- within Media, Telecoms, IT and Entertainment topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Advertising & Public Relations and Law Firm industries

- within Media, Telecoms, IT, Entertainment, Corporate/Commercial Law, Government and Public Sector topic(s)

UAE's traditional position on gaming

Traditionally, the United Arab Emirates has adopted a restrictive and prohibition-based approach towards gaming and gambling. Such activities were addressed primarily through the criminal law framework, under which gambling and games of chance were broadly prohibited.

In this regard, Articles 460 and 461 of Federal Decree-Law No. (31) of 2021 Promulgating the Crimes and Penalties Law1 define "gambling" as a game whereby each party agrees, in the event of losing, to pay the winner a specified sum of money or any other agreed consideration, and prescribe penal consequences including imprisonment of up to two years or a fine of up to AED 50,000 for participation in gambling.

There was no dedicated licensing system, no sector-specific regulator, and no compliance framework that allowed commercial gaming operations. As a result, organised gaming was generally treated as unlawful, reflecting an approach that relied on outright prohibition rather than regulated permission, with legal certainty achieved by not allowing such activities at all.

Beyond criminal prohibitions, the UAE's historic position also reflected a civil law consequence: gambling and prohibited betting arrangements were treated as void, meaning they could not be relied upon as enforceable contracts. The Civil Transactions Law (Federal Law No. 5 of 1985) provides that "any agreement relating to gambling, or prohibited betting, is void" and also allows a loser to reclaim what was paid within a specified period. This matters commercially because one of the practical outcomes of a licensing regime is not merely "permission to operate", but also greater clarity on the enforceability of operator terms, payment obligations and dispute outcomes—provided the underlying activity falls within the scope of licensed commercial gaming rather than prohibited gambling.

Need for regulating the gaming industry

Market projections indicate that the size and success of the UAE's gaming sector will depend largely on how clearly and effectively it is regulated. As per SCCG Management's "The UAE Gambling Industry Research Report",2 analysts suggest that if gaming is permitted only in a limited manner, such as a single integrated resort with restricted online activity, annual revenues could be around USD 1.5–2 billion by 2030.

With a more structured regulatory framework allowing multiple integrated resorts across major emirates along with regulated online gaming, revenues could increase to approximately USD 5–6 billion annually.

In a broader scenario, where gaming is permitted across several emirates under a well-defined and consistently enforced regime, the market could reach USD 8–10 billion per year, bringing the UAE close to established gaming jurisdictions such as Singapore.

Without a clear regulatory framework, the UAE would risk losing out on a major economic and tourism opportunity, while gaming activity could either go unchecked or move into informal channels. A well-designed regulatory system is therefore important not just to control growth and maintain stability, but also to ensure that the UAE is able to fully realise the economic benefits of a carefully regulated gaming industry.

Globally, the gaming industry is increasingly being evaluated through the lens of Environmental, Social, and Governance (ESG) standards. The regulated gaming market, which generated approximately USD 540 billion in global revenues in 2025, faces mounting pressure from investors and regulators to demonstrate sustainable and responsible operations.3 According to recent industry assessments, leading gaming jurisdictions are integrating ESG principles into their regulatory frameworks, recognising that sustainability is not merely a compliance cost but a performance lever. A 2025 PwC study found that companies prioritising sustainability delivered 12–18 percent higher returns while demonstrating greater resilience against market volatility.

For the UAE, this global trend converges with national sustainability objectives, including the UAE's Net Zero by 2050 Strategic Initiative.4 Gaming facilities will also fall within the scope of Federal Decree-Law No. (11) of 2024 on the Reduction of Climate Change Effects (effective May 2025), which establishes mandatory greenhouse gas emissions reporting for facilities exceeding specified thresholds.5 Aligning the gaming regulatory framework with both domestic environmental legislation and emerging global ESG benchmarks positions the jurisdiction to attract institutional investment while building stakeholder trust from the outset.

Establishment of the General Commercial Gaming Regulatory Authority (GCGRA)

In September 2023, the UAE announced the establishment of the GCGRA by federal decree as the central authority responsible for overseeing commercial gaming in the UAE. The GCGRA has been established as the federal authority to establish and oversee a regulatory framework for all lottery and commercial gaming activities in the UAE. The GCGRA is mandated to regulate, license, supervise, and investigate individuals and entities involved in commercial gaming activities, in accordance with applicable federal laws and regulations.

The GCGRA is tasked with several functions6. A core function of the GCGRA is licensing. It is the sole authority empowered to grant licences to gaming operators, suppliers, and other participants in the gaming ecosystem. Through this process, the GCGRA determines who is eligible to operate, the conditions under which activities may be carried out, and the scope of permitted gaming activities.

Licensing is complemented by ongoing supervision, including inspections and investigations. In addition, the GCGRA plays a critical role in preventing financial crime and promoting responsible gaming. It oversees anti-money laundering and counter-terrorism financing controls within the gaming sector and requires licensed entities to implement robust compliance systems. At the same time, it promotes responsible gaming through self-exclusion tools, and awareness initiatives aimed at reducing harm and encouraging ethical conduct.

These functions align closely with emerging global ESG benchmarks for the gaming industry. The Malta Gaming Authority, a leading jurisdiction in gaming regulation, introduced its ESG Code of Good Practice in 2023, providing an industry-specific framework covering 19 topics across Environmental, Social, and Governance pillars.7 The Code establishes two reporting tiers and awards ESG approval seals to compliant operators. Similarly, the UK Gambling Commission has integrated sustainability reporting into its regulatory oversight, implementing a statutory gambling levy from October 2025 to fund research, education, and treatment of gambling-related harm.8 The American Gaming Association has conducted industry-wide ESG assessments,9 while Singapore's Gambling Regulatory Authority implements strict responsible gambling codes alongside comprehensive AML/CFT controls.10

Notably, the GCGRA's AML oversight will operate within the broader framework of Federal Decree-Law No. 10 of 2025 on Combating Money Laundering, Countering Terrorism and Proliferation Financing (effective October 2025), which aligns with FATF Recommendation 22 identifying casinos as requiring enhanced customer due diligence.11 On the social dimension, gaming operators must also comply with Federal Decree-Law No. 33 of 2021 on the Regulation of Labour Relations, including Emiratisation requirements and Wage Protection System mandates.12 The GCGRA's emphasis on responsible gaming, financial crime prevention, and operational integrity positions it well to adopt comprehensive ESG frameworks, potentially establishing the UAE as a regional leader in sustainable and transparent gaming regulation.

Scope of regulation of GCGRA

Meaning of Commercial Gaming and Gaming Facility

Following the establishment of the GCGRA, no person may operate, manage, or participate in any activity relating to commercial gaming, or establish or operate a gaming facility, without first obtaining the requisite licences, approvals, and permits from the GCGRA and relevant local authorities.

This makes it essential to understand what constitutes "Commercial Gaming" and what qualifies as a "Gaming Facility" under the GCGRA framework.

Commercial Gaming:

"Commercial Gaming" includes games of chance and or skill where money or anything of value is placed as a bet for the purpose of winning money or a prize. The definition also extends to arrangements where the losing party is required to compensate the winner with money or any other item of value.

Commercial gaming includes, among others:

- Land-based gaming activities, such as slot machines and table games including blackjack, roulette, baccarat, craps, and poker

- Lotteries, where a player pays for or bets on a ticket that provides a chance to win a prize

- Internet gaming, being commercial gaming conducted online through computers, mobile phones, or other digital devices within the UAE

- Sports wagering, being the activity of placing bets or wagers on the outcome of sporting events, matches, or competitions

Gaming Facility:

A "Gaming Facility" is a land-based, physical establishment, where Commercial Gaming takes place

Commercial Gaming v Promotional Activities

The GCGRA does not license or regulate activities that are genuinely promotional in nature, that is, activities undertaken as marketing initiatives rather than revenue-generating gaming activities. However, the GCGRA retains sole discretion to determine whether an activity constitutes commercial gaming or qualifies as a legitimate promotion.

To distinguish a true promotion from commercial gaming, the GCGRA considers the following key factors:

- Objective of the promotion

The promotion must have a clear marketing purpose, such as increasing brand awareness, introducing a product, driving sales, or engaging customers. - Fair market value

Where participation requires a purchase, the product or service must be priced at its fair market value. Pricing goods significantly above market value in exchange for a chance to win a prize may amount to a lottery, which is a form of commercial gaming. - Prize as a marketing cost

In a legitimate promotion, prizes are treated as marketing expenses and not as a means of generating revenue. Typical prizes include giveaways, discounts, or limited-time offers linked to the promotional objective.

The following illustrations explain when an activity is considered a promotion and when it may be treated as commercial gaming:

- A company runs a product launch campaign where visitors are entered into a draw to win a gift hamper, with no entry fee and no purchase requirement. The activity is clearly aimed at brand promotion. However, the same activity would qualify as commercial gaming if participation required payment or purchase mainly to access the draw, making revenue generation the primary purpose.

- A retailer sells a product at its usual market price and offers customers a free chance to win a prize as part of a limited-time promotion. This remains a promotional activity. If the product price is increased specifically to include a chance to win, such that customers are effectively paying for the opportunity, the activity would be treated as a lottery and therefore as commercial gaming.

- A business funds prizes for a festive campaign entirely from its marketing budget, offering giveaways or discounts linked to sales promotion. This is promotional in nature. The same activity would qualify as commercial gaming if customers are required to pay an entry fee or if the prizes are funded directly or indirectly from participant payments rather than being treated as a marketing expense.

Advertising is typically one of the most sensitive regulatory areas in gaming because it intersects with consumer protection, vulnerable groups and public policy. GCGRA has issued Advertising Standards as part of its compliance framework, positioned alongside the broader Executive Regulation architecture for commercial gaming. For operators and vendors, this means marketing campaigns should be designed with compliance-by-design controls—covering audience targeting, responsible messaging, avoidance of misleading claims, and governance approvals—because advertising breaches in mature jurisdictions are increasingly treated as serious "social responsibility" failures rather than minor conduct issues.

Licensing

Types of Licenses

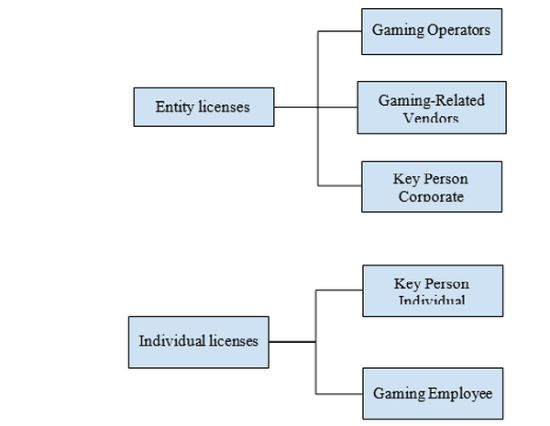

Activities regulated by the GCGRA cannot be carried out unless the required licences, approvals, and permits have been obtained. The GCGRA is empowered to issue five categories of commercial gaming licences. Depending on the nature and structure of the business, an applicant may be required to obtain more than one licence.

The categories of licensing can be divided into 2 parts as discussed in the illustration below:

We have discussed the types of licenses in detail below:

- Entity licenses

- Gaming Operators

A licence is required for any entity that operates or manages commercial gaming activities falling under one or more of the following categories:

- Gaming Facility Operator

- Lottery Operator

- Lottery Retailer

- Internet Gaming Operator

- Sports Wagering Operator

Each category corresponds to the specific type of gaming activity undertaken, and licences are activity-specific and multiple licences may be required depending on activities/group structure..

- Gaming-Related Vendors

Entities that manufacture, supply, maintain, or provide goods or services related to gaming equipment or gaming operations are required to obtain a Gaming-Related Vendor licence in order to operate in the UAE.

- Key Person - Corporate

Certain entities connected to a gaming operation are required to obtain a Key Person (Corporate) licence. The GCGRA adopts a group-level integrity assessment, meaning that scrutiny is not limited to the UAE entity alone.

Key corporate persons include:- A Controller

A controller is any person or entity that exercises control over another entity. Control exists where the controller:- Holds or is entitled to acquire, directly or indirectly, 15 percent or more of the economic rights, or

- Holds or is entitled to exercise, directly or indirectly, 15 percent or more of the voting rights, or

- Has the power to appoint or remove a majority of the board or governing body, whether by contract, agreement, or otherwise

Accordingly, any controlling entity of a UAE gaming entity may itself be required to obtain a licence from the GCGRA.

- Affiliate

An affiliate is a person or entity that is subject to control by another person or entity. - Management Services Provider

Any person engaged by a Gaming Operator to manage a gaming facility or provide core operational services such as accounting, administration, maintenance, recruitment, or similar services. - Other persons

Any other entity designated as a key person by the GCGRA based on its role, duties, or level of influence.

- A Controller

B. Individual Licenses

- Key Person - Individual

Individuals holding senior or influential roles are required to obtain a Key Person (Individual) licence, including:

- Directors and Executive Officers (such as the CEO, CFO, COO, or equivalent senior management) of a Gaming Operator or Gaming-Related Vendor

- Directors of a Controller

- Directors or Executive Officers of an Affiliate

- Any other individual designated as a key person by the GCGRA due to their duties or status

- Gaming Employee

A Gaming Employee means any employee of a Gaming Operator or a Management Company, but does not include a Key Person.

Gaming Employees are individuals who work for a licensed Gaming Operator or Management Company and are involved, directly or indirectly, in the conduct, operation, or supervision of commercial gaming activities. While they may not hold senior or decision-making roles that qualify them as Key Persons, their functions are considered sufficiently sensitive to require regulatory oversight.

Gaming Employees are required to obtain an occupational licence from the GCGRA, based on the nature of their role. These licences are categorised as follows:

- Occupational Licence Level 1 – required for Gaming Employees performing supervisory or managerial functions within gaming operations.

- Occupational Licence Level 2 – required for Gaming Employees who are involved in gaming activities but do not hold supervisory responsibilities.

Licensing process

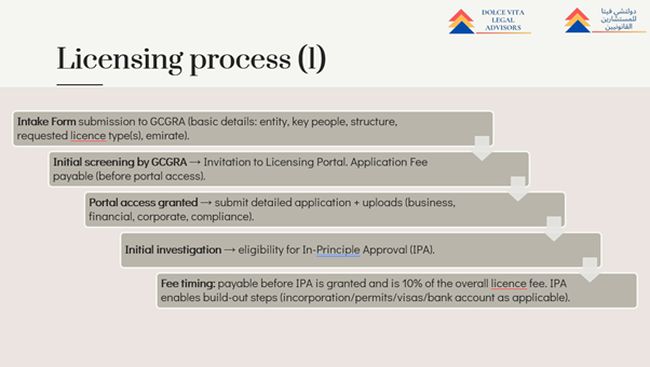

- Preliminary structuring

Before approaching the regulator, the applicant must first determine the exact licence category required. At this stage, the applicant should finalise its group structure, including parent entities, controllers, affiliates, and any management companies, and identify all Key Persons, both corporate and individual, as well as Gaming Employees. The applicant must also determine the emirate in which operations are proposed to be carried out and identify the relevant Qualifying Domestic Entity (QDE), as the licensing framework requires the licensed activity to be anchored in the UAE. A QDE is a UAE-incorporated company that has substantial business operations within the jurisdiction and is able to satisfy prescribed requirements relating to financial standing and operational history. An applicant seeking an Operator licence is required to have a clear relationship with a QDE in order to be eligible to obtain a licence.

- Submission of Intake Form

Once preliminary structuring is complete, the applicant submits an Intake Form to the GCGRA. This form contains high-level information, including the legal name of the applicant, the proposed licence type or types, the emirate of intended operations, and details of the group and ownership structure. This includes disclosure of the ultimate beneficial owners, the shareholding pattern of all stakeholders, and an organisation chart, enabling the GCGRA to assess which entities within the group may require licensing.

- Initial screening by GCGRA

Following submission of the Intake Form, the GCGRA conducts a preliminary assessment to determine whether the proposed activity is licensable, whether the applicant appears suitable at a high level, and whether there are any initial regulatory or risk concerns. If the application is accepted at this stage, the applicant receives an invitation to access the Licensing Portal. If rejected, the process ends before a formal application is made. The application fee becomes payable upon acceptance.

- Submission of full application via Licensing

Portal

After portal access is granted, the applicant submits a detailed application through the Licensing Portal. This includes the business plan and operational model, detailed corporate and group structure charts, financial information and projections along with proof of funding, AML and financial crime prevention frameworks, governance and internal control policies, and detailed information on directors, officers, controllers, affiliates, and management service providers.

- In-Principle Approval (IPA)

If, following its initial investigation, the GCGRA is satisfied that the applicant meets the eligibility requirements, it grants an In-Principle Approval. At this stage, an IPA fee equal to ten percent of the overall licence fee becomes payable. The IPA allows the applicant to incorporate or finalise the UAE entity, open bank accounts, obtain visas and local permits, and establish a physical and operational presence in the UAE. However, the IPA does not authorise the applicant to commence gaming operations.

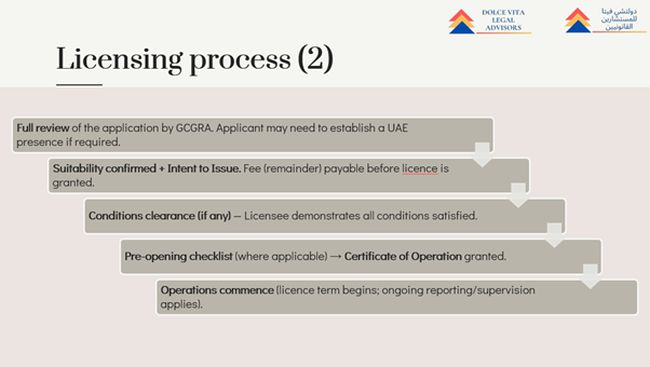

- Full regulatory review and enhanced due diligence

The GCGRA then undertakes a deeper and more detailed review of the application. This includes enhanced due diligence on shareholders, controllers, and group entities, assessment of integrity, financial soundness, and criminal history, and evaluation of governance arrangements, systems, technology readiness, AML and sanctions controls, and overall operational capability and risk management. Notably, leading gaming jurisdictions are expanding due diligence frameworks to include ESG-related considerations. In the UK, the Gambling Commission has issued fines running into millions of pounds for failings in both ESG and AML provisions, signalling that social responsibility compliance is now treated with equal severity to financial crime prevention.13 The Malta Gaming Authority's ESG Code requires operators to report on environmental practices, workforce diversity, responsible gambling programme effectiveness, and governance structures. For gaming operators with parent companies in jurisdictions with mandatory ESG reporting, such as the EU's Corporate Sustainability Reporting Directive (CSRD), extraterritorial compliance obligations extend to UAE operations. The CSRD's double materiality assessment requirement—evaluating both how the organisation affects people and environment, and how sustainability issues affect enterprise value—presents significant operational complexity requiring extensive data collection across the value chain. Applicants with established ESG reporting frameworks in other jurisdictions should include this documentation as evidence of governance maturity. This evolution reflects broader regulatory expectations that applicants demonstrate not only financial and operational capability but also a commitment to sustainable and socially responsible business practices, supported by audit-ready data governance systems.

- Intent to Issue Licence

If the applicant is found suitable following the full review, the GCGRA issues an Intent to Issue Licence. At this stage, the balance licence fee becomes payable. The licence may be issued with conditions or without conditions, and the licence term formally begins upon issuance.

- Pre-operational readiness and Certificate of

Operation

Before commencing operations, the licensee must satisfy all licence conditions, complete any pre-opening checklist issued by the GCGRA, and demonstrate operational readiness. Once the GCGRA is satisfied that all requirements have been met, it issues a Certificate of Operation.

- Commencement of operations and ongoing

supervision

Commercial gaming operations may commence only after the Certificate of Operation has been issued. Following commencement, the licensee is subject to ongoing regulatory oversight throughout the licence term, including periodic regulatory reporting, AML and financial crime compliance, audits and inspections, licence renewals, and mandatory notification of any material changes.

Current Licensees

The GCGRA does not permit any commercial gaming activity to be carried out unless the required licence has first been obtained. As of date, only one entity, Coin Technology Projects LLC, has been granted licences for internet gaming and sports wagering. Access to its platform is restricted to users located within the UAE.

This restriction aligns with the GCGRA's technical standards, including GLI-19: Standards for Interactive Gaming Systems (paragraph 2.7.4) and GLI-33: Standards for Event Wagering Systems (paragraph 2.7), which require the use of geolocation technology to determine a player's physical location and an associated confidence radius. The confidence radius must fall entirely within the permitted boundary, which, in the current context, is the UAE.

In relation to land-based gaming facilities, only one licence has been granted so far, to Wynn Al Marjan Island, which is scheduled to open in Spring 2027. As regards lottery operations, the sole licensee at present is The Game LLC.

Conclusion

The establishment of the General Commercial Gaming Regulatory Authority marks a clear change in how the UAE approaches gaming. What was once dealt with through outright prohibition is now being addressed through a structured and carefully controlled regulatory system. By introducing a clear licensing framework covering operators, vendors, and key individuals, the UAE has created a way to allow limited commercial gaming while maintaining strong oversight to protect the public interest and prevent misuse.

The global trajectory of gaming regulation demonstrates that ESG considerations are becoming integral to sustainable industry development. On the environmental front, large gaming facilities in the UAE will likely meet the 0.5 MtCO₂e threshold under Cabinet Resolution No. 67 of 2024 requiring registration with the National Register for Carbon Credits, given the energy intensity of gaming floors, hotel operations, and cooling systems. Beyond operational emissions (Scope 1 and 2), Scope 3 emissions from supply chains, construction, and guest travel typically represent 70–90 percent of a facility's carbon footprint, presenting measurement challenges that require sophisticated supplier engagement and data governance frameworks.

The "S" pillar extends beyond responsible gambling to encompass compliance with Federal Decree-Law No. 33 of 2021 on Labour Relations, including working hour restrictions critical for 24/7 gaming operations, Wage Protection System mandates, and Emiratisation requirements that the GCGRA will assess during licensing. Robust governance frameworks must encompass data privacy, transparent compliance mechanisms, ethical marketing practices, and clear board-level ESG oversight. Proactively integrating ESG principles into the GCGRA framework would enable the UAE to position itself not merely as a new gaming destination, but as a jurisdiction setting benchmarks for responsible and sustainable gaming regulation in the region.

How well this framework works will ultimately depend on how it is applied on the ground. If the rules are enforced consistently and clearly, businesses will have a predictable and workable path to enter the market. At the same time, the focus on proper checks, financial strength, and operational readiness helps ensure that only serious and responsible players participate. As the framework settles in and evolves, regulated gaming can support the UAE's wider economic and tourism goals, as long as standards are applied carefully and without dilution.

Looking ahead, the integration of comprehensive ESG standards presents an opportunity for the GCGRA to differentiate the UAE gaming market. On responsible gaming, license applicants should demonstrate concrete measures including self-exclusion mechanisms, staff training to identify problem gambling behaviour, player education materials, and collaboration frameworks with problem gambling support services; for internet gaming, algorithmic detection of at-risk behaviour represents an emerging standard. International trends suggest areas where the GCGRA framework may evolve: mandatory ESG reporting for gaming operators (as adopted in Singapore and the UK), industry levies on gross gaming revenue funding problem gambling services, and enhanced environmental performance standards aligned with the UAE's Net Zero by 2050 commitment. Operators should consider ESG-linked financing with interest rates tied to ESG performance metrics, demonstrating commitment to ongoing improvement while potentially strengthening financial standing assessments. Encouraging LEED-certified or Estidama green building standards for gaming facilities, establishing centralised ESG data management infrastructure, and linking executive compensation to ESG metrics would further enhance the framework.

The widening gap between regulated and unregulated gaming markets globally underscores the reputational value of transparent, sustainable, and ethically-governed operations. By embracing ESG as a strategic pillar rather than an afterthought, the UAE can attract quality investment, build public trust, and establish a gaming industry that serves as a model for emerging markets across the Middle East and beyond.

Footnotes

1. https://uaelegislation.gov.ae/en/legislations/1529

2. https://sccgmanagement.com/research/the-uae-gambling-industry/

3. SustainabilityPlus Rankings 2025: Why sustainability is even more important today, iGaming Business, December 2025. Available at: https://igamingbusiness.com/sustainable-gambling/csr/sustainabilityplus-rankings-2025-key-trends/

5. https://uaelegislation.gov.ae/en/legislations/2558/download

6. https://www.gcgra.gov.ae/en/about-us/what-we-do/

7. https://www.mga.org.mt/licensee-hub/esg/

9. https://www.americangaming.org/esg-landing/

10. https://igamingexpress.com/global-responsible-gambling-regulation-regional-contrasts-in-2025/

11. https://uaelegislation.gov.ae/en/legislations/3314/download

12. https://uaelegislation.gov.ae/en/legislations/1541/download

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.