- within Intellectual Property topic(s)

- in United States

- within Litigation and Mediation & Arbitration topic(s)

- with readers working within the Technology industries

In today's knowledge-based economy, patent monetization has become a crucial strategic tool for business development. Although this concept may seem abstract, it is deeply tied to corporate growth. In this article, PurpleVine's team will explore the diversified models of patent monetization based on the characteristics of patents as intangible assets. We will also analyze relevant successful cases within China's unique market landscape to uncover the hidden value embedded in intangible assets in the field of patent monetization.

1. Patents: the life cycle of intangible assets

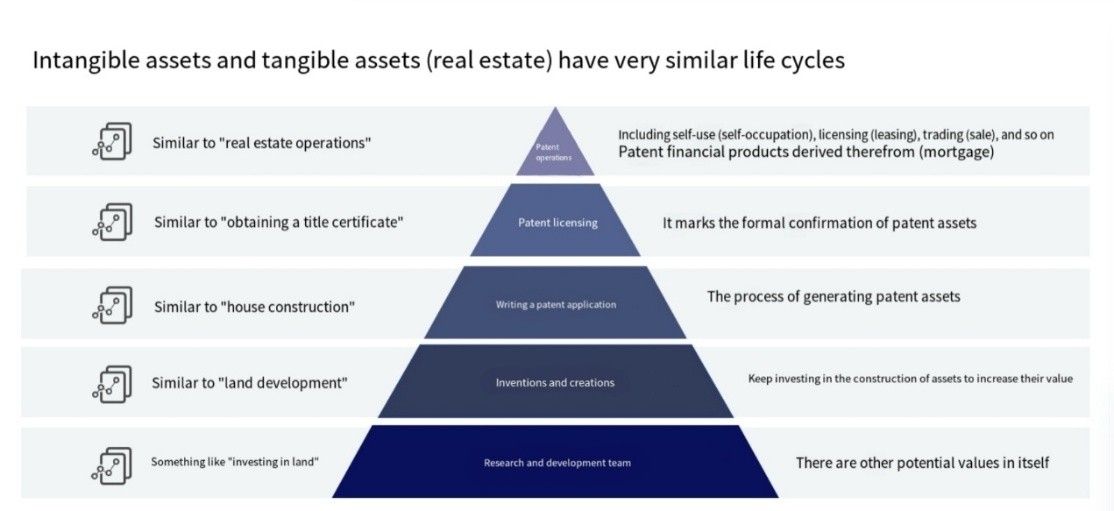

Patents, like tangible assets such as real estate, follow a lifecycle with several similarities. However, patents are marked by distinct complexities. The following diagram illustrates the parallels in the lifecycle trajectory of patents with real estate.

Specifically, when an enterprise forms an R&D team, it not only undertakes the task of applying for intellectual property rights but also needs to solve product problems in actual business and promote technological upgrades. The establishment of an R&D team is the prerequisite for generating patent assets, just as real estate developers purchase land for subsequent property development and construction.

During the R&D process, various innovations emerge naturally. Unlike routine development efforts, these innovations are novel and inventive, warranting protection through patents. This process is similar to developing on land, where engaging in the "three connections and one leveling" fosters the appreciation of property value.

Upon the creation of new inventions, enterprises must undertake careful evaluations to discern which ones merit protection through patents. This decision often necessitates cooperation with third-party patent agencies like PURPLEVINE IP to ensure that the scope of protection is broad enough while maintaining discretion over essential trade secrets. The process of generating patents can be likened to building a house. The internal team of the enterprise provides technical solutions (such as design drawings), while actual patent writing and other work can be partially or completely outsourced (like outsourcing house construction). The two parties communicate closely, ensuring smooth supervision and rectification.

When a patent is authorized by the government, it is akin to a house obtaining a property certificate. This marks the formal confirmation of patent assets, and the company can proceed with its monetization activities.

Patents can be monetized in various ways, including self-use (like self-occupied real estate), licensing (like renting real estate), transactions (like buying and selling real estate), and mortgages (like mortgaging real estate).

However, unlike standardized real estate, patents are non-standard assets. The value of property can be measured by limited dimensions such as location, age, and decoration, while patent valuation requires multi-dimensional evaluation, including technology, market, and legal considerations. Technically, it is necessary to analyze whether there are infringing products and how stable the patent is. From the market perspective, the impact of patent infringement on the business must be considered; from a legal standpoint, the risks of patent infringement litigation must be evaluated. This multi-dimensional evaluation introduces uncertainty in patent valuation.

2. Multiple models of patent monetization: diversified paths to realize patent value monetization

Patent monetization refers to the process of realizing the value of patents and converting them into revenue. Here are four common patent monetization methods:

A. Self-use: build industry barriers

Self-use means that the enterprise uses the patent itself to build industry barriers. The premise of this method is that the patent must be a factual standard, meaning it is difficult for others to bypass the patent by design. Enterprises use patented technologies to produce exclusive products, thus preventing competitors from entering the market and securing a technological monopoly. However, if patents can be circumvented by design, companies can only block one path to technical products, making it difficult to completely block competitors. For example, in the pharmaceutical industry, companies can achieve market monopoly with formula patents. The company that owns the patent can exclusively produce and sell the drug. High compensation litigation cases also deter competitors, preventing easy infringement.

B. License: a mutually beneficial and win-win cooperation model

Licensing means that the patent owner licenses the patent to others for use without transferring the patent's use rights and collects licensing fees. Patent licenses can be classified into unilateral and bilateral types. In unilateral licensing, strong patent owners such as Nokia, relying on their first-mover advantage in the communications industry and strong patent portfolios, license their patents to competitors like Huawei and ZTE. Bilateral licensing, or cross-licensing, is suitable for enterprises with equivalent patent portfolios. Both parties license patents to avoid litigation and achieve mutual benefit.

Patent licensing is the most common model of patent monetization, involving several stages: first, technical asset analysis, where the technical value of the patent package is assessed; second, market research to identify technical applications, market size, and potential cooperation partners; finally, the exercise process, where negotiations, litigation, customs complaints, and other means are employed to secure licensing fees. Contract management is also required after signing the agreement. The entire process involves collaboration across technology, market, legal, and business departments.

C. Transactions: flexible adjustment of asset allocation

Transactions involve the sale of patent ownership. Patent transactions are commercial activities, and the decision-making logic varies depending on whether the buyer or seller is involved.

From the seller's perspective, companies usually choose to sell patented assets in two strategic scenarios:

- When a company withdraws from a specific competitive field, it will focus resources by divesting patents. For example, when LG Group withdrew from the photovoltaic industry, it transferred its patent package in this field to companies like JinkoSolar, Tianhe Chemicals Group, and JA Solar.

- When the patent portfolio precedes business development, companies sell patents to avoid idle technology and realize the value of R&D investments.

From the buyer's perspective, patent acquisition may serve dual strategic goals:

- Defensive self-use: To eliminate infringement risks in technology implementation by acquiring patent rights and establishing safe R&D and production barriers.

- Strategic value-added expectations: To capitalize on the potential of patented technologies in industrial evolution, promote them to become industry standards through technology incubation and ecosystem integration, and realize intangible asset appreciation.

D. Mortgage: a less adopted operational method

Patent mortgages are not commonly used, as patents are non-standard assets, difficult to value, and fraught with uncertainty in exercising rights. Financial institutions are hesitant to offer loans against patents due to the risks involved. However, in some innovative enterprises, if funds are lacking, they may attempt to obtain loans through patent mortgages to support R&D and operations.

Among these four models, patent licensing is the most widely adopted. It enables licensors to generate rental income while licensees gain legal access to the market, promoting the improvement and commercialization of patented technologies, and realizing the appreciation of patent assets.

3. China' s patent monetization landscape: opportunities and challenges coexist

In China, the patent monetization market is a rapidly growing sector with great potential. We can analyze this market from several perspectives, including its development momentum, existing obstacles and challenges, and key success factors (see the figure below for details), to explore a patent monetization path with Chinese characteristics:

A. Market development momentum

a) Policy Promotion: Government-supported policies have evolved from early R&D and patent application funding to current funding for patent monetization, effectively boosting market development. Initially, the government encouraged universities and high-tech enterprises to invest in R&D through special subsidies. Later, due to difficulties in transforming innovation results, the government focused on patent applications, increasing the number of patents filed yearly but decreasing quality. Now, the government funds patent monetization, encouraging the transformation of inventions into commercial products.

b) Market Demand: As the world's largest manufacturing hub, China has a strong demand for advanced foreign technologies and patents. The country is undergoing a social transformation, creating a demand for technology upgrades and attracting high-end patents for implementation. As Chinese companies expand globally, patent licensing and purchasing demand also rise to avoid patent litigation.

c) Culture and Capital: China's entrepreneurial spirit and active capital investment create more opportunities for patent monetization. Chinese companies are more willing to explore new business models, and the growing acceptance of patent monetization has increased.

B. Challenges

a) Policy Restrictions: The government is cautious with patent compensation policies. Given China's manufacturing base development stage, high compensation for patent infringement may lead to the bankruptcy of small and medium-sized enterprises. Current low compensation for patent infringement limits incentives for companies to protect their rights, thus hindering the full market potential of patent monetization.

b) Model and Cognition: Patent monetization is a new business model in China, lacking successful case references, and companies have limited awareness and acceptance. Many companies are unaware of the process, risks, and benefits of patent monetization and are reluctant to try it, slowing down market growth.

c) Talent Shortage: Patent monetization requires professionals who combine technical, legal, and business skills. These professionals must understand technology, assess the value of patents, handle patent disputes, and negotiate and trade patents. Currently, such talent is scarce, limiting market development.

C. Key factors for successful patent monetization

Several factors are crucial for success in patent monetization:

- Companies must establish standardized patent monetization processes, as seen in the long-term success of companies like Nokia, GE, and Dolby.

- The industry in which the company operates plays a critical role. Industries such as communications, electronics, energy storage, semiconductors, and home appliances, where technological changes occur rapidly, offer opportunities to create high-value patents, making them key areas for patent monetization.

- Good government relations and handling of public industry opinion are vital for patent monetization success. In China, establishing strong relationships with government agencies is crucial for the smooth development of patent monetization initiatives.

- Chinese companies should explore innovative cooperation models, such as establishing patent alliances with key partners to jointly deal with competitors, or developing patent pools to improve licensing success rates.

4. Case analysis: lock patent monetization in the flooring industry

Through the case of Unilin' s lock patent monetization in the flooring industry, we can more intuitively see the power of patent monetization.

The company' s patent monetization process can be divided into the following stages:

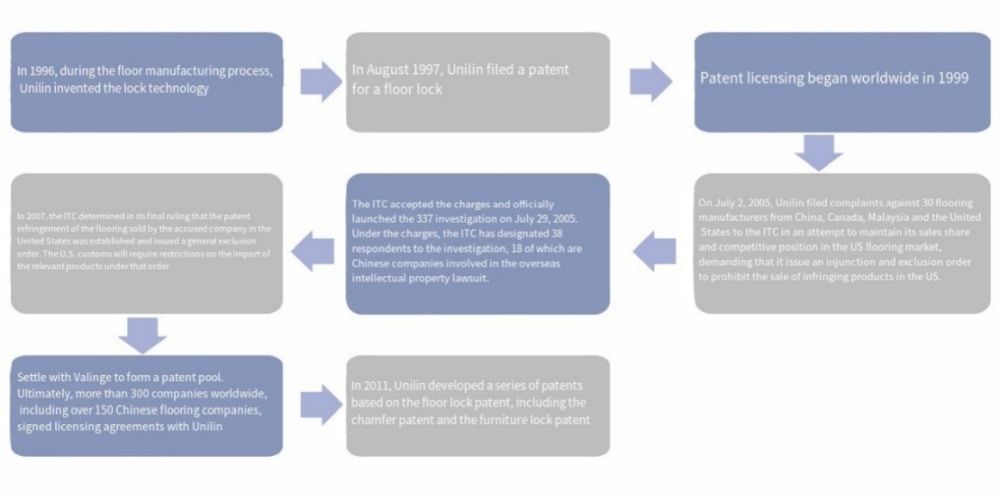

- Technical Breakthrough and Patent Layout Stage (1996-1997): In 1996, Unilin invented the lock connection technology, subverting the traditional process model of flooring that relies on glue to fix, and significantly improving the connection strength through innovative tongue and groove structures. The following year, the company applied for patents from the European Patent Office for the technology and was authorized. Its initial strategic goal was to build patent barriers, curb competitors' production of similar lock floors, and establish a technological monopoly advantage.

- Infringement Dilemma and Operation Model Transformation (1999-2005): In 1999, Unilin discovered widespread infringement in the industry at an industry show—almost all competitors produced lock floors without authorization. Faced with the inefficiency of simply protecting rights, the company quickly adjusted its strategy: from defensive protection to active operations by launching a global patent licensing project, trying to convert patent assets into sustainable profit points. After six years of licensing negotiations, the company realized the market's natural resistance to patent payments. In 2005, it filed a 337 investigation with the US International Trade Commission (ITC), accusing more than 30 flooring companies of patent infringement.

- Judicial Rulings Lay Industry Standards (2006-2007): After a year and a half investigation, the ITC ruled that the infringement was established and issued a universal exclusion order prohibiting unauthorized lock floors from entering the U.S. market. This ruling made Unilin's patent the de facto standard in the global field of lock flooring.

- Large-scale Formation of Licensed Networks (2007-2016): In the end, more than 300 companies around the world (including more than 150 Chinese companies) signed license agreements, with annual licensing income exceeding RMB 1 billion, of which the annual income from the Chinese market exceeded RMB 100 million. It achieved the ultimate in light asset operation, requiring only one person to handle the patent licensing business full-time, resulting in a high-yield input-output ratio.

- Patent Matrix Extension and Pattern Replication (2011-present): On the eve of the expiration of the original core patent in 2011, Unilin expanded its patent family by applying for a series of derivative patents, horizontally copying the locking technology from the flooring field to furniture products, completing the cross-category migration of the patent monetization paradigm. The business line has maintained good growth, confirming the sustainability of its business model.

This case demonstrates a comprehensive business cycle of "Technology R&D → Patent Portfolio → Litigation Deterrence → Standardization → Licensing Revenue → Patent Family Expansion," highlighting three key areas of innovation:

- From Technological Monopoly to Ecosystem Development: Transforming a single patent into an industry standard and constructing a technology ecosystem through a strategic licensing model.

- Scalability of Business Models: Demonstrating that patent monetization can function as an independent business model, leveraging its low-cost asset structure and high marginal returns to enable cross-industry expansion.

- Broadening the Scope of Innovation: Highlighting that both business model innovation and technological R&D hold equal strategic importance—where the former creates a secondary growth avenue for companies through resource reallocation and innovation.

Unilin's case underscores the importance for businesses, in the knowledge economy era, to not only possess technological innovation capabilities but also to grasp the financial management of patent assets. This enables companies to fully unlock the value of intellectual property through the coordinated application of legal frameworks, market dynamics, and business strategies.

5. Conclusion

Patent monetization is a critical strategy for businesses to unlock the value of intangible assets and boost competitiveness. Despite the challenges in China's patent monetization market, its prospects remain broad. Enterprises and professionals should deeply understand patent monetization, seize opportunities, and utilize this new business model to create more value for their development.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.