- within Finance and Banking topic(s)

- in India

- within Finance and Banking, Real Estate and Construction and Environment topic(s)

I. MONGOLIA

The Government of Mongolia concludes an investment contract with an investor who intends to invest more than MNT 500 billion, based on the investor's request and for the purpose of ensuring a stable business environment. By entering into an investment contract, the Government provides legal guarantees to the investor, stabilizes the tax environment, and extends various forms of support for the implementation of the investment project. The investment agreement pursues the same objective as stabilization certificates issued under the Investment Law; however, it has the advantage of being concluded for a longer term than the period for which stabilization certificates are granted. Accordingly, entering into an investment agreement creates favorable conditions for investors and can be regarded as a mechanism for attracting investment.

Most recently, in 2025, the Government of Mongolia concluded an investment contract with "Orano Mining," a company registered in the French Republic, for a uranium mining project, under which four types of taxation were stabilized. This agreement is the second major investment contract concluded by the Government of Mongolia with a third country. The Government emphasized that the agreement is expected to increase foreign investment, generate revenue for the state and local budgets, create jobs, introduce new technology, and positively contribute to socio-economic development and international cooperation.

Procedures for concluding investment agreements

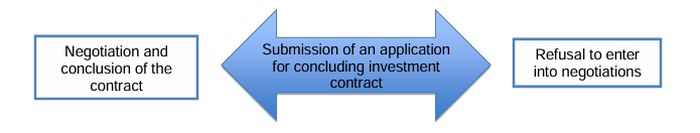

1. Submission of an Application to Conclude an Investment Agreement

A legal entity intending to make an investment of MNT 500 billion or more shall submit its application to conclude an Investment Agreement to the state administrative authority in charge of investment affairs, in accordance with the Investment Law and the Procedure for Concluding an Investment Agreement. The application shall be accompanied by the following documents1:

- Information regarding the creation of stable employment;

- Information on the introduction of advanced techniques and technology;

- Information about the shareholders, business activities, and previously implemented projects of the applicant legal entity;

- A feasibility study approved by the state administrative body of the relevant sector or its Scientific and Technical Council, demonstrating that the total investment amount will reach MNT 500 billion or more; and other documents as required.

The state administrative authority in charge of investment affairs shall receive and review the application for concluding an Investment Agreement. During the review process, the authority may request additional documents from the investor, other than those specified in paragraph 2.1 of the Procedure for Concluding an Investment Agreement.

Grounds for Refusing to Enter into Negotiations for an Investment Contract2:

- The investor's activities or the nature of the investment contradicts the National Security Concept of Mongolia;

- The investment is inefficient or is likely to adversely affect the state budget, financial revenues, or economic policy of Mongolia;

- Failure to meet the criteria specified in Article 16.13 of the Investment Law; and other grounds.

In the course of determining whether grounds for refusal exist, the state administrative authority in charge of investment affairs shall obtain opinions and conclusions from relevant institutions. If grounds for refusal to enter into negotiations are established, the authority shall provide a written response to the applicant legal entity.

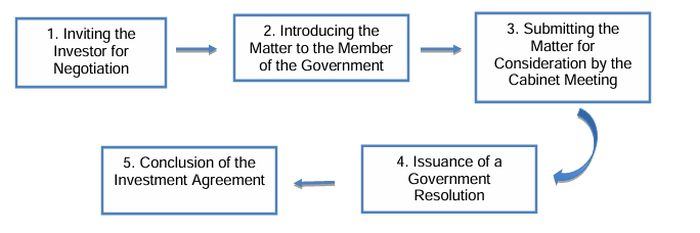

2. Negotiation and conclusion of the contract

- If no grounds for refusing to conclude the Investment Agreement are established, the state administrative authority in charge of investment affairs shall invite the applicant legal entity to negotiations for concluding the Investment Agreement.

- Once the parties have fully agreed on the draft Investment Agreement as a result of negotiations, the draft shall be submitted to the Government member responsible for investment affairs.

- If the Government member responsible for investment affairs supports the draft Investment Agreement, the matter shall be submitted to the Cabinet meeting for consideration in accordance with the Law on the Government of Mongolia and relevant procedures.

- The Government shall issue a resolution on whether to conclude the Investment Agreement, in accordance with applicable laws and procedures.

- If the Government supports the draft Investment Agreement, the Government member authorized by an order of the Prime Minister under Article 20.2 of the Investment Law shall obtain the authority to sign and shall enter into the Investment Agreement with the applicant legal entity.

Content of the Agreement

The investment agreement shall be concluded in writing in both Mongolian and English in accordance with the laws and regulations in force. The agreement shall include the following items4:

- The legal and regulatory basis for concluding the investment agreement;

- The parties to the investment agreement and their shareholding percentages;

- If the investor implements the investment project together with a corporate entity, a partnership structure, or any related legal entity, the contract shall specify the name of the legal entity involved, as well as its state registration number and taxpayer registration certificate number;

- The purpose of the investment and the main activities;

- The amount of investment and sources of funds;

- The timeline and stages of the investment;

- The term of the investment agreement;

- Conditions for tax stability, regulatory and financial support, in accordance with Article 20.4 of the Law on Investment;

- Measures to address or mitigate any adverse impact on public health and the environment;

- Contributions to regional development;

- Clause related to in the event of the investor fails to fulfill the obligations stipulated in the contract and the investment does not reach the legally established level, the tax support and stabilization provided to the investor shall be revoked, and the amount of taxes granted under the contract may be claimed. In total, the agreement shall include 25 such provisions.

Monitoring the Implementation of the Investment Agreement

The investor, as a legal entity that has concluded an investment agreement, is obligated to submit a report on the implementation of the investment activities and the project in accordance with the Law on Investment and the provisions of the investment agreement to the competent government authority responsible for investment no later than the first quarter of the following year. The competent government authority shall monitor the implementation of the investment agreement and may, if necessary, cooperate with sectoral or other relevant authorities. In the event of any violations or deficiencies arising during the course of the investment agreement, the competent government authority shall promptly notify the investor and take measures to ensure that such violations are remedied. If the investor fails to fulfill the obligations stipulated in the agreement, the Government reserves the right to suspend or terminate the contract. Any disputes arising from the investment contract shall be resolved in accordance with the laws of Mongolia and the provisions of the agreement.

II. THE REPUBLIC OF KAZAKHSTAN

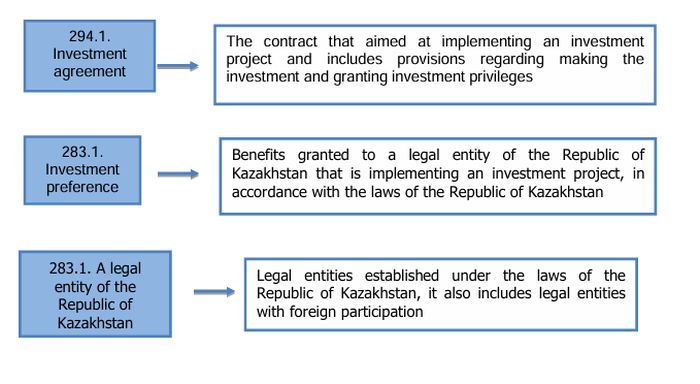

One of the few countries that an authorized authority of the country concludes investment agreement with investors same as Mongolia is the Republic of Kazakhstan. The Republic of Kazakhstan does not have a specific law on investment; instead, investment relations are governed by the Entrepreneur Code of the Republic of Kazakhstan, adopted in 2015. According to the law, not only Investment Agreement which is similar to that provided for under the law of Mongolia, but also there is the concept of a "Special Investment Contract"5 in the Republic of Kazakhstan. However, for the purposes of this legal alert, only the investment contract and the procedure for its conclusion are compared with Mongolia; the procedure for concluding a special investment contract will not be examined in detail. According to the provisions of this law:

According to Article 282.1, activities related to providing state support for investments are carried out by an authorized investment body designated by the Government of Kazakhstan. This body is responsible for concluding investment contracts and monitoring their implementation.

Procedures for obtain investment preference

Submitting a request to obtain investment preference

To obtain investment preferences, a legal entity of the Republic of Kazakhstan shall send to the authorized body for investments an application for the investment preferences provision and documents confirming the applicant's compliance with the requirements established by the Entrepreneur Code in the form established by the authorized body for investments6. The authorized body shall accept and register an application for investment privileges if it is accompanied by the following documents7:

- A copy of the state registration certificate of the legal entity, signed and stamped by the director of the legal entity;

- A copy of the charter of the legal entity, signed and stamped by the director of the legal entity;

- A business plan for the investment project, prepared in accordance with the requirements established by the authorized body;

- Documents confirming the amount (value) of state benefits requested by the legal entity of Kazakhstan and prior approval for granting such benefits; etc.

Registering and reviewing the application

The authorized body shall accept the application for investment privileges and, in accordance with the requirements set out in Articles 285 and 286 of the Law, issue a decision within 20 (twenty) working days from the date of registration of the application.

Conclusion of investment agreement

Footnotes

1. Article 2.1 of the Procedures for concluding investment contract.

2. Article 2.4 of the Procedures for concluding investment contract.

3. Article 16.1 of the Law on Investment specifies the requirements that a legal entity investor must fulfill for a project implemented in Mongolia in order to obtain a stabilization certificate.

4. Article 4.1 of the Procedures for concluding investment contract.

5. According to Article 295-1, paragraph 1 of the Entrepreneur Code of the Republic of Kazakhstan, a "Special Investment Contract" means a contract that regulates the granting of investment preferences within the framework of a special investment project.

6. Article 285.1 of the Entrepreneur Code of the Republic of Kazakhstan.

7. Article 292.1 of the Entrepreneur Code of the Republic of Kazakhstan.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]