- within Corporate/Commercial Law topic(s)

- in United States

- in United States

- within Insurance, Consumer Protection, Government and Public Sector topic(s)

Merging Companies Doesn't Have to Feel Like Merging In-Laws

Section 44 of the Income Tax Act 58 of 1962(the "ITA") provides targeted tax relief for companies undergoing a genuine consolidation through an amalgamation, merger, or conversion. Much like navigating the dynamics of blending families, corporate mergers can be complex, but section 44 offers a framework to ease the transition. Where the transaction results in the complete absorption of one company into another, the provision allows for the deferral of capital gains tax, recoupments, and other income tax consequences, provided all statutory requirements are satisfied.

This form of corporate rollover relief is especially useful in group structures, integrating acquisitions, or merging aligned businesses, without triggering immediate tax liabilities for the parties involved.

The provision contains three components:

- Paragraph (a) applies to domestic amalgamation transactions,

- Paragraphs (b) and (c) apply to certain cross-border amalgamation transactions.

This article focuses exclusively on domestic amalgamation transactions under paragraph (a) of Section 44(1).

Understanding Amalgamation Transactions

An amalgamation transaction occurs when a resident company (the amalgamated company) disposes of all its assets to another resident company (the resultant company) in terms of an amalgamation, merger, or conversion. These terms are not defined in the ITA and must be interpreted according to their ordinary commercial meaning.

The amalgamated company is not required to dispose of assets that it intends to retain for settling ordinary business debts, meeting public-law liabilities, or covering the administrative costs of winding up. Crucially, the amalgamated company's existence must terminate as a result of the transaction.

Practical Application and Reasons to Conclude an Amalgamation Transactions

Before considering the technical aspects of section 44 of the ITA we think it is important to look at a couple of reasons why companies would want to merge, by looking at some practical examples.

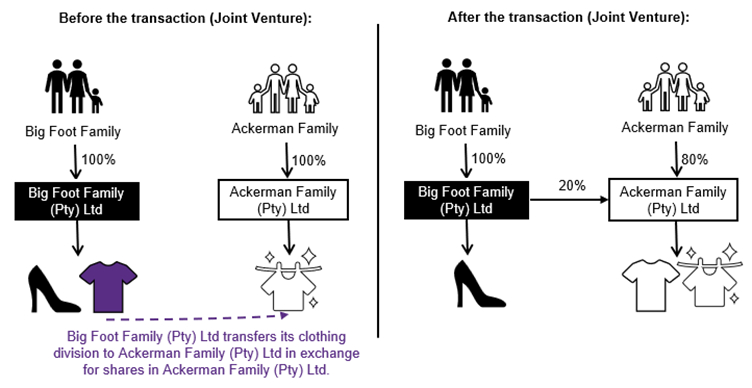

1. Creation of a Joint Venture

This is like two families deciding to co-parent a new venture without fully combining households. Each retains its identity but contributes something valuable to a shared purpose.

Imagine Big Foot Family (Pty) Ltd ("Big Foot"), known for its premium footwear, has recently developed a clothing line. It sees an opportunity to combine this line with Ackerman Family (Pty) Ltd ("Ackerman"), a company already established in the clothing industry. Big Foot transfers only its clothing division to Ackerman in exchange for 20% of the equity shares in Ackerman, while continuing its core shoe business.

This transaction does not qualify as an "amalgamation transaction" under Section 44 because:

- Big Foot does not dispose of all its assets.

- Its existence continues post-transaction.

Instead, this could be structured under Section 42 as an asset-for-share transaction, which still allows for tax deferral but under different rules.

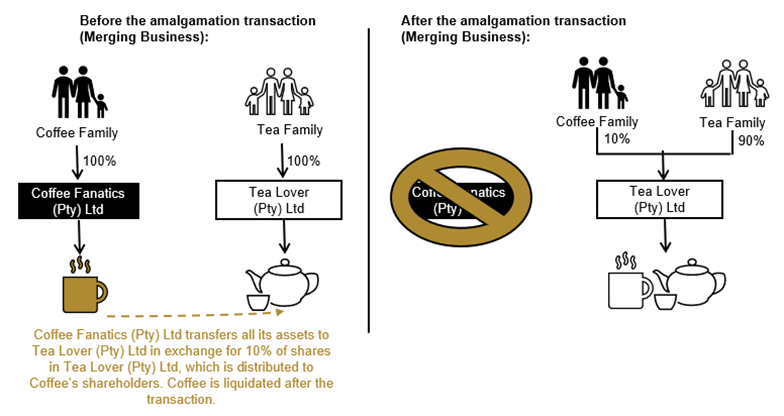

2. Merger of Existing Business

A merger using section 44 of the ITA also allows for the seamless consolidation of business operations without triggering immediate tax consequences.

For example, Coffee Fanatics (Pty) Ltd ("Coffee"), a boutique coffee manufacturer, merges into Tea Lover (Pty) Ltd ("Tea"), a larger tea producing company. Coffee transfers all its assets to Tea in exchange for 10% of Tea's shares, which are then distributed to Coffee's shareholders. Coffee is liquidated after the transaction.

This qualifies as a domestic amalgamation transaction under section 44:

- Coffee disposes of all its assets to Tea.

- The transaction is executed via a merger.

- Coffee's existence is terminated.

The tax benefits, which will be discussed in more detail below, include:

- No capital gains or recoupments for Coffee on asset disposal.

- Roll-over relief for Tea, which inherits the tax base of the assets.

- No capital gains for shareholders of Coffee, who are deemed to have acquired Tea shares at the original cost and date of their Coffee shares.

Section 44 Compliance Requirements

To qualify for full roll-over relief under Section 44, the following conditions must be satisfied:

- Both the amalgamated and resultant companies must be South African tax residents, and the transaction must not fall within any of the statutory exclusions.

- The amalgamated company must dispose of all assets except those necessary to settle debt and complete liquidation to the resultant company.

- The transaction must take the form of an amalgamation, merger, or conversion that results in the dissolution of the amalgamated company.

- Consideration must consist exclusively of equity shares or the assumption of qualifying debts, not cash or non-qualifying liabilities.

- Liquidation or deregistration proceedings must be initiated within 36 months, and not subsequently withdrawn or invalidated.

- Where shares are issued, the resultant company must apply the correct method for determining its contributed tax capital ("CTC").

- The shareholders of the amalgamated company must continue to hold the new shares in line with their original intention.

These requirements must be met in both form and substance. Any deviation – particularly involving hybrid consideration or administrative failures may result in loss of relief, with retrospective tax consequences for all parties involved.

Tax Implications for the Amalgamated Company

Where the transaction qualifies, the amalgamated company is deemed to dispose of its assets at their tax cost. This means no gain, loss, or recoupment arises. However, the tax-neutral treatment applies only if the consideration received consists of equity shares in the resultant company or the assumption of qualifying debts.

Consideration outside this scope, such as cash or ineligible debt assumptions, will result in partial relief only. The relief is also denied to the shareholders of the amalgamating company if the consideration is subsequently distributed to them.

Tax Implications for the Resultant Company

The resultant company inherits both the tax cost and the nature of the assets acquired. This ensures a seamless rollover of tax values, allowing the resultant company to step into the shoes of the amalgamated company from a tax perspective.

Where equity shares are issued as consideration, the resultant company may increase its CTC in line with a portion of the CTC previously held by the amalgamated company, based on a formula in section 44(4A) of the ITA. This ensures that any future distributions or repurchases of those shares are appropriately treated for tax purposes.

Tax Implications for Shareholders

Shareholders of the amalgamated company may exchange their shares for equity shares in the resultant company without triggering tax, provided their intention with respect to the shares remains aligned.

If shares in the amalgamated company were held as capital assets, the resultant company shares must also be held as capital or trading stock. Similarly, trading stock must remain trading stock. Where this alignment exists, shareholders are deemed to have disposed of their original shares at tax cost and to have acquired the new shares on the same date and at the same base cost.

| Amalgamated company share (before) | Resultant company share (after) | Relief applies |

| Capital asset | Capital asset or trading stock | Yes |

| Trading stock | Trading stock | Yes |

Conclusion

Section 44 of the ITA offers a well-defined route for tax-neutral amalgamations between resident companies. It enables comprehensive business consolidations where the amalgamated company ceases to exist, and its shareholders and assets transition into the resultant company without immediate tax consequences.

Just as merging families can be delicate, merging companies doesn't have to feel like merging in-laws, provided the transaction is properly structured and all legislative requirements are met, the relief ensures that economic substance, rather than tax form, drives business restructuring. Professional tax and legal guidance remain essential to avoid disqualification and to ensure the transaction withstands SARS scrutiny.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.