- in Australia

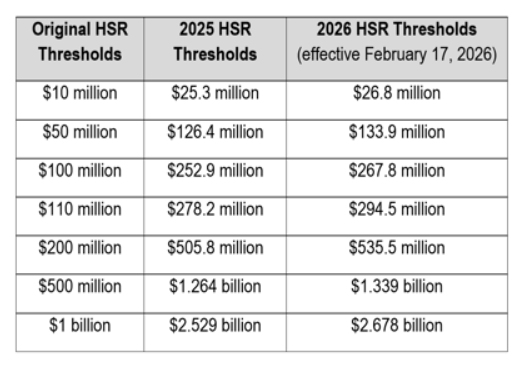

The Federal Trade Commission has announced new, higher Hart-Scott-Rodino (HSR) Act premerger notification thresholds and higher HSR filing fees, which will take effect on February 17, 2026. The new minimum size-of-transaction threshold potentially triggering an HSR filing will be $133.9 million.

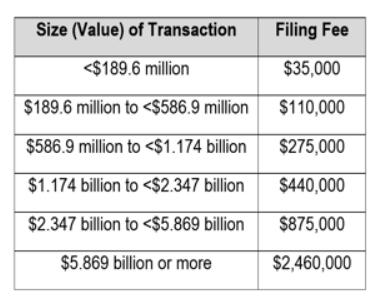

The six-tiered filing fee structure requires filing fees per transaction ranging from $35,000 (for transactions valued under $189.6 million) to $2.46 million (for transactions valued at $5.869 billion or more).

An important distinction is that the applicable HSR Act thresholds are those in effect when the deal closes (rather than when you submit an HSR filing), and the applicable HSR filing fees are those in effect when you submit your HSR filing.

2026 HSR Thresholds

Pursuant to 15 U.S.C. § 18a, the HSR Act's jurisdictional thresholds are adjusted annually to reflect changes in nominal (non-inflation-adjusted) gross national product (GNP). The 2026 thresholds reflect an approximately 5.9% increase from the 2025 thresholds. The new $133.9 million minimum size-of-transaction threshold is an increase of $7.5 million from the $126.4 million 2025 threshold.

Adjustments to Size-of-Transaction Thresholds

Transactions that are never reportable: A transaction that results in holdings of $133.9 million or less will not require HSR notification.

Transactions that are always reportable: At the other end of the size spectrum, a transaction that results in holdings of more than $535.5 million will trigger the HSR notification and waiting requirements unless an HSR filing exemption applies.

Transactions that may be reportable: For transactions resulting in holdings between these two size-of-transaction thresholds (i.e., greater than $133.9 million but no greater than $535.5 million), whether HSR premerger notification requirements apply depends on whether both parties meet the applicable size-of-person thresholds. (Note that the size-of-person thresholds apply to the size of the parties and not merely to the size of the acquiring entity and the target—so it is necessary to look to the ultimate parent entity of each and include all entities controlled by it to determine the size-of-person.)

Adjustments to Size-of-Person Thresholds

The adjusted size-of-person thresholds for 2026 are $26.8 million and $267.8 million, meaning that acquisitions resulting in holdings greater than $133.9 million but no greater than $535.5 million will not require an HSR filing unless one party has total assets or annual net sales of $26.8 million or more and the other party has total assets or annual net sales of $267.8 million or more. (Note that, additionally, if the acquired person is not engaged in manufacturing, it must have annual net sales of $267.8 million or total assets of $26.8 million.)

Other HSR Thresholds Adjustments

The HSR Rules (16 C.F.R. §§ 801–803) provide several exemptions that contain dollar value limitations described by the parenthetical "(as adjusted)." Those limitations—for example, the nexus with commerce limitations for the exemptions for acquisitions of foreign assets (16 C.F.R. § 802.50) and acquisitions of voting securities of a foreign issuer (16 C.F.R. § 802.51)—will also be adjusted upward.

The HSR Rules also provide "notification thresholds" for acquisitions of voting securities (16 C.F.R. § 801.1(h)), setting forth levels of holdings of voting securities that would require another HSR filing. (Note, however, that once an acquiring person acquires 50% or more of a target's voting securities, no additional filings will be required.) As the dollar values for these notification thresholds are also set forth with the parenthetical "(as adjusted)," they will similarly be adjusted upward.

2026 HSR Filing Fees

The Merger Filing Fee Modernization Act of 2022 established a six-tiered fee structure and requires that the filing fee tiers be adjusted annually to reflect changes in GNP. In addition, the fees applicable to each tier are adjusted annually based on changes in the consumer price index.

As a result of those adjustments, the HSR filing fees and corresponding tiers for transactions filed on or after February 17, 2026, are:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]