- within Tax topic(s)

- in United Kingdom

- with readers working within the Utilities industries

- within Law Department Performance topic(s)

During the Seminar Percukaian Kebangsaan 2025 (Belanjawan 2026) held on October 14, 2025, and subsequently via the Finance Bill 2025 released on November 18, 2025, the Malaysian Inland Revenue Board (MIRB) issued an important clarification on the scope of Capital Gains Tax (CGT) on unlisted shares.

Currently, most taxpayers assumed that CGT would only apply when there is a sale or transfer of shares. The current definition of "disposal" for CGT provides that "disposal" means "by way of sell, convey, transfer, assign, settle, alienate whether by agreement or by force of law and includes a reduction of share capital and purchase by a company of its own shares."

However, with the latest announcement, the MIRB has now confirmed that "disposal" for CGT will include any situation where share ownership ceases - even if there is no traditional sale.

Expanded Definition of "Disposal"

The following triggers, current (*) and expanded, will now be treated as a disposal for CGT purposes:

This last point was raised by the MIRB in the Seminar Percukaian Kebangsaan 2025 and is particularly significant as a catch-all, and it suggests that any merger, buyback, forced cancellation or restructuring steps may all trigger CGT, even if no cash changes hands.

Following this, the determination of the date of disposal shall be based on the earlier of, the date on which share ownership ends or shareholders' rights being extinguished in the case of winding up or dissolution, or the date the consideration is received, where relevant. Based on the Finance Bill, this will take effect from January 1, 2026.

Who Will Be Most Affected?

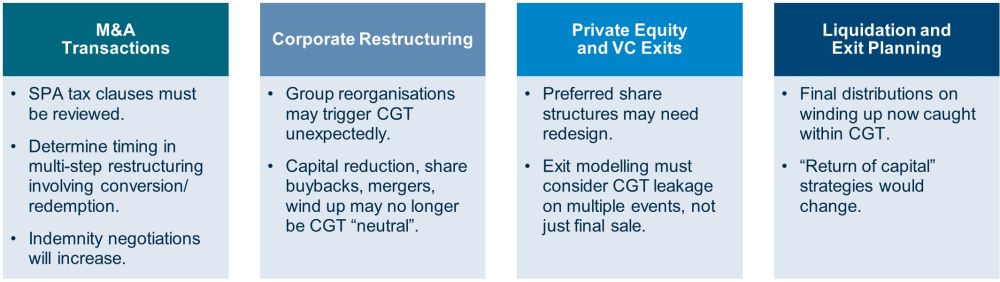

This change will impact:

A&M Tax's Viewpoint

To manage risk and protect value, it is time for investors with unlisted shares in Malaysian companies to consider:

It is crucial now to note that CGT in Malaysia is no longer limited to a traditional share "sale". It can now be triggered by any event that results in the loss or cessation of share ownership, regardless of the legal form or mechanism. This clarification broadens the scope of CGT and is poised to reshape tax planning strategies for M&A transactions, corporate restructurings, and exit planning.

Originally published 18 December 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.