- within Government and Public Sector topic(s)

- with Inhouse Counsel

- with readers working within the Banking & Credit industries

Reporting entities will be familiar with the obligation to appoint an AML/CTF Compliance Officer (Compliance Officer), who is responsible for ensuring compliance with the reporting entitys AML/CTF obligations.

Reforms introduced by the AML/CTF Amendment Act clarify this obligation. One of the key aims of the reforms introduced by the Amendment Act is to enhance governance, oversight, and accountability within reporting entities, especially by codifying the role and requirements of the Compliance Officer. Previously, many of the responsibilities of the AML/CTF Compliance Officers were found in the AML/CTF Rules or AUSTRAC guidance. The Amendment Act elevates these obligations into primary legislation, giving them greater legal force and removing ambiguity.

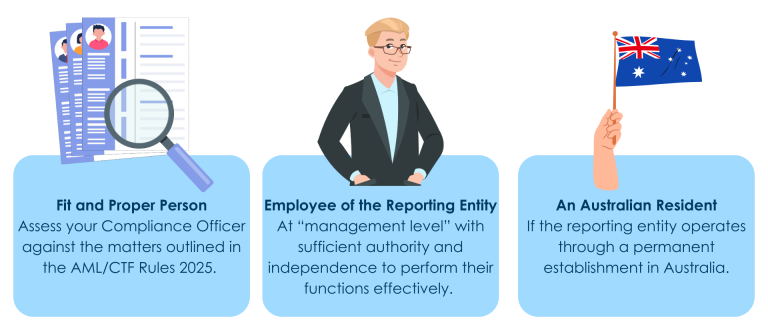

The reforms mandate that the appointed AML/CTF Compliance Officer must meet the following legally enforceable criteria:

- must be a "fit and proper person";

- must be employed by the reporting entity at a "management level" with sufficient authority and independence to perform their functions effectively; and

- If a reporting entity operates through a permanent establishment in Australia, the Compliance Officer must be an Australian resident.

What is a "Fit and Proper Person"?

The AML/CTF Rules 2025 outline the matters which a reporting entity should consider when determining whether its AML/CTF Compliance Officer is a "fit and proper" person, including whether the person:

- has the necessary competence, skills, knowledge, diligence, expertise and soundness of judgement to properly perform their duties having regard to the nature, size and complexity of the reporting entity;

- has the attributes of good character, honesty and integrity;

- has been convicted of a serious offence;

- has been the subject of civil or criminal proceedings, or a regulatory or disciplinary process in Australia or a foreign country that relate to the management of a company or involve adverse findings as to their competence, diligence, judgement, honesty or integrity

- is an undischarged bankrupt or has executed a personal insolvency agreement;

- has a conflict of interest that will create a material risk that the individual will fail to properly perform their duties.

The reporting entity must implement an assessment process to determine if the AML/CTF Officer is fit and proper. As part of their AML/CTF obligations, the reporting entity's AML/CTF Program must outline the criteria assessed for the AML/CTF Compliance Officer role, and the procedures to remove the Compliance Officer if they are no longer "fit and proper".

Effective Dates

The reforms relating to the fit and proper requirement become operational for current reporting entities from 31 March 2026. From July 1 2026, the newly regulated tranche two reporting entities must appoint an AML/CTF Compliance Officer under these updated rules.

Further Reading

- Anti-Money Laundering and Counter-Terrorism Financing Act 2006

- Anti-Money Laundering and Counter-Terrorism Financing Rules 2025

- Is your AML Compliance Officer fit and proper?

- Second Exposure Draft AML/CTF Rules

- Tranche Two Reforms

- Simplifying and Modernising the AML/CTF Regime

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.