Aurtus Consulting LLP’s articles from Aurtus Consulting LLP are most popular:

- in India

Aurtus Consulting LLP are most popular:

- within Energy and Natural Resources, Government, Public Sector and Employment and HR topic(s)

BACKGROUND

- The Mumbai bench of Income Tax Appellate Tribunal (ITAT), on 17th October 2025, issued a ruling in favour of Netflix Entertainment Services India LLP1 ('Netflix India' or 'Taxpayer'), rejecting the Revenue's recharacterization of Netflix India from a limited-risk distributor to an entrepreneurial content and technologyserviceproviderin India.

- Netflix India operates as a non-exclusive distributor, providing access to the global Netflix streaming platform within India. Its responsibilities include marketing, subscriber billing and collections, customer support, and regulatory compliance. It does not create or own any intellectual property, content, or technology related to the Netflix platform. All core content, platform technology, and intellectual property rights remain with foreign affiliates, primarily Netflix Inc. ('Netflix US') and Netflix International B.V.

REVENUE'S POSITION

- The Revenue contended that Netflix India's agreement, infrastructure ownership, and conduct indicate that it performs a bouquet of vital functions ranging from content dissemination and customer management to pricing, promotion, and network facilitation thus constituting a full-fledged operator in the Indian market. The TPO alleged that the Indian entity has obtained licence both for the content and the technological platform, and hence the payments made to its Associated Enterprises (AEs) partake the character of royalty. Accordingly, the TPO rejected the benchmarking approach (using TNMM)adoptedbythetaxpayer.

- The TPO argued that the OTT business relies on three key pillars-content, technology platform, and marketing & sales. Since Netflix India was alleged to have licensed content and technology from its AEs, the TPO determined that the arm's length price should be based on royalties for content distribution and technology platform rights. Using the Royaltystat database, the TPO identified comparable agreements and calculated a royalty rate of 57.12% on revenue,resulting in an upwardadjustmentof approximatelyINR445crores.

- Aggrieved by the same, Netflix India filed its objections before the Dispute ResolutionPenal('DRP').

- DRP affirmed the TPO's characterization of Netflix India as a key operational hub within the global Netflix group, a significant technological and asset service provider as well as an entrepreneurial distributor. It ruled that the Taxpayer had under-reported its functions, assets, and risks, and that its Transfer Pricing Study Report was therefore inaccurate. Consequently, the Panel upheld the TPO's adoption of the "Other Method" as most appropriate methodandconfirmedtheadjustmentproposedontheroyalty-ratebasis.

- Further, DRP also suggested an alternative ad-hoc benchmarking approach purportedly to "corroborate" the reasonableness of the ALP determined by the TPO. In this alternative model, the Panel sought to attribute approximate margins to various functional clusters such as content distribution, infrastructure, marketing, legal and regulatory support, customer management,andtechnologicaloperations.

NETFLIX INDIA'S CONTENTION

- Taxpayer contended that the entire factual and legal framework was misconstrued by both the TPO and the DRP, who, by selective reading of contractual clauses and unfounded presumptions, had re-characterized a simple distribution arrangement into a complex license transaction of content andtechnology.

- Netflix India is merely a distributor of access to the Netflix Service, functioning as a limited-risk entity with routine marketing and administrative responsibilities. Netflix India argued its functions were confined to promotion, invoicing, subscription collection, local customer support, marketing support per global strategies, liaising with internet service providers and regulatory compliance. It neither owns nor controls any intellectual property, nor does it acquire or transfer any copyright in the content, technology, or trademarks formingpartof theNetflix Service.

- The TPO's allegation of pricing autonomy and marketing discretion was misconceived. Although the Indian entity could offer only minor discounts or gift subscriptions to customers as part of localized marketing campaigns, all such initiatives were executed within the strict parameters prescribed by the AEs. The subscription fee itself was determined centrally by the Netflix group's global pricing team.

- Netflix India was fully insulated by fixed return on sales of 1.36%, bearing only minor operational / regulatory risks indemnified by AE, with critical entrepreneurial risks (market, investment, tech obsolescence, service liability) borneoffshoreby AE.

- Netflix India's total assets are approximately ₹ 75 crores (~ USD 1 million), while Netflix US's assets exceed USD 3,928 crores, about 4,000 times larger. Further, the employee strength (64 in India versus 9,400 globally) and roles (predominantly marketing, administration, and compliance) demonstrate a purelysupportivefunction,not IP creation.

- Basis the FAR analysis, Netflix India considered Transactional Net Margin Method (TNMM) as the most appropriate method. Both authorities disregarded settled judicial precedents wherein software distributors have been accepted as valid comparables for benchmarking distribution activities in thebroadcastingandentertainmentsector.

ITAT'S FINDINGS

- Netflix India performs routine distribution and marketing support functions understrict supervisionof its AEs;

- It owns no valuable intangible assets and undertakes no DEMPE functions;

- Its risks are limited and cost-insulated;

- Accordingly, its profitability benchmark under TNMM reflects an arm's-length outcome.

- TheTribunal found the TPO's assertion of content and technology licensing to Netflix India internally inconsistent, noting: "We find that such an inference is internally inconsistent because the very paragraph quoted by the TPO begins by recognising that Netflix India 'does not get access to content' yet ends by concluding that it does. Such self-contradiction, as the assessee rightly argued, betrays a perverse appreciation of record and an outcome-driven approach."

- The TPO's entire approach proceeds not from economic comparability but fromfunctionalmischaracterisation.

- The entire transfer-pricing adjustment of INR 445 crores is deleted. The ALP determined by the taxpayer under TNMM stands accepted. The re characterisation of Netflix India as a full-fledged entrepreneur or content provideris held tobe contrarytorecordandlaw.

-

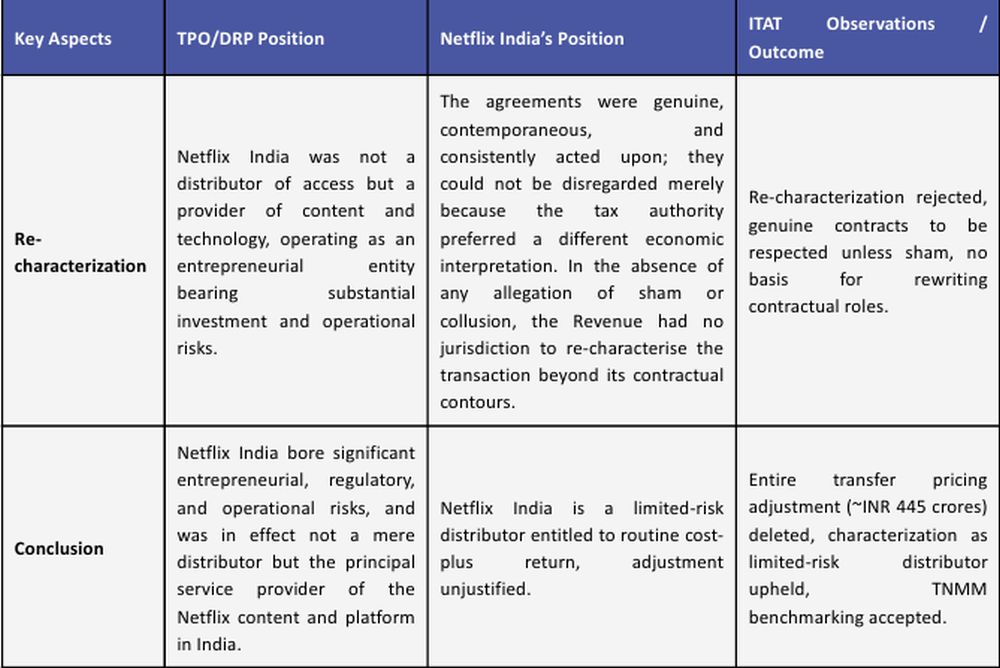

FollowingtablesummarizestheTPO/DRPandNetflixIndia'scontentionsand

ITAT'sobservationonkeyaspects:

AURTUS COMMENTS

- The Tribunal has pronounced a very reasoned ruling covering various aspects of functional and economic analysis.This ruling clearly emphasizes the critical role of FAR analysis and the need to evaluate various commercial factors comprehensively. It further emphasizes that the contractual language and its interpretation is vital to substantiate the conduct of parties.This decision is alsocritical for technology-based businesses setting-up local presence for ensuring last mile delivery.

- Having said that, it is vital for taxpayers toensure timely review the FAR analysis, inter-company agreements, transfer pricing policy to align with the actual conduct between the parties.

Footnotes

1. NetflixEntertainment ServicesIndiaLLP vs. DCIT[TS-636-ITAT-2025(Mum)-TP]

2. EngineeringAnalysisCentreofExcellence(P.)Ltd.(432ITR471)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]