- within Corporate/Commercial Law topic(s)

- in Australia

- with readers working within the Technology industries

- within Law Department Performance topic(s)

Market overview

The built environment consulting market size was valued at ~ $35bn globally in 2024, led by large, international multidisciplinary firms offering comprehensive consultancy services across the entire project lifecycle. Growth is driven both organically and through aggressive M&A strategies, as firms develop niche capabilities and access attractive end markets. Emerging themes include the rise of connected buildings—integrating building and engineering design with smart technologies—and increased focus on reshoring of factories and data centres. Additionally, infrastructure design areas, such as railways and transport projects are gaining prominence, supported by Building Information Modeling (BIM) and digital engineering.

Alongside these leaders sits a vibrant mid-market of independent firms expanding service lines, geographic footprints, and sector focuses. These firms often outperform larger counterparts by leveraging stronger talent attraction and retention, as well as adopting more professional and efficient systems and processes.

The remainder of the market comprises a fragmented tail of over a thousand smaller local firms, typically single-discipline or limited multidisciplinary in scope. These organisations face ongoing challenges including succession planning and talent access. Over 90% of market participants are micro firms in scale but collectively generate less than a third of total revenue. This fragmentation continues to provide fertile ground for consolidation led by both strategic and financial sponsor buyers.

Sponsor activity has intensified in recent years, underpinning buyand-build strategies that accelerate growth and consolidation across the sector. The combined effect of these dynamics points toward sustained M&A momentum as companies pursue scale, advanced capabilities, and stronger competitive positioning in an evolving market.

Over 90% of market participants are micro firms in scale but collectively generate less than a third of total revenue.

Key themes impacting the market

Talent acquisition and retention remain critical challenges.

Regulatory driven

The built environment sector is being transformed by increasingly stringent regulations, such as the UK's Building Safety Act and tightening energy standards across Europe. These evolving rules require higher compliance, transparency, and sustainability. As a result, project planning and design timelines are lengthening, costs are rising, and demand for specialist consultancy support throughout the project lifecycle is significantly increasing.

Infrastructure investment requirements

Government investment themes and spending commitments across energy security, utilities, transport and critical infrastructure modernisation and shoring up housing stock mean a robust project pipeline. These developments require multidisciplinary expertise from planning to operation and are opening up new opportunities across the value chain.

War for talent Talent

acquisition and retention remain critical challenges. Mid-sized consultancies often attract skilled professionals through focused cultures and flexible work, providing a more varied training ground for their developing workforce and therefore enabling them to outperform larger firms. Skills shortages and ageing workforces pressure smaller firms, driving succession challenges.

Technology

Digital transformation is reshaping consultancy services through the integration of smart technology in building design. Smart buildings use IoT-enabled systems for real-time monitoring of energy use, environments, occupancy, and equipment, enabling data-driven, adaptive management. This results in infrastructure that improves sustainability, operational efficiency, lifecycle management, and occupant experience—delivering predictive maintenance, optimised energy use, and greater long-term value for the built environment.

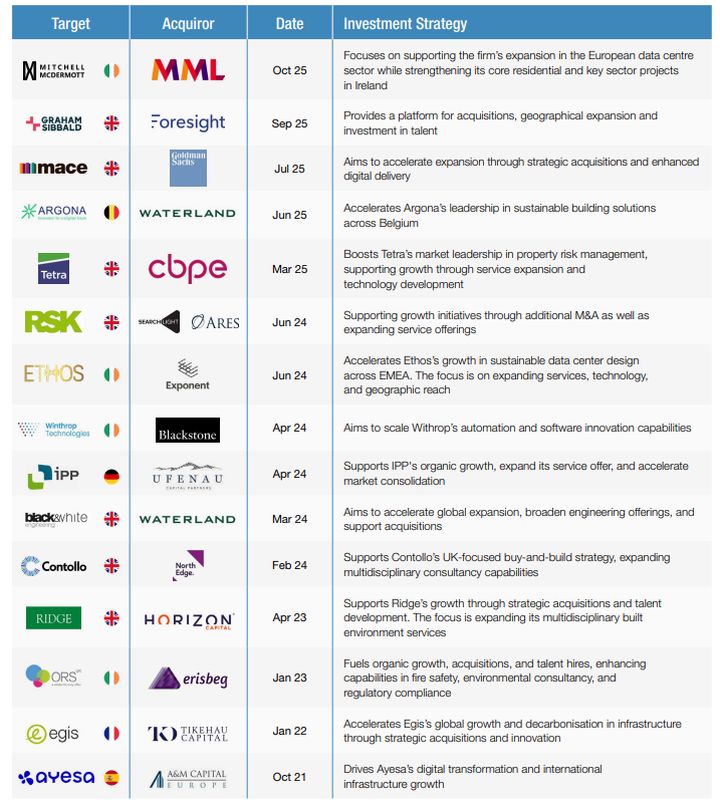

Select Financial sponsor platform investments

Select strategic transactions

European Regulatory Landscape: Driving market transformation

European regulation driving demand

The built environment sector across Europe is being reshaped by an increasingly stringent regulatory agenda focused on sustainability, safety, and energy performance.

Frameworks such as the EU Green Deal, and the revised Energy Performance of Buildings Directive (EPBD) are embedding carbon reduction and lifecycle efficiency requirements across all asset types. These policies are driving significant investment in decarbonisation, retrofit, and energy transition projects, increasing demand for consultancy support and creative new solutions across the lifecycle of an asset.

As the regulatory landscape evolves, clients are relying more heavily on consultants to interpret complex frameworks, quantify environmental performance, and implement compliance systems. Firms with sustainability, environmental, and digital expertise are emerging as clear market leaders, capturing share through regulatory advisory and ESG-led service offerings.

At the same time, Europe's regulatory alignment around frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy is accelerating cross-border standardisation. Clients increasingly seek partners capable of providing consistent compliance and ESG advisory across jurisdictions, strengthening the competitive advantage of firms with established international platforms.

This growing complexity is also driving professionalisation and consolidation within the sector, as mid-sized and independent firms look to scale through acquisition or partnership to meet heightened digital and reporting requirements. Larger firms are leveraging their regulatory insight and data-driven capabilities to differentiate services, deepen client relationships, and secure recurring revenue streams.

In combination, these dynamics are embedding regulation as a long-term structural growth driver for the built environment consulting market.

Sector Outlook: A growing and resilient underlying market

Continued consolidation from strategic operators

Strategic operators are expected to maintain strong consolidation momentum. Acquisitions are carefully targeted to strengthen sector expertise, gain access to scarce talent, and enhance multidisciplinary advisory capabilities.

Digital transformation is a key enabler, with strategics investing in technology to expand their data analytics and sustainability service offerings which are critical to the design and development of new infrastructure and capital projects. Strengthening digital capabilities not only improves project delivery and client engagement, but also supports new value-added services throughout the project lifecycle.

This strategic consolidation enables larger firms to broaden geographic reach, deepen client relationships, and differentiate through innovative, data-driven solutions, positioning them for longterm competitiveness in an evolving market landscape.

Financial sponsors to play an increasing role

Financial sponsors are set to be a major force shaping the built environment sector's future growth. Financial sponsor firms are increasingly targeting a growing number of robust mid-tier multidisciplinary consultancies that have the capability to challenge the dominance of global strategic operators. These mid-market businesses offer attractive platforms for buy-and-build strategies.

Financial sponsor investors are particularly drawn to firms with a strong presence in high-growth, high-margin sectors, differentiated service offerings, and the ability to manage complex projects across the full lifecycle. Sponsor-backed firms are positioned to accelerate innovation and digital transformation.

This trend is fueling continued consolidation and competitive disruption, as private capital supports businesses that combine national scale with international growth potential, creating new challengers to the established global leaders.

The consolidation drivers in the built environment sector and growth in financial sponsor investment

1 Strategics continue to invest

International, multidisciplinary firms remain at the forefront of M&A activity in the sector, maintaining aggressive M&A strategies to continue to expand their footprint in niche sectors and build specialist advisory capabilities.

Recent acquisitions target areas across renewable energy, smart infrastructure, and complex data centre design reflect growing client demand for sustainable and tech-enabled solutions. These moves reflect a broader industry shift toward sustainability, decarbonisation, and digital transformation, as clients increasingly seek partners with the expertise to deliver integrated, future-proof solutions

Strategics are leveraging data analytics and digital tools and platforms to enhance their service offerings and provide deeper insights and value to clients. This focused expansion strategy allows large strategics to offer more comprehensive, differentiated service portfolios—positioning them as end-to-end partners across the full project lifecycle.

2 Growing interest from financial sponsors

Financial sponsors are becoming increasingly active in the built environment sector, attracted by its fragmentation and the prevalence of mid-sized firms. This dynamic creates fertile ground for buy-andbuild strategies that enable portfolio companies to scale efficiently, broaden capabilities, and expand geographically.

Investments typically target multidisciplinary firms involved across the full project lifecycle, particularly in high-growth areas such as infrastructure, data centres, and sustainable development. These businesses are well positioned to meet growing client demand for integrated, future-focused solutions.

In addition to M&A, sponsors drive value through operational improvements—accelerating digital adoption, strengthening talent pipelines, and reinforcing compliance. Their focus on sustainability and innovation, including smart asset management and data analytics, helps build more resilient, future-ready businesses.

By combining strategic acquisitions with operational transformation, financial sponsors are playing a key role in consolidating the sector and supporting long-term value creation.

3 Unlocking opportunities through diversification and client engagement

The built environment sector offers significant opportunity but requires keen insight into its unique dynamics. Understanding how strong operators manage project pipelines provides insight into revenue visibility and resilience.

A critical focus is assessing revenue quality and client relationships. Leading businesses achieve a balanced mix of repeat revenue from core, loyal clients alongside selective one-off projects to diversify risk. Firms that proactively deepen client engagement and broaden sector exposure demonstrate greater revenue sustainability amid market shifts.

The sector's fragmentation presents significant opportunity for consolidation. Understanding how strong operators manage project pipelines provides insight into revenue visibility and resilience.

Successful investment hinges on deep due diligence with an eye for companies that innovate around cyclicality by building diversified, resilient revenue bases, strengthening operational infrastructure, and maintaining strong client relationships.

Originally published 24 November 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.