- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

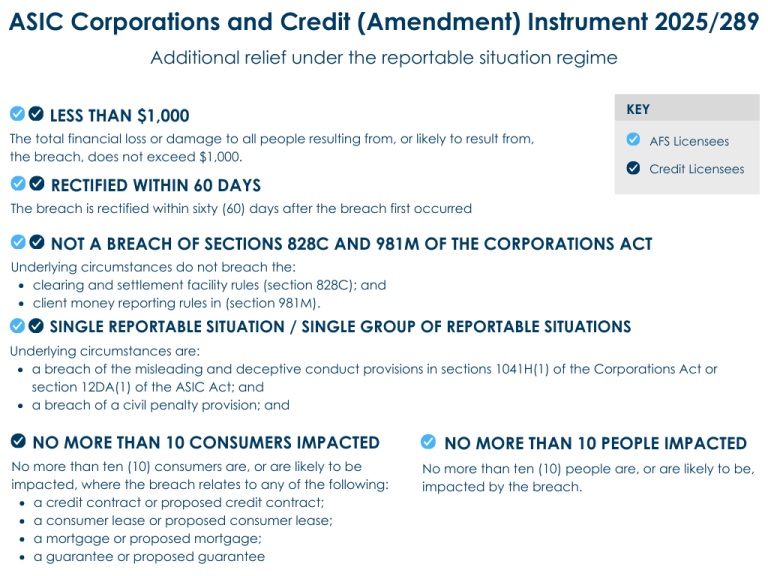

ASIC has provided additional relief for Australian Financial Services Licence ("AFSL") and Australian Credit Licence holders under the reportable situations regime, which applies from June 2025 onwards.

1. What relief does the ASIC instrument provide to licensees?

Section 912D of the Corporations Act, deems certain breaches as "significant". The ASIC Instrument provides an exemption, where a breach will not be deemed "significant" if:

- the underlying circumstances relating to the breach would only

give rise to a single reportable situation or a single group of

reportable situations as a result of:

- a breach of the misleading and deceptive conduct provisions in sections 1041H(1) of the Corporations Act or section 12DA(1) of the Australian Securities and Investments Commission Act 2001 (Cth) ("ASIC Act"); and

- a breach of a civil penalty provision; and

- the underlying circumstances do not breach the clearing and settlement facility rules or client money reporting rules in sections 828C and 981M of the Corporations Act, respectively; and

- no more than ten (10) people are, or are likely to be, impacted by the breach; and

- the total financial loss or damage to all people resulting from, or likely to result from, the breach, does not exceed $1,000; and

- the breach has been rectified within sixty (60) days after the breach first occurred.

2. What relief does the ASIC Instrument provide to credit licensees?

Similar to section 912D of the Corporations Act, section 50A of the National Credit Act states that there are certain breaches that are deemed to be "significant". The ASIC Instrument provides an exemption where a breach will not be deemed "significant" if:

- the underlying circumstances relating to the breach would only

give rise to a single reportable situation or a single group of

reportable situations as a result of:

- a breach of the misleading and deceptive conduct provisions in sections 1041H(1) of the Corporations Act or section 12DA(1) of the ASIC Act; and

- a breach of a civil penalty provision; and

- no more than ten (10) consumers are, or are likely to be,

impacted, where the breach relates to any of the following:

- a credit contract or proposed credit contract;

- a consumer lease or proposed consumer lease;

- a mortgage or proposed mortgage;

- a guarantee or proposed guarantee; and

- the total financial loss or damage to all consumers resulting from, or likely to result from, the breach, does not exceed $1,000; and

- the breach has been rectified within sixty (60) days after the breach first occurred.

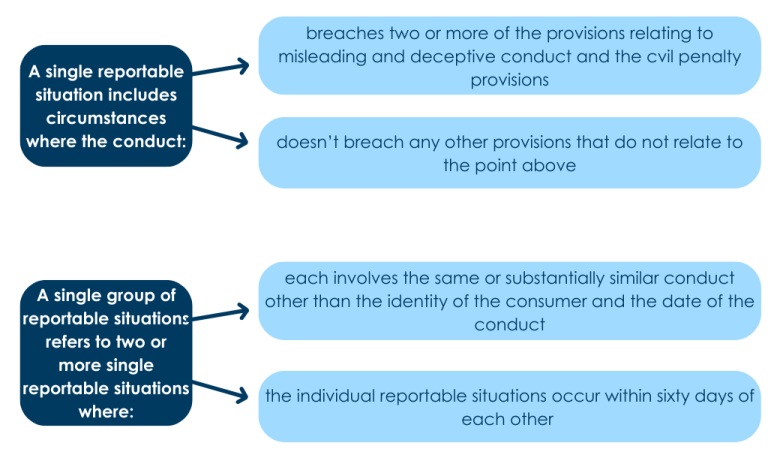

3. What does a "single reportable situation" and "a single group of reportable situations" mean?

- A single reportable situation includes

circumstances where the conduct:

- breaches two (2) or more of the provisions relating to misleading and deceptive conduct and the civil penalty provisions; and

- does breach any other provisions that do not relate to point (a)(i) above

- A single group of reportable situations refers

to two (2) or more single reportable situations where:

- each involves the same or substantially similar conduct other than the identity of the consumer and the date of the conduct; and

- the individual reportable situations occur within sixty (60) of each other.

4. Does this mean that if a reportable situation is rectified within sixty (60) days, licensees do not need to report the breach to ASIC?

No, all licensees must still notify ASIC within thirty (30) days after it first knew about or was reckless as to whether there are reasonable grounds to believe a reportable situation has arisen.

However, if at the time the licensee first knew about or was reckless as to whether there are reasonable grounds to believe a reportable situation has arisen, and the reportable situation has already been rectified within sixty (60) days of the breach first occurring (or would be rectified within 60 days - if it has not yet been 60 days since the breach first occurred), then licensees do not need to report the breach to ASIC, provided:

- the AFS licensee has also satisfied the requirements under question 1(a) to (d) of this article; or

- the Credit licensee has also satisfied the requirements under question 2(a) to (c) of this article.

5. Does the relief extend the time to conduct investigations about a breach?

Yes, all licensees now have sixty (60) days to investigate whether a reportable situation has occurred. If the investigation is completed within sixty (60) days and no reportable situation was identified, licensees do not need to notify ASIC about the investigation.

6. Should I update my compliance documents?

Yes, we recommend updating your Breach Reporting Policy to ensure it remains consistent the with relief ASIC has provided. Sophie Grace can assist with updating your Breach Reporting Policy. For further assistance, please contact us.

7. Is the relief found in the Corporations Act 2001 (Cth) ("Corporations Act") and National Consumer Credit Protection Act 2009 (Cth) ("National Credit Act")?

The relief is found in the ASIC Corporations and Credit (Amendment) Instrument 2025/289 ("ASIC Instrument"). This ASIC Instrument should be read alongside:

- section 912D of the Corporations Act for AFSL holders; and

- section 50A of the National Credit Act for Credit Licence holders; and

- ASIC Corporations and Credit (Breach Reporting-Reportable Situations) Instrument 2024/620.

8. Where can I find more information about reporting breaches?

You can refer to:

- ASIC Regulatory Guide 78: Breach reporting by AFS licensees and credit licensees; and

- Reportable situations for AFS and credit licensees.

Sophie Grace also has dedicated website pages for credit and AFS licensees:

Further Reading

- ASIC Corporations and Credit (Amendment) Instrument 2025/289

- ASIC gives further relief for licensees under the reportable situations regime (Media Release)

- Australian Securities and Investments Commission Act 2001 (Cth)

- Corporations Act 2001(Cth)

- National Consumer Credit Protection Act 2009(Cth)

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.