- with readers working within the Retail & Leisure industries

- with readers working within the Retail & Leisure industries

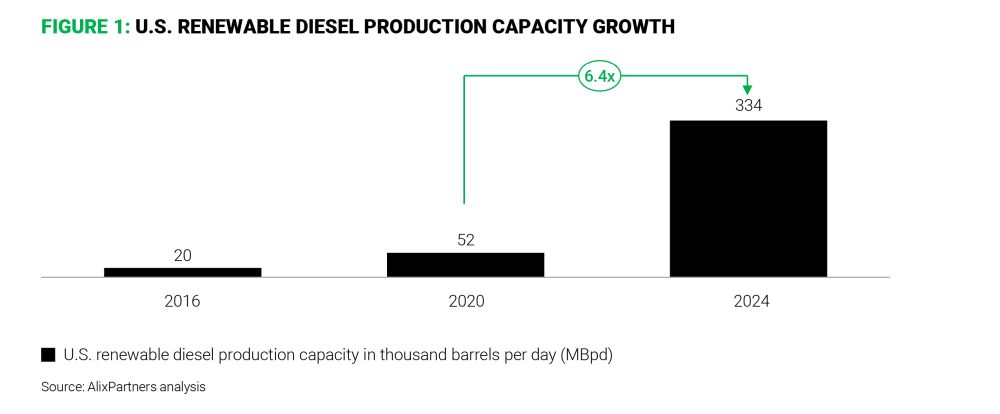

Over the past few years, steadily growing demand and government incentives have made renewable diesel a highly profitable industry for investors. As such, investment and production capacity across the North American market booked, with U.S. capacity expanding nearly 6.5x since 2020.

The result, however, is supply that now outstrips demand. Our analysis suggests that total North American capacity exceeds demand by nearly one-third, creating an intensely competitive market for renewable diesel refiners. On top of this, shrinking federal incentives, declining renewable credit values, and stubbornly high raw-material prices are squeezing margins for all producers in the sector.

So how should renewable diesel refiners and investors rethink the sector's prospects and re-evaluate their strategies for profitability?

Fading incentives erode profitability

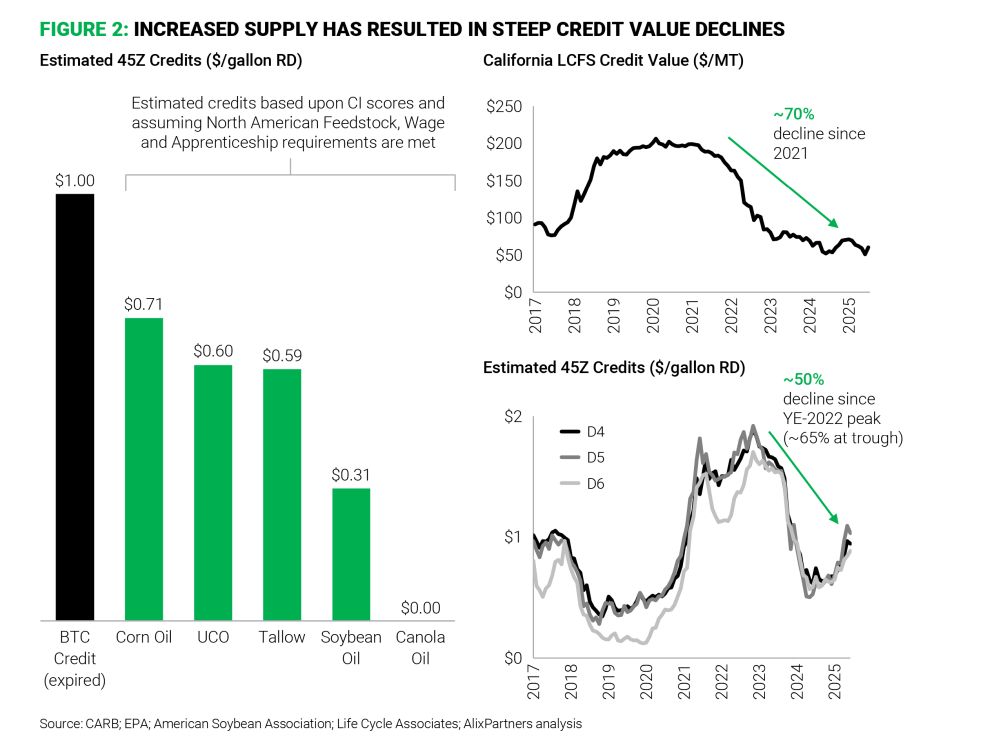

Renewable diesel producers have historically enjoyed healthy margins driven by federal and state incentives. As recently as 2022, incentives provided producers with margins of at least $4.50 per gallon, resulting in significantly higher margin levels than fossil diesel.

However, policy and market pressures have quickly shifted dynamics. Congress allowed the $1-a-gallon Biodiesel Blenders' Tax Credit to expire in December 2024 and replaced it with a new 45Z Clean Fuel Production Tax Credit that offers much less value. At the same time, federal market-based incentives (RINs) and state-based credit values have declined steeply from the highs of just a few years ago, due to the surplus in supply.

While renewable diesel producers have felt some relief via reductions in feedstock prices such as soybean oil, the feedstock cost declines have not kept pace with credit value declines and remain elevated compared to pre-2020 historical averages.

Put it all together and cash margins for renewable diesel refiners have plummeted – and in many cases may be negative depending on a refiner's cost structure and location. Some producers, such as Vertex and Global Clean Energy Holdings, have already filed for bankruptcy, while others, such as Braya Renewables, have idled production given the challenging market environment.

Tight margins call for tighter operations

Unfortunately, significant near-term relief may not be on the horizon as we expect supply to continue to outpace demand through 2030. While the One Big Beautiful Bill Act ("OBBBA)" did extend the 45Z tax credit expiry date from 2027 to 2029 and re-instated the small bio-diesel producer credit for producers, it did little to spur additional demand meaning the oversupply situation will persist. The OBBBA also restricts 45Z credit availability to North American feedstocks which will increase feedstock costs for refiners.

Given the challenging market conditions, renewable diesel players that hope to survive the industry shakeout will need to:

- Optimize cost and capital management: Refiners will need to undergo a plant cost reset to aggressively right-size their G&A functions as well as plant headcount, optimize their preventative and predictive maintenance, and ensure optimal process and operational performance to minimize disruptions. Additionally, this is a critical time to revisit existing planned and in-flight capital programs to take a hard look at capital spending – for required compliance, maintenance projects, and discretionary projects – with an eye towards deferring or canceling projects.

- Scrutinize feedback selection: Refiners will need to closely analyze the total profitability impact of feedstock selection. This will require careful review of not only feedstock cost differences, but also analysis of logistics costs by each source, carbon intensity and associated impact on credit value generation of different options. Additionally, careful evaluation of the associated operational cost impact of running different feeds such as the associated impact on catalyst life and waste treatment and disposal should also be considered.

- Assess cash and liquidity: Finally, refiners will need to minimize the risk of liquidity issues by taking proactive actions to be aware of such a threat. These actions include reviewing current and forecasted cash positions, setting a clear set of cash balance targets, developing a clear cash balance budget, and beginning weekly tracking activities of liquidity as well as managing payments where possible. If necessary, refiners may also need to begin discussions with creditors to gauge their appetite for adjusted payment schedules.

The renewable diesel sector has entered a new era—a shift from production at all costs to belt-tightening and operational efficiency. Only those that rapidly adapt to the new reality and operate with financial discipline are likely to emerge on the other side of the downcycle to a more attractive margin environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]