- within Intellectual Property topic(s)

- with readers working within the Pharmaceuticals & BioTech industries

- within Intellectual Property topic(s)

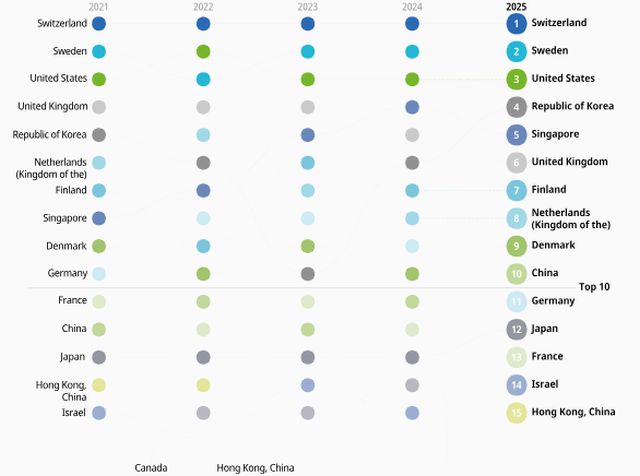

On September 16, 2025, the World Intellectual Property Organization (WIPO) released the Global Innovation Index 2025 Report (hereinafter referred to as the "Report"). Switzerland, Sweden, the United States, the Republic of Korea, and Singapore ranked among the top five, while the United Kingdom, Finland, the Netherlands, Denmark, and China secured positions six through ten. Switzerland retained its top position for the 15th consecutive year, and China entered the global top 10 for the first time. Over the past 18 years, China has climbed 25 places, becoming the first middle-income economy to break into the top ten.

Since its inaugural launch in 2007, the Global Innovation Index (GII) has been published annually. Based on a set of 78 indicators, it provides metrics for measuring innovation performance and ranks the innovation ecosystems of approximately 140 economies. The 2025 GII is calculated as the average of two sub-indices: the Innovation Input Sub-Index, which includes five key pillars—Institutions, Human Capital and Research, Infrastructure, Market Sophistication, and Business Sophistication; and the Innovation Output Sub-Index, comprising two pillars—Knowledge and Technology Outputs, and Creative Outputs.

The shifts in rankings of the top fifteen countries in the GII from 2021 to 2025 are shown in the figure below

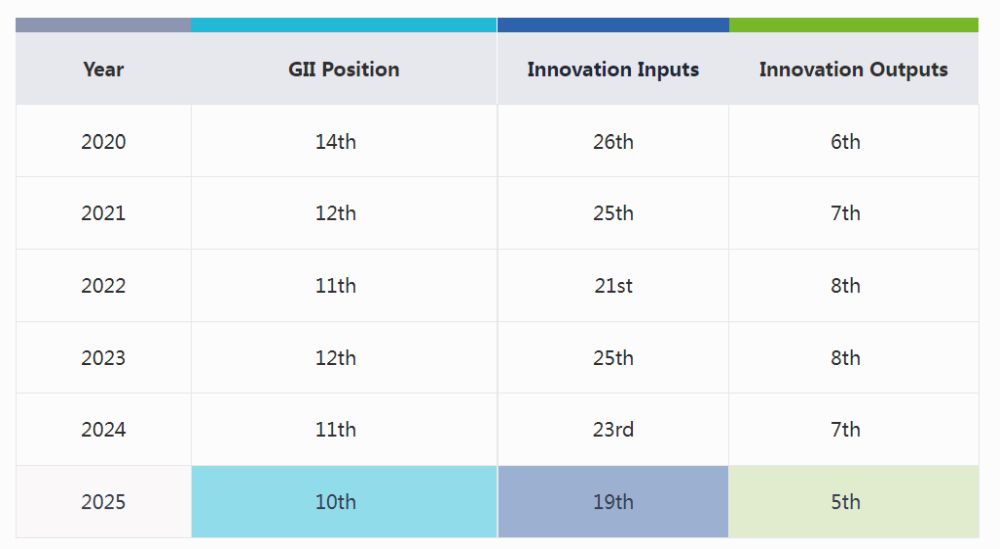

From a regional perspective, Southeast Asia, East Asia, and Oceania (SEAO) remain a key driver of global innovation, with six economies from the region ranking among the top 25 globally. Among them, the Republic of Korea (4th) and Singapore (5th) continue to lead, demonstrating strong performance in corporate Research and Development (R&D), education, and innovation infrastructure. In addition to entering the top ten in the overall ranking, China has also made significant progress in both innovation input and output. China's innovation input ranking rose to 19th globally, while its innovation output ranking climbed to 5th globally, achieving a "dual improvement" in both dimensions.

Furthermore, China ranks among the global leaders in several intellectual property-related sub-indicators. Among them, China ranks first globally in indicators such as the number of domestic industrial design applications, utility model applications, and trademark applications per unit of GDP, as well as the proportion of creative goods exports in total trade. It ranks second globally in indicators such as the number of domestic invention patent applications per unit of GDP, the development of industrial clusters, and the proportion of business-funded R&D expenditure. China also maintains its position as the world's second-largest in terms of total brand value. In 2025, the total value of Chinese brands among the world's top 5,000 brands reached 1.81 trillion US dollars.

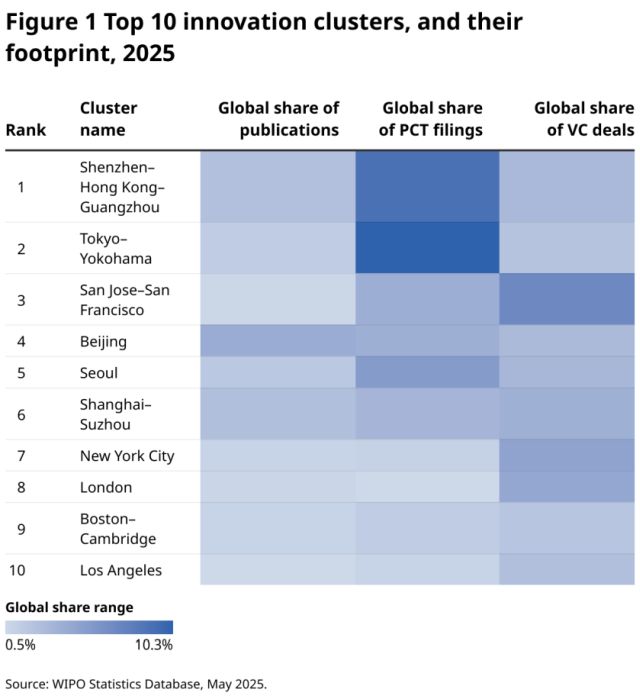

The GII also assesses the world's top 100 innovation clusters annually. In 2025, the evaluation of the top 100 global innovation clusters was based not only on the two indicators used in previous years—the location of inventors listed in PCT international applications and the location of inventors in published scientific articles—but also, for the first time, included a new indicator: the location where venture capital deals are executed.

In the 2025 global innovation cluster ranking released by the GII, Shenzhen-Hong Kong-Guangzhou ranked first in the world, followed closely by Tokyo-Yokohama. This indicates that Shenzhen-Hong Kong-Guangzhou demonstrated stronger performance in venture capital transactions compared to Tokyo-Yokohama. These two clusters have made significant contributions to global scientific publications and patent outputs, together accounting for nearly one-fifth of the world's PCT patent applications filed. San Jose-San Francisco in the United States, Beijing in China, Seoul in South Korea, and Shanghai-Suzhou in China ranked third, fourth, fifth, and sixth, respectively. Among the top 100 global science and technology clusters, China accounted for 24, securing the top position globally for the second consecutive year.

Additionally, this year's GII report presents the following key findings:

The global innovation landscape in 2024 showed an overall positive trend. In general, aside from the decline in the number of venture capital deals, the volume of new drug launches, and global warming, various forms of innovation investment exhibited a positive momentum. Following a downturn in 2023, innovation investment in 2024 displayed signs of recovery, yet this rebound remains fragile, with most innovation investments yet to return to their long-term growth trends.

Scientific publications surged. Driven by China's notable 14% increase and India's steady 7.6% growth, research output reached a record-breaking 2 million papers in 2024.

Research & Development(R&D) investment growth is slowing. Global R&D expenditure is projected to grow by 2.9% in 2024, marking the lowest growth rate since 2010. Public R&D spending saw a modest recovery, while corporate R&D expenditure outside China and the United States increased by only 1.4%, reflecting a lack of growth momentum in many high-income and middle-income economies.

Corporate R&D investment hit a new high, but its growth rate plummeted. In 2024, corporate R&D expenditure reached a historic peak of $1.3 trillion. However, the nominal growth rate dropped to 3.2% (with a real growth rate of only 1%), far below the average of 8% over the past decade. Industry performance diverged markedly: information and communication technology-related firms (particularly in AI-intensive sectors), software companies, and pharmaceutical companies increased their R&D budgets, while traditional manufacturing companies in sectors such as automobiles and consumer goods generally cut R&D investment due to sharp declines in revenue.

Venture capital remains sluggish. Venture capital deal value increased by 7.7% in 2024, primarily driven by mega-deals in the United States and a surge in generative AI investments. However, excluding these factors, venture capital activity actually contracted. The number of global venture capital deals fell by 4.4%, marking the third consecutive year of decline, indicating broad investor caution beyond a few specific sectors and regions. Venture capital is returning to its traditional core position of investing in the United States, AI, and information and communication technology, abandoning its previous expansion into emerging markets and non- information and communication fields.

International patent applications stabilized. After an unusual decline in 2023, PCT patent applications saw a modest increase of 0.5% in 2024. Growth in application volume was weak, with significant variations across countries and regions.

Source: official website of the WIPO

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]