- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Technology, Retail & Leisure and Telecomms industries

The Reserve Bank of India ("RBI"), on November 28, 2025, issued new Know Your Customer ("KYC") Master Directions which will apply to Payment Aggregators, namely, the consolidated 'Reserve Bank of India (Commercial Banks - Know Your Customer) Directions, 2025' ("KYC MD 2025"). This consolidation is part of RBI's broader regulatory review exercise aimed at reducing compliance complexity by organising instructions separately for each class of regulated entity.

The primary intent was to consolidate the plethora of existing circulars and the KYC Master Direction, 2016 ("KYC MD 2016") into a single, comprehensive document on an 'as-is' basis, removing obsolete instructions and improving clarity without introducing major substantive changes to the core KYC obligations.

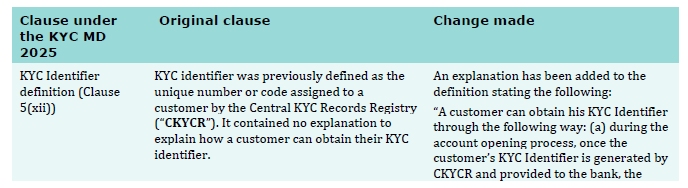

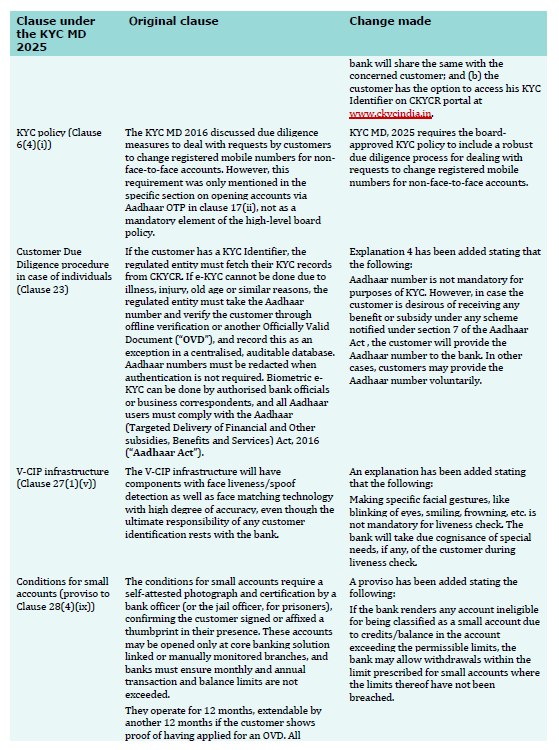

While the RBI invited stakeholder comments on the draft versions to ensure completeness and accuracy, the final text largely retains the existing framework, barring minor editorial reorganisations and the inclusion of specific explanations or provisos to address ambiguities (listed in the table below).

The new structure

Notably, while the new KYC MD 2025 is explicitly titled for 'Commercial Banks', it has immediate legal implications for Payment System Providers ("PSPs"), including Prepaid Payment Instrument ("PPI") issuers and Payment Aggregators ("PAs"). Concurrently with this issuance, RBI released a specific notification repealing the KYC MD 2016. Consequently, the notification mandates that all references to the KYC MD 2016 in existing payment system instructions (such as the Master Directions on PPIs and PAs) must now be read as references to the new KYC MD 2025. Therefore, despite the nomenclature, your compliance teams must map their KYC protocols to the specific paragraphs of this new KYC MD 2025.

Conclusion

While the KYC MD 2025 largely preserves the 'as-is' framework of the previous regulations, it signals a shift toward a more organised and distinct regulatory architecture. For PAs and PSPs, the immediate challenge is administrative rather than structural; accurately mapping internal protocols to the new 'Commercial Bank' standards to replace the now-repealed KYC MD 2016 . By proactively addressing the specific nuances, ranging from V-CIP accessibility to CKYC identifier handling, compliance teams can ensure a seamless transition that aligns with the RBI's ultimate goal of reducing compliance complexity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.