- within Strategy topic(s)

- with Finance and Tax Executives

- in United Kingdom

- with readers working within the Law Firm industries

Executive Summary

Short-term caution; long-term commitment

Multinational companies (MNCs) in China are relatively optimistic for the future and are maintaining market presence and navigating a period of slower growth by shifting strategies from growth to profitability.

Introduction

China's economy is entering a new phase – transitioning from a developing economy to a mature economy. This shift towards a more complex economic model presents not only many opportunities for multinational companies (MNCs), but also a new set of challenges. How do MNCs perceive their growth prospects amid this change? Are they still committed to the China market, and how are their strategies adapting to secure future success?

To answer these questions, KPMG China conducted its 2025 MNC China Outlook Survey with key executives of MNCs operating in the Chinese Mainland. The resulting report provides rare insights into MNC sentiment, exploring their confidence in their revenue growth, their investment plans, and how they are adjusting their operations.

The findings reveal that, as MNCs face their new challenges, the main narrative is that of strategic recalibration. While they remain cautious as to their short-term revenue forecasts, they express relative long-term confidence and are adapting by shifting towards profitability rather than growth, making adjustments to improve operational efficiency, and moving forward with their localisation strategies.

We hope you find this report enlightening as you read about the key shifts, positions, and beliefs defining this new chapter for MNCs in China.

Growth and Revenue Outlook

Mixed sentiment on economic outlook, whilst more optimistic on the Chinese economy than for the global economy

Confidence in Chinese and global growth

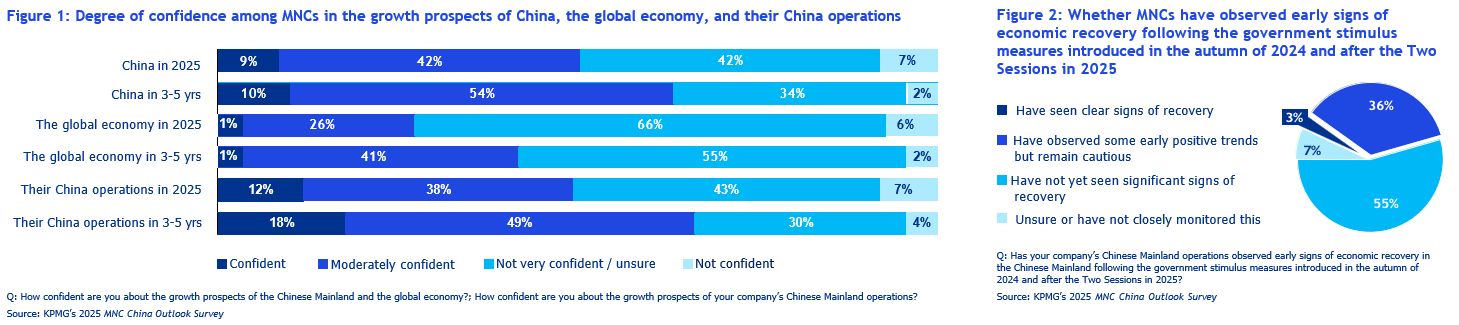

The MNCs surveyed have mixed confidence in China's economic growth for 2025, with only half the respondents expressing at least moderate confidence (see Figure 1). To address China's slowing economic growth, the government has initiated sporadic stimulus measures, including once in the autumn of 2024 and once after the Two Sessions in 2025. However, only 39% of respondents state that they have observed at least some signs of recovery since these measures were announced (see Figure 2).

But despite the mixed sentiments as to the pace of China's economic recovery, MNCs have greater confidence in the Chinese economy than in the global economy – in both the short and medium term. Only 27% of respondents express at least moderate confidence in global economic growth in 2025. As for China's economic growth prospects over the next 3 to 5 years, as many as 64% of respondents express at least moderate confidence, while only 42% express at least moderate confidence for global economic growth.

Regarding revenue growth of their China operations in 2025, MNC confidence is similarly mixed. However, notably more confidence is apparent in terms of revenue growth over the next 3 to 5 years, with 67% of respondents expressing at least moderate confidence, matching the relative optimism for China's economic growth in the near-to-medium term.

Mixed revenue forecasts for 2025

MNCs' growth forecast

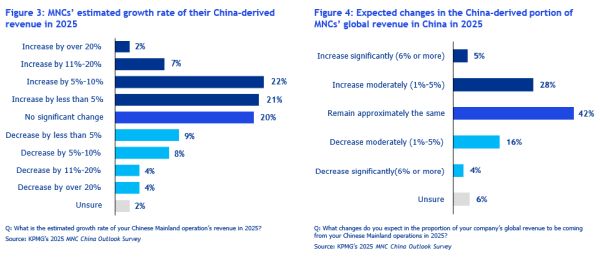

Delving deeper into MNCs' revenue outlook, only 52% of MNCs surveyed forecast growth in 2025, with as many as 25% forecasting negative growth (see Figure 3). Of the MNCs forecasting growth, 31% estimate their growth rates to increase by at least 5% or more. Meanwhile 20% of respondents expect no significant change to their revenue growth in 2025.

As for expected changes in the China-derived portion of MNCs' global revenue in 2025, as many as 33% of respondents expect an increase in their global revenue to come from China, while 20% expect a decrease (see Figure 4). Perhaps more significantly, 42% of respondents expect the contribution of their China operations to remain about the same.

Of the 50% of MNCs in Figure 3 who expressed at least moderate confidence in their company's 2025 growth prospects in China, the top reasons cited for their confidence are: operational optimisation (30%); new product/revenue stream launches (27%); and localisation measures, including localising of R&D (19%) (see Figure 5).

Click here to view the full report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.