- in India

- in India

- with readers working within the Retail & Leisure industries

- within Insurance, Litigation, Mediation & Arbitration and Family and Matrimonial topic(s)

- with Inhouse Counsel

Introduction

CMS INDUSLAW unveils the latest edition of 'The Sentinel' - our quarterly foray into the ever-intriguing world of Indian competition law. True to its name, this concise yet comprehensive compilation helps the readers to keep a vigilant watch over significant decisions from the Competition Commission of India ("CCI"), National Company Law Appellate Tribunal, various High Courts, and the Hon'ble Supreme Court of India ("SC"), along with notable regulatory and institutional stirrings — all curated to help the readers navigate the evolving Indian competition law landscape with ease.

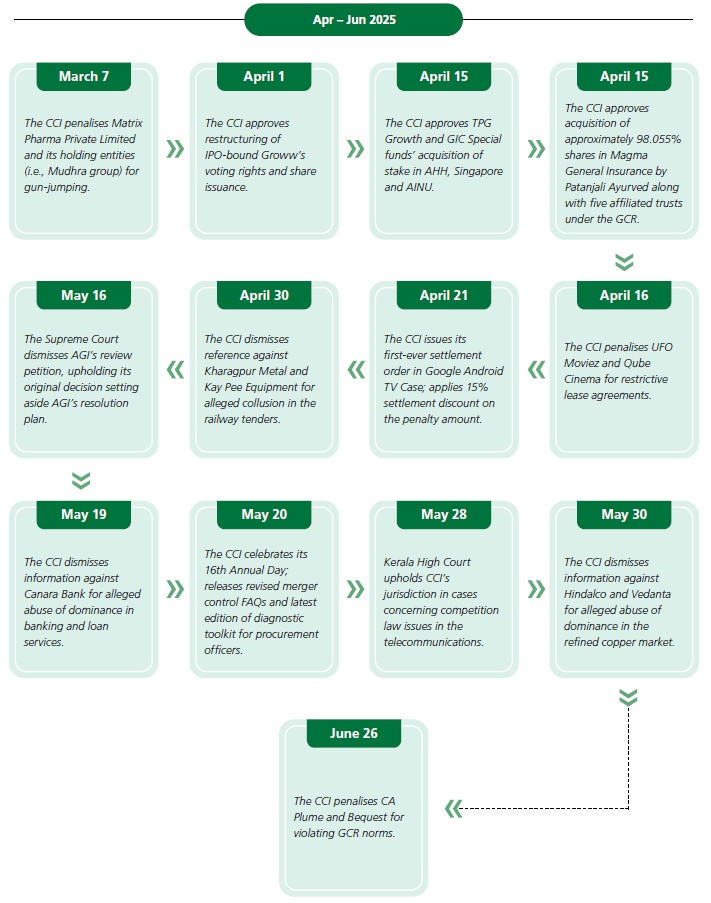

And for those short on time, a distilled and delightful reckoner of key developments from the first quarter ("Q1") of the financial year ("FY") 2025-26 awaits in the flowchart below.

Summary of Key Developments in Q1 of FY 2025-2026

Overview of Enforcement Cases

Decisions by the SC

The SC dismisses AGI Greenpac's review petition, effectively upholding the original decision which had set aside AGI Greenpac's resolution plan on grounds of legal and procedural non-compliance1

On May 16, 2025, the SC dismissed the review petition filed by AGI Greenpac Limited ("AGI") against the majority judgment of the SC in Independent Sugar Corporation Limited vs Girish Sriram Juneja2 dated January 29, 2025 ("Majority Order"). The SC noted that AGI attempted to re-agitate questions of law which had already been deliberated and settled by way of the Majority Order. Given that "such an exercise does not fall strictly within the ambit of review", the SC reinforced that review jurisdiction is not an avenue for a second round of legal arguments and is limited to only rectifying glaring errors that may have been made in the Majority Order.

A separate review petition was also filed by the CCI seeking a review of the interpretation of Section 29 of the Competition Act, 2002 ("Act") (which deals with the procedure for investigation of combination) in the Majority Order.3 The SC allowed the CCI's review petition and clarified that even if the CCI forms a prima facie opinion under Section 29(1) of the Act regarding likelihood of a combination causing appreciable adverse effect on competition ("AAEC"), it is not mandatory for the CCI to send the matter for investigation to the Director General, CCI ("DG"). Further, in cases where the parties offer voluntary modifications to alleviate AAEC, the CCI can exercise its discretion and approve the combination expeditiously based on such modifications (if they are found to be satisfactory).

CMS INDUSLAW's competition team successfully represented and advised Independent Sugar Corporation ("INSCO") before the Hon'ble SC. Further, CMS INDUSLAW's disputes team is also actively advising INSCO on the corporate insolvency resolution process ("CIRP").

Decisions of the HC

Kerala High Court upholds CCI's jurisdiction in cases concerning competition law issues in the telecommunications sector4

On May 28, 2025, the Kerala High Court ("KHC") upheld the CCI's jurisdiction to investigate matters involving competition law issues in the telecommunications sector (specifically in relation to broadcasting services).

Asianet Star Communications Private Ltd., Star India Private Ltd. ("SIPL"), and Disney Broadcasting (India) Private Ltd. ("Disney") filed writ petitions before the KHC challenging the CCI's order5 directing a DG probe into abuse of dominance allegations against SIPL.

The informant6 had alleged before the CCI that SIPL abused its dominance by: (i) circumventing Telecom Regulatory Authority of India's ("TRAI") 35% discount cap under the 2017 Interconnection Regulations7 and Eighth Tariff Order8, routing excess discounts as marketing payments to Kerala Communicators Cable Limited ("KCCL") with ads aired on test channels; (ii) extending effective discounts of up to 70% to KCCL, thereby distorting the market and violating TRAI's non-discrimination principles; and (iii) favouring KCCL, a competitor through advertising agreements lacking genuine commercial purpose, thereby restricting Asianet Digital Network Private Limited's ("ADNPL") market access9.

The CCI delineated the relevant market as the 'market for provision of broadcasting services in the State of Kerala'. Further, based on its review of the information submitted, the CCI formed a prima facie opinion and directed the DG to investigate the matter. The petitioners challenged the CCI's order before the Bombay High Court ("BHC"), which disposed of the writ application on the grounds of no jurisdiction, since no part of the cause of action had arisen within the territorial jurisdiction of the BHC. The petitioners then filed their writ application before the KHC and contended that the issues raised were exclusively within the domain of the TRAI and that the CCI could not proceed without TRAI first determining compliance with the applicable broadcasting regulations10.

The CCI argued that it was the only regulator constituted by the Government of India empowered to direct investigations into matters involving alleged abuse of dominant position under the Act. The TRAI did not have the power to examine a transaction in the context of abuse of dominant position. Therefore, in cases involving allegations of abuse of a dominant position by a market player in a relevant market, it is the CCI that would have jurisdiction and not the TRAI, even in respect of the broadcasting and cable services.

The KHC held that:

- Both the Act and the TRAI Act, 1997 ("TRAI Act") are special statutes in their respective domains— while the Act governs anti-competitive practices, the TRAI Act regulates the telecommunication sector including, broadcasting services. Although there may be overlaps in the discharge of functions by the CCI and TRAI, the TRAI Act does not cover the alleged anti-competitive practices, including abuse of dominance;

- Since the purview of the CCI and TRAI is different, the CCI has the jurisdiction to examine allegations of abuse of dominance, while TRAI governs regulatory compliance, hence, both regulators can act concurrently without encroaching upon each other's authority; and

- No sequential proceeding was necessitated. ADNPL was not required to first approach TRAI or the Telecom Disputes Settlement and Appellate Tribunal for alleged violations of TRAI's new regulatory framework, nor was the CCI required to defer its proceedings pending TRAI's findings. Orders under Section 26 (including any prima facie directions) of the Act are in rem and carry no civil consequences at the preliminary stage, therefore, the CCI order was not required to be dismissed.

Accordingly, the writ petition was dismissed, with liberty to the petitioners to raise jurisdictional objections before the CCI, which must address them prior to adjudicating the merits.

Decisions by the CCI:

In Q1 of FY 2025-26, the CCI issued a total of 9 orders in relation to enforcement matters. Of these, the CCI:

- Passed 1 (one) order finding contravention and imposed penalties;

- Passed 1 (one) settlement order;

- Directed the DG to investigate 3 (three) information11;

- Declined to investigate 4 (four) information relating to allegations of abuse of dominance and anticompetitive agreements; and

A summary of the noteworthy cases is set out below:

The CCI penalises UFO and Qube for restrictive lease agreements12

On April 16, 2025, the CCI found UFO Moviez India Pvt. Ltd. ("UFO") and Qube Cinema Technologies Pvt. Ltd. ("Qube Cinema") guilty of engaging in anticompetitive conduct (as detailed below) and imposed penalties of INR 1.04 crore (approximately USD 0.12 million13) and INR 1.66 crore (approximately USD 0.2 million) respectively along with imposing behavioural remedies.

The informant14 alleged that the equipment lease agreements between UFO, Qube, and Cinema Theatre Owners ("CTOs") imposed restrictive conditions including: (i) tie-in arrangements compelling the CTOs to use content only from Scrabble Digital Limited ("Scrabble")15/UFO/Qube; (ii) exclusive supply agreements (only UFO/Qube content allowed on leased equipment); (iii) refusal to deal by blocking content from other Post-Production Processing ("PPP") providers through technological restrictions; (iv) UFO's blocked access to leased Digital Cinema Equipment ("DCE") for films not processed by Scrabble, effectively denying market access to rival PPP service providers; and (v) UFO leveraging its dominance in the leased DCE market to protect the position of Scrabble in the PPP services market in India.

Pursuant to the CCI's investigation order16, the DG in its investigation report delineated two relevant markets: (i) the market for the supply of digital cinema initiatives ("DCI")17 compliant DCEs on lease/rent to CTOs in India; and (ii) the market for PPP services in India.

The DG's findings included: (i) existence of a vertical relationship between DCE suppliers and CTOs, as well as between producers, PPP service providers, and CTOs18; (ii) the fact that UFO holds approximately 40% market share and Qube holds approximately 48% market share in the leased DCE market; and (iii) the conduct and agreements of UFO, Scrabble, and Qube with the CTOs constituted tie-in arrangements, exclusive supply agreements, and refusal to deal, leading to exclusion of competitors, in violation with the provisions of the Act.

The CCI agreed with the DG's findings, including the relevant market delineation, and noted the exisiting vertical relationship between CTOs and DCE suppliers, such as UFO, Qube, and Scrabble. Considering their substantial market shares and presence in the leased DCI-compliant DCE market in 2023, CCI held that UFO and Qube possessed significant market power. It concurred with the DG that the following conduct caused AAEC by creating barriers to entry in the PPP market in India:

- Tie-in arrangements: UFO and Qube imposed tie-in conditions on the CTOs by leasing DCEs with content supply rights exclusively tied to themselves, and restricting the CTOs from playing third-party content on the leased DCEs.

- Exclusive supply agreements: UFO and Qube's lease agreements explicitly required CTOs to source digital content solely from them (as well as from UFO's subsidiary Scrabble), forbidding content from other PPP providers.

- Refusal to deal: UFO and Qube created technological firewalls on leased DCEs that blocked Key Delivery Messages from other PPP providers, preventing CTOs from exhibiting content processed by other competitors.

Therefore, the CCI imposed a penalty of INR 1.04 crore (approximately USD 0.12 million) on UFO and INR 1.66 crore (approximately USD 0.2 million) on Qube and directed them to: (i) refrain from entering into or renewing lease agreements that restrict CTOs from sourcing content from parties other than UFO, Qube and Scrabble; and (ii) modify the existing agreements to remove such restrictions.

The CCI issues its first-ever settlement order in Google Android TV Case19

On April 21, 2025, the CCI issued its first-ever settlement order under the Act. The CCI accepted the settlement proposal submitted by Google LLC, and Google India Private Limited (collectively referred to as "Google"), and imposed a settlement amount of INR 20.24 crore upon Google (approximately USD 2.38 million).

The informants20 alleged that Google, TV manufacturers, Xiaomi Technology India Pvt. Ltd. ("Xiaomi"), and TCL India Holdings Pvt. Ltd. ("TCL") had abused their dominant position by executing anti-competitive agreements with restrictive covenants, namely the Television Application Distribution Agreement ("TADA") and conditional Android Compatibility Commitments ("ACC").

Pursuant to CCI's investigation order21, where the CCI formed a prima facie opinion and directed the DG to investigate the matter, the DG in its investigation report delineated two relevant markets: (i) licensable smart TV device operating systems ("OS") in India; and (ii) app stores for Android smart TV OS in India.

The DG's findings included that Google:

- through its Play Store holds a dominant position in the market for app stores for Android Smart TV OS in India;

- compelled Xiaomi, TCL, and other smart TV original equipment manufacturers ("OEMs") under the TADA and ACC agreements to pre-install the entire Google TV Services ("GTVS") suite to access the Play Store, amounting to tying and imposition of unfair conditions;

- restricted OEMs from pre-installing rival Android versions or forks and the OEMs had to seek Google's approval for all devices amounting to limiting technical development and denying market access; and

- tied its YouTube app (an online video hosting platform ("OVHP") in India) with Play Store, therefore abusing its dominant position.

Google subsequently offered a settlement proposal to address the DG's findings, committing to a 5-year plan wherein it would offer a "New India Agreement"—a standalone license for Google Play Store and Play Services on compatible smart TV devices without mandating pre-installation of other Google apps or imposing placement/default requirements. This agreement would be available to all OEMs, including those using rival smart TV OS or incompatible Android versions, with applicable license fee. Google also proposed to cease certifying new Android TV models after June 2025, while continuing support for existing devices until the end of 2029.

The CCI noted that the settlement proposal would address the following concerns: (i) unfair tying of the entire GTVS suite under TADA and protection of its position in the OVHP market through bundling of YouTube with the Play Store; (ii) restrictions that limited technical or scientific development and denied market access to developers of android forks by compelling OEMs to use only Google-approved versions; and (iii) conditions that prevented OEMs from distributing non-GTVS versions of android or working on Android forks, thereby reducing competition and OEM flexibility. It will enable OEMs to tailor their devices, cater to consumer preferences, and strategically select preinstalled apps.

Consequently, the CCI accepted Google's proposal for settlement. Additionally, the CCI determined that the final settlement amount to be paid by Google, after applying a 15% settlement discount, was INR 20.24 crore (approximately USD 2.38 million).

View: The CCI's settlement with Google in the Android TV case marks a paradigm shift in the Indian competition law enforcement, moving away from traditional punitive measures toward anticipatory, behavioural solutions. By endorsing Google's settlement, the CCI has prioritised expedited market correction and increased contestability in the smart TV sector. This case underscores the need for robust compliance oversight as the digital markets evolve. It remains to be seen whether the CCI will demonstrate the flexibility needed to adapt these remedies over time, and whether similar settlements will withstand judicial scrutiny or invite further legal challenges.

To read this article in full, please click here.

Footnotes

1. Review Petition No. 657 of 2025, AGI Greenpac Limited & Anr. vs. Independent Sugar Corporation Limited & Ors., order dated May 16, 2025, available at: https://api.sci.gov.in/supremecourt/2025/10627/10627_2025_7_301_61956_Order_16-May-2025.pdf.

2. Civil Appeal No. 6071 OF 2023, Independent Sugar Corporation Limited vs Girish Sriram Juneja, order dated January 29, 2025, available at: https://api.sci.gov.in/supremecourt/2023/38828/38828_2023_4_1503_59041_Judgement_29-Jan-2025.pdf. Our detailed analysis of the instant order can be accessed here.

3. Review Petition No. 482 of 2025, Competition Commission of India & Anr. vs. Independent Sugar Corporation Limited & Anr., order dated May 16, 2025, available at: https://api.sci.gov.in/supremecourt/2025/10627/10627_2025_7_301_61956_Order_16-May-2025.pdf.

4. Writ Petition (Civil) No. 29766, 29767, and 29768 of 2022, Asianet Star Communications Private Limited & Anr. vs. Competition Commission of India & Ors., order dated May 28, 2025, available at: https://hckinfo.keralacourts.in/digicourt/Casedetailssearch/fileviewcitation?token=MjE1NzAwMjk3NjYyMDIyXzYucGRm&lookups=b3JkZXJzLzIwMjI=&citationno=MjAyNTpLRVI6MzY3NTU=&isqr=1.

5. Case No. 9 of 2022, Asianet Digital Network (P) Ltd. v. Star India Private Limited, Disney Broadcasting (India) Limited, and Asianet Star Communications Private Limited, order dated February 28, 2022, available at: https://www.cci.gov.in/images/antitrustorder/en/0920221652182588.pdf.

6. The information was filed by Asianet Digital Network Private Limited, a multi-system operator that acquires broadcasting signals from SIPL for a fee and distributes SIPL's channels to its customers under contractual agreements.

7. Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable Systems) Regulations, 2017.

8. Telecommunication (Broadcasting and Cable) Services (Eighth) (Addressable Systems) Tariff Order, 2017.

9. ADNPL's subscriber base in Kerala declined from 14.5 lakh to 11.76 lakh, while KCCL's increased from 21.3 lakh to 29.35 lakh between April 2019 and September 2021, allegedly indicating the anti-competitive impact.

10. The petitioners also cited the SC's order in Civil Appeal No. 11843 of 2018, Competition Commission of India v. Bharti Airtel Limited, order dated December 05, 2018, available at: https://cdnbbsr.s3waas.gov.in/s3ec0490f1f4972d133619a60c30f3559e/documents/aor_notice_circular/51.pdf. As such, the petitioners asserted that CCI would have sequential jurisdiction where there was a cartelisation. If there were no allegation of cartelisation, the CCI would not possess any jurisdiction at all. They also contended that the jurisdiction issue had to be decided at the threshold itself by the CCI to assess if it had the jurisdiction to proceed with the information or not.

11. The CCI granted confidentiality on all three investigation orders, and they stand redacted on the CCI's website.

12. Case No. 11 of 2020, PF Digital Media Services Ltd. and Ravinder Walia v. UFO Moviez India Ltd., Scrabble Digital Ltd. and Qube Cinema Technologies Pvt. Ltd., order dated April 16, 2025, available at: https://www.cci.gov.in/antitrust/orders/details/1181/0.

13. All Indian Rupee ("INR") numbers converted to United States Dollar ("USD") at the rate of USD 1 = INR 85.

14. The information was filed by: (i) PF Digital Media Services Limited ("PF Digital") (now known as DNEG India Media Services Limited) a subsidiary of Prime Focus Limited, engaged in the business of post-production processing of cinematograph films; and (ii) Mr. Ravinder Walia, a film producer with over 15 years of experience, whose film "Roam Rome Mein" was post-production processed by PF Digital.

15. Scrabble was the wholly owned subsidiary of UFO and was engaged in the same business activity as PF Digital.

16. Case No. 11 of 2020, PF Digital Media Services Ltd. and Ravinder Walia v. UFO Moviez India Ltd., Scrabble Digital Ltd. and Qube Cinema Technologies Pvt. Ltd., order dated September 17, 2021, available at: https://www.cci.gov.in/antitrust/orders/details/35/0.

17. DCI is an entity comprising seven motion picture studios, namely, Disney, Fox, MGM, Paramount Pictures, Sony Pictures Entertainment, Universal Studios, and Warner Brother Studios. It was formed to establish uniform specifications for digital cinema.

18. The suppliers of the DCE are positioned upstream providing equipment to cinema owners, while PPP service providers are positioned downstream, preparing films for digital screening. These relationships are vertical because DCE suppliers and PPP service providers interact with CTOs at different but sequential levels—DCE suppliers lease equipment to CTOs, and PPP providers supply the processed film content to be played on that equipment.

19. Case No. 19 of 2020, In re: Kshitiz Arya and Anr. vs. Google LLC and Ors., order dated April 21, 2025, available at: https://www.cci.gov.in/antitrust/orders/details/1182/0.

20. The information was filed by two individuals, namely, Mr. Kshitiz Arya and Mr. Purushottam Anand, who were stated to be the consumers of the android based smart-phones and smart television devices.

21. Case No. 19 of 2020, In re: Kshitiz Arya and Anr. vs. Google LLC and Ors., order dated June 22, 2021, available at: https://cci.gov.in/antitrust/orders/details/38/0.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.