2013 (CA 2013) and the SBO Rules. Additionally, the RoC imposed penalties on Satya Nadella, CEO of Microsoft Corporation (the ultimate holding company of LinkedIn India), and Ryan Roslansky, CEO of LinkedIn Corporation USA. The RoC's findings were primarily based on sub-clause (iv) of clause (h) of Rule 2(1) of the SBO Rules. This rule states that an SBO includes any individual who has the right to exercise, or actually exercises, significant influence or control in ways other than through direct holdings alone.

(viii) Penalties imposed

ROC levied heavy penalties on Company and its directors under section 90(10), 90(11), 450 of the Companies Act,2013 total amounting to Rs. 21,50,000/- (Twenty one lakh fifty thousand only )for violating section 90(1), 90(4A) and 90(5) of the Companies Act, 2013

K S&Co Comment

If the current interpretation of the SBO provisions in the LinkedIn Order were accepted, it could potentially allow RoCs to take action against all CEOs of foreign holding companies with a global presence. This would involve extensive scrutiny through multiple layers of the holding company-subsidiary structure, effectively piercing the corporate veil to hold individuals from the holding companies accountable for compliance violations in the reporting company in India.

The incorrect declaration of beneficial ownership and failure to disclose significant beneficial owners, despite clear control exercised by Microsoft executives, underscore the necessity for stringent adherence to corporate governance norms. The penalties imposed highlight the importance of accurate and timely reporting to regulatory authorities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]