- within Environment topic(s)

The Chancellor of the Exchequer, Rt Hon Rachel Reeves MP, is preparing to deliver her second Budget on Wednesday 26 November 2025.

The challenges that she faces are significant. These include:

- a highly volatile geoeconomic climate;

- anaemic growth – HM Treasury forecasts predict an average of 1.2% gross domestic product (GDP) growth for 2025, slowing to 1.1% in 2026;

- a current budget deficit (i.e. borrowing required to fund day-to-day spending) – the ONS suggests the total current budget deficit for the five months to the end of August 2025 to be £62.0bn; and

- elevated net debt – the ONS figures show public sector net debt was equivalent to 96.4% of GDP at the end of August 2025.

In addition, the Chancellor has restricted her policy choices both:

- fiscally – due to her two

'non-negotiable' fiscal rules to:

- push the current budget into surplus by 2029-30, and

- ensure the ratio of debt-to-GDP (net debt) is declining in 2029-30; and

- politically – due to the Labour government's 2024 Manifesto pledge to "not increase taxes on working people... [and] not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT": the three single largest revenue-raising levers available.

There are no "cost-free" solutions to the challenges. The Chancellor will hope that economic growth will accelerate to ease the pressure, but she will need to balance additional borrowing, further spending cuts, and tax policy changes to encourage that growth. Additional borrowing could breach the government's fiscal rules and will inevitably increase the cost of servicing its debt, while cuts to public spending will be politically difficult, both within the Parliamentary Labour Party and with the wider electorate.

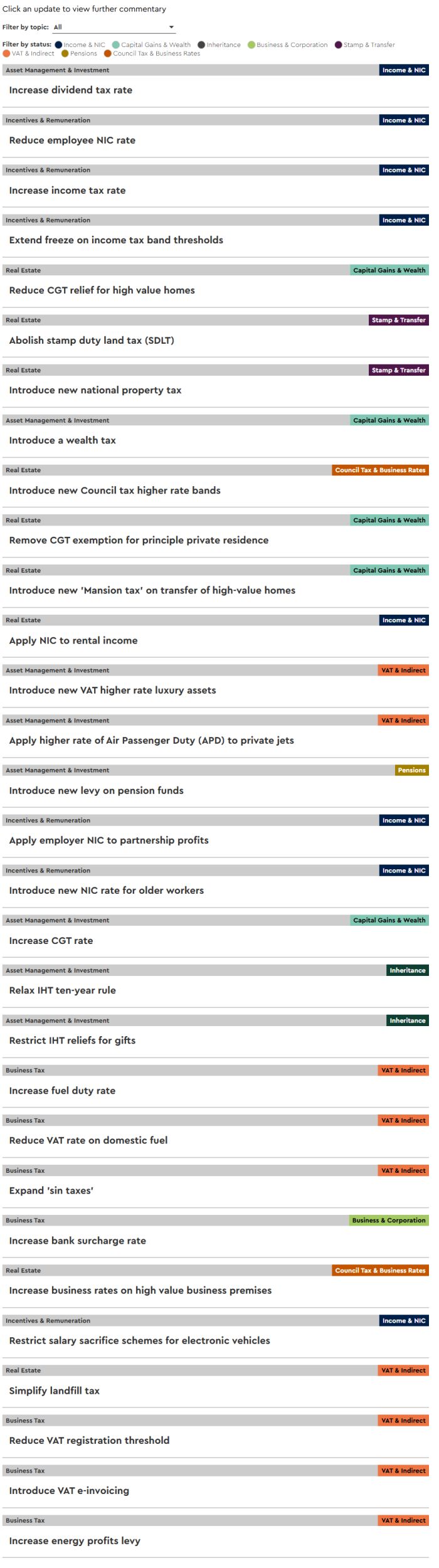

Against this backdrop, speculation is rife that HM Treasury is considering a broad range of tax policy changes. This page tracks some of the more prominent proposals that have surfaced across the main taxes and sectors.

To read more about the government's Manifesto commitments, see our 2024 UK General Election Manifestos page, and for more on the Labour government's first budget, see our analysis on Autumn Budget 2024.

Tax Measures Speculation Tracker

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.