- within Consumer Protection topic(s)

- within Consumer Protection, Law Department Performance and Wealth Management topic(s)

- with readers working within the Retail & Leisure industries

What do firms have to do?

- For firms that wish to begin to provide targeted support, they need to apply for permission to enable them to conduct this

- To support their application, they need to establish appropriate systems and controls and risk management, and design their approach to compliance They need to update

their systems to ensure they are keeping appropriate records in respect of the targeted support services they provide.

They need to create new policies and procedures, train staff as relevant on the new requirements, and create appropriate marketing plans, consumer facing materials and a target operating model.

- Firms that propose to charge for targeted support need to be able to demonstrate it provides fair

- Firms must ensure they can respond to FCA requests for data "to monitor how the market is evolving and support our supervisory activities". This will include data on the delivery and outcomes of the firm's targeted support

For more on this, see below.

NB: (a) Firms should be on notice that the FCA proposes to conduct a post implementation review within two years.

(b) For FCA regulated firms, there is a minimum level of regulatory capital: GBP500,000. The FCA's justification: "Targeted support is designed to reach large numbers of consumers. It should be conducted by firms that can meet its associated prudential risks."

If you would like further advice, and/or information on the products we offer to assist firms gearing up to provide targeted support and project implementation, please let us know.

How do firms apply for permission?

- For firms already authorised, this involves a variation of permission

- FCA authorised firms apply to the FCA; PRA authorised firms apply to the PRA.

- The gateway for applications will likely open in March

- In advance of an application, firms can use the FCA's new pre-application support service (PASS) if they wish.1

- We strongly recommend firms take this option where possible, as it may shorten the overall timeline for the application being decided For more on this, see below.

- The service is provided at no cost and may be used if a firm wants to discuss its plans and/or has questions.

- In terms of process, the firm registers for a pre-application meeting via The firm sends information and any relevant questions in advance. It then meets with an FCA case officer; where possible, they will answer questions or

provide feedback on plans. They would also "outline [the FCA's] expectations and signpost you to useful information."

- The FCA says it will try to have the same case officer assess the firm's application if

What is the timing for an application being decided on?

- Technically, the usual timeline for variation of permission applications applies (i.e., six months for applications that are complete or 12 months if the FCA considers the application to have gaps).

- But the FCA has said: "Firms which have engaged with us through PASS to submit complete applications, demonstrating they are ready, willing and organised to deliver targeted support, will be granted permission "

- NB: The Treasury has proposed to shorten these sorts of timelines, consistent with its "regulating for growth" In the interim, the FCA has introduced a voluntary target: "For variations of permission applications where the new permissions closely align to the existing business model, the target will reduce further to three months for complete applications and six months for incomplete applications."2

What should a firm focus on when developing its application?

Specific points

We recommend that a firm has a clear and crisp answer to each of the following as flagged by the FCA:

- How the firm plans to identify consumers who might benefit from targeted support.

- How the firm plans to conduct an initial segmentation of

- How the firm intends to develop suitable ready made suggestions which are consistent with the overall purpose of providing targeted support.

- How the firm will check that consumers align with particular segments and can be offered ready made suggestions.

- Evidence that the firm can demonstrate examples of end to end consumer journeys for targeted support along with relevant

- The firm's plans for ongoing checking to ensure their targeted support model continues to operate as

- Evidence that the firm has adequate systems and controls

in place to deliver targeted support effectively and to comply with the FCA rules on an ongoing basis.

Firms will need to prepare a business plan to support their application:

- This will need to explain what key regulatory, operational and other risks will arise from the firm's targeted support service, how the firm will mitigate these and how the firm will ensure compliance with its regulatory obligations on an ongoing

- Firms must explain their business model in relation to targeted support and be able to show that it is

- Firms must explain what financial and non-financial resources they have available to support the targeted advice

As the FCA will assess whether these are adequate, firms may also wish to articulate why they consider these to be appropriate and adequate.

OVERARCHING POINTS

Among other things, the FCA's regime references five key areas—in developing its application for the new targeted support permission, we recommend a firm is able to explain and evidence its approach to each of these areas, ensuring this approach is robust:

|

CONSUMER SEGMENTS |

READY-MADE SUGGESTIONS |

PRODUCT GOVERNANCE |

COMMUNICATIONS |

MONITOR OUTCOMES |

|

Identify key segments |

Formulate standard |

Comply with the |

Communicate the nature |

Review outcomes |

|

where consumers have |

suggestions for |

requirements of the |

(and limitations) of the targeted |

regularly |

|

shared financial support |

each segment |

product governance |

support service, and the common |

|

|

needs or objectives |

regime in terms of |

characteristics of the segment, |

||

|

products and services |

so there is transparency, and |

|||

|

being offered/sold |

consumers are not misled |

How can a firm assess if its targeted support service is delivering "intended outcomes"?

The FCA has not given specifics on this, meaning it is something that firms must decide on for themselves:

"We will not mandate the specific outcomes we expect to see from targeted support, nor the metrics for firms to collect to demonstrate this. Firms will need to identify and collect relevant sources of data so they can assess and monitor the outcomes for their customers. They should also keep sufficient records in line with existing requirements on record keeping, as set out in SYSC 3, SYSC 9 and PRIN 2A.9. We expect firms to maintain records on targeted support to underpin our supervision of firms offering these services. This will help us measure success, and support future evaluations on the effectiveness of the regime."

If you would like further advice on this, please let us know.

Industry views to date

A mix of quantitative and qualitative metrics and data will likely be used. In the FCA policy statement, the FCA cited the following inputs to the assessment process based on feedback received from the industry to date. This is a useful point of reference:

- Complaints data—to identify recurring issues and

- Behavioural outcomes, g., consumer service interactions, uptake rates, journey dropout rates, opt out levels, proportion of consumers acting on suggestions, number of consumers switching from cash to investments, investment amounts.

- Consumer feedback—user research and satisfaction surveys to test clarity and

- Consumer understanding—to assess whether consumers felt better

- Independent audits (or peer reviews)—to ensure outcomes are being fairly

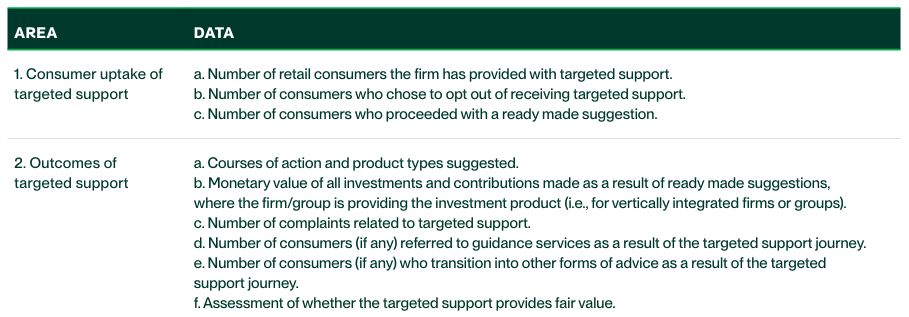

What data will firms need to provide the FCA?

The FCA has said it will start collecting data periodically from firms to "monitor how the market is evolving and support our supervisory activities". At this stage, however, it is only prepared to indicate "the type of data that we might collect".

REFERENCES

www.fca.org.uk/publication/consultation/cp25-17.pdf

www.fca.org.uk/publication/consultation/cp25-26.pdf

www.fca.org.uk/publication/policy/ps25-22.pdf

www.gov.uk/government/publications/targeted-support/targeted-support-policy-note-accessible

www.fca.org.uk/firms/authorisation/pre-application-support-service

Footnotes

1 https://www.fca.org.uk/firms/authorisation/pre-application-support-service

2 http://www.gov.uk/government/consultations/fs-sector-strategy-regulatory-environment-cross-cutting-reforms, http://www.gov.uk/government/speeches/rachel-reeves-mansion-house-2025-speech and http://www.fca.org.uk/news/news-stories/fca-sets-faster-targets-authorisations

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.