- within Corporate/Commercial Law topic(s)

- within Real Estate and Construction and Transport topic(s)

Despite ongoing geopolitical uncertainty, signs of recovery are emerging in the private equity market. With liquidity remaining the key focus, the private equity market has seen innovation in investment fund strategies and transaction structures, with an uptick in alternative investment.

Jefferies reported in their Global Secondary Market Review that global secondary market transaction volume reached a record high in 2024, with a value of $162bn, up from $132bn in 2021. They project that this will exceed $185bn in 2025. These figures reflect the increased activity and interest we are seeing in the private equity secondaries market.

In this briefing, we consider private equity secondary investments and transactions, explaining what these entail and touch on some of the most common structures which may be used to achieve an investor's goals. We also highlight some of the key benefits of using Guernsey as your jurisdiction of choice to facilitate private equity secondary transactions.

What is a PE secondary transaction?

A secondary PE transaction is perhaps best distinguished as against a primary PE transaction. Whilst both primary and secondary PE transactions may be structured in a multitude of ways, the basic principle and distinction between the two is as follows:

Primary PE transaction / investment

This transaction typically involves a direct subscription of shares or limited partnership interests by an investor for the purposes of providing a capital injection to fund the start-up of a business or acquisition of an initial portfolio of assets. Shares or interests are created and sold in exchange for investment capital directly between the investor and an issuer (the investment vehicle – which may be structured as a company or a limited partnership and is likely to (but may not in some circumstances) constitute a "fund"). As the investor is providing capital directly to the investment vehicle it is considered a primary investment.

Secondary PE transaction / investment

By contrast to a primary transaction, a secondary transaction typically involves the sale and purchase of existing interests in a private equity vehicle, rather than investing directly into a new investment vehicle. Secondary PE transactions are most commonly associated with late-stage vehicles who have been operating and increasing their investment value over an extended period of time.

The investors in the above scenarios can take different forms – from individuals to corporates or limited partnerships. Limited partnerships are particularly common in the context of Guernsey private equity investment vehicles, many of which will constitute funds for Guernsey regulatory purposes. PE secondary transactions in the context of limited partnerships can be described as either GP-led secondaries or LP-led secondaries.

GP-led secondary transaction

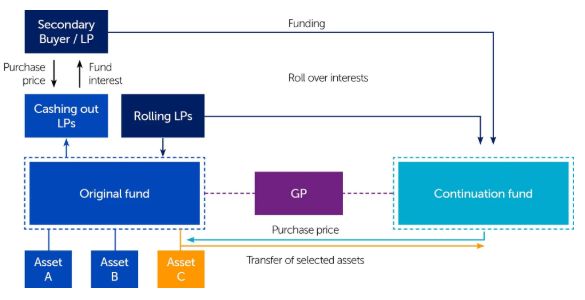

These can take a variety of forms, but the most common is the "continuation vehicle". A continuation vehicle is useful where the general partner and/or manager of a limited partnership believes there is upside potential in continuing to hold certain of the remaining assets beyond the original investment vehicle term but not all investors are willing to approve a sufficient extension to the life of the vehicle. In this case, the remaining assets are sold to a new investment vehicle and investors are given the option to either "cash out" or "roll-over" their investment into the continuation vehicle.

Investors opting for the "cash-out" (or sell) option will receive their share of the sale proceeds whereas those who "roll-over" gain interests in the new vehicle in place of their interests in the previous vehicle.

LP-led secondary transaction

Unlike GP-led secondary transactions which are initiated by the general partner of the private equity partnership, LP-led secondary transactions are initiated by the limited partners themselves. In a LP-led secondary transaction, a limited partner will sell their existing interests to a secondary buyer. The underlying fund and portfolio remain unchanged and the buyer steps into the seller's shoes, taking over the responsibility of future capital calls and the benefit of future distributions.

Guernsey as a key jurisdiction to facilitate PE secondary transactions

Guernsey is well-placed to facilitate both primary and secondary PE transactions with a flexible legal framework and range of structures available within the alternative investments space. We highlight some of the main benefits of using Guernsey as a domicile for your private equity vehicle (including continuation vehicles):

- Guernsey is a highly reputable international finance centre widely used by relevant stakeholders in the private equity market;

- Guernsey's corporate and partnership laws allow for significant flexibility in terms of legal form as well as capital structuring, which is ideal for complex GP-led secondaries, where bespoke structures are often required;

- legal mechanisms for transfer of interests, roll-overs and capital restructures are well-established and commonly used;

- non-Guernsey fund vehicles can be migrated to Guernsey in a straightforward and expedient process;

- funds can be established and regulated quickly – useful for continuation vehicles where timing is important;

- Guernsey's Private Investment Fund (PIF) regime is particularly useful for club-style continuation vehicles, even more so following recent changes which have made this product even more flexible and cost effective; and

- Guernsey has a wealth of highly qualified world-class finance, tax, legal, audit and fund administration professionals experienced in working on complex and innovative fund structures.

How can we help?

Our Guernsey Investment Funds & Corporate team has specialist experience in both primary and secondary PE transactions having acted for some of the largest institutional investors and sponsors in the market. We offer extensive legal services to clients across all matters under Guernsey law, providing bespoke and innovative legal solutions to GPs and LPs on a variety of alternative investment solutions. If you're interested in how a Guernsey company structure can help your next private equity deal, please get in touch.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.