I. Background and Overview

In view of the United States' plan, pursuant to its Section 301 Investigation Report, to impose "special port service fees" on vessels built in China or owned and operated by Chinese entities starting from 14 October 2025, the State Council of China issued an order on 28 September 2025, revising the Regulations of the People's Republic of China on International Maritime Transport ("the Regulations"). The revision clarifies the specific countermeasures that the Chinese Government may adopt in response to discriminatory measures taken by other countries.

Subsequently, on 3 October 2025, the U.S. Customs and Border Protection (CBP) released Announcement CSMS#66427144, declaring that, based on the Section 301 Investigation Report on China's Maritime, Logistics, and Shipbuilding Sectors, the United States would impose special fees on vessels owned, operated, or built by Chinese entities. In response, the Chinese Government swiftly invoked the newly revised Regulations to take reciprocal countermeasures. On 10 October 2025, the Ministry of Transport of China issued the Announcement on the Collection of Special Port Charges on U.S. Vessels (Announcement No. 54 [2025]), stipulating that such countermeasures would formally take effect from 14 October 2025.

It is expected that the Ministry of Transport will soon release detailed implementing rules for this Announcement. However, given the large number of inquiries and concerns within the maritime community, this article seeks to provide an early interpretation and projection of the key legal and practical issues arising from the Announcement prior to the promulgation of the detailed rules.

II. Contents of the Announcement

The main provisions of the Announcement are as follows:

"In accordance with the Regulations of the People's Republic of China on International Maritime Transport, other relevant laws and regulations, and the fundamental principles of international law, and with the approval of the State Council, effective from 14 October 2025, special port charges shall be levied by the maritime administration at the port of call in China on the following vessels:

- Vessels owned by U.S. enterprises, other organisations, or individuals;

- Vessels operated by U.S. enterprises, other organisations, or individuals;

- Vessels owned or operated by enterprises or organisations in which U.S. enterprises, organisations, or individuals directly or indirectly hold 25% or more of the equity, voting rights, or board seats;

- Vessels flying the U.S. flag;

- Vessels built in the United States.

The specific matters are announced as follows:

1. For the above-mentioned vessels, special port charges shall be collected on a per-voyage basis and implemented in stages. The detailed rates are as follows (fractions of one net ton shall be counted as one net ton):

o From 14 October 2025, RMB 400 per net ton for vessels calling at Chinese ports;

o From 17 April 2026, RMB 640 per net ton for vessels calling at Chinese ports;

o From 17 April 2027, RMB 880 per net ton for vessels calling at Chinese ports;

o From 17 April 2028, RMB 1,120 per net ton for vessels calling at Chinese ports.

2. For vessels calling at multiple Chinese ports during the same voyage, the special port charge shall be collected only at the first port of call, and no further charges shall be imposed at subsequent ports. For the same vessel, the special port charge shall not be collected for more than five voyages within one year.

3. The Ministry of Transport will formulate and promulgate detailed implementing rules for the enforcement of this Announcement.

III. Scope of Application: Broad Coverage and Interpretative Flexibility

The Announcement specifies that the vessels subject to the special port charges include:

1. Vessels owned by U.S. enterprises, organisations, or individuals;

2. Vessels operated by U.S. enterprises, organisations, or individuals;

3. Vessels owned or operated by enterprises or organisations in which U.S. enterprises, organisations, or individuals directly or indirectly hold more than 25% of the equity;

4. Vessels flying the U.S. flag;

5. Vessels built in the United States.

It can therefore be seen that the Announcement adopts a fourfold criterion of "ownership + control + nationality + place of construction", resulting in a very broad scope of application. A broad interpretation of these criteria could bring significant turbulence and disruption to the global shipping industry.

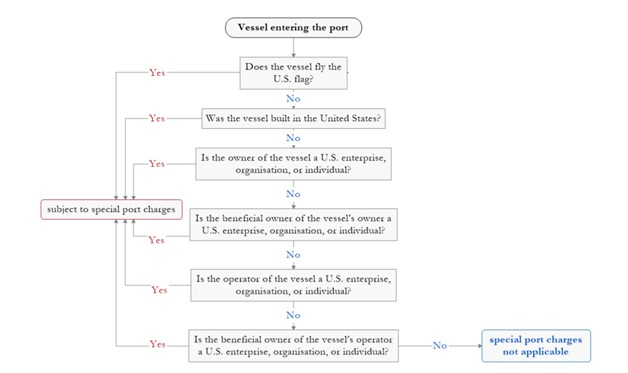

IV. Process for Determining the Applicability of the Special Port Charges

The following sections provide a brief commentary on the relevant concepts involved in the above determinations.

V. Vessels Flying the U.S. Flag or Built in the United States

Determining whether a vessel flies the U.S. flag is relatively straightforward; however, certain complexities may arise in cases involving bareboat charters. If a vessel is registered for ownership in the United States but, after being bareboat chartered, is re-registered by the charterer in another country and flies that country's flag, the vessel may not fall under the category of "vessels flying the U.S. flag." In such a case, the determination of whether special port charges apply may depend on the nationality of the vessel's owner as a relevant connecting factor.

As for determining whether a vessel is built in the United States, it is expected that the assessment will be based directly on the place of building recorded in the vessel's certificate, rather than extending to places where blocks/sectional construction or primary structural assembly occurred.

VI. Definition of "U.S. Enterprises, Organisations, and Individuals"

From the perspective of international sanctions and countermeasure practices and considering the purpose of the U.S. CSMS#66427144 Announcement, this concept likely extends beyond merely U.S. nationals and entities incorporated in the United States. It may also include:

a. Entities established under U.S. law;

b. Entities whose headquarters or principal place of business is located in the United States.

c. Entities whose parent entity's headquarters or principal place of business is in the United States.

Merely being listed on the New York Stock Exchange would not, by itself, constitute a U.S. enterprise under this definition.

VII. Definition of "Shipowners"

Under maritime law and international practice, the term "shipowners" generally refers to the registered owner of the vessel, as recorded in the vessel ownership or nationality registration certificate.

In the case of joint ownership, each co-owner is considered an "owner".

In cases of tenancy in common, an individual holding more than 50% ownership interest would be regarded as an "owner." For those holding 50% or less, whether all such persons—regardless of their shareholding—will be treated as "owners," or whether a threshold (e.g. 25%) will be set to determine inclusion within the definition, remains to be clarified in forthcoming implementing rules. Furthermore, within ship financing and leasing structures, financial institutions registered as shipowners under the lease arrangement are also likely to fall within the definition of "shipowners".

VIII. Scope of "Ship Operators"

The term "ship operators" shall include bareboat charterers, but whether it also covers time charterers, voyage charterers, slot charterers, non-vessel-operating common carriers (NVOCCs), or ship managers remains uncertain and will depend on the detailed provisions to be issued by the Ministry of Transport. However, the following entities are highly likely to be regarded as vessel operators:

a. Companies that have obtained an International Ship Transport Licence under the Regulations on International Maritime Transport;

b. International liner shipping operators, whether operating through vessel-sharing agreements, slot exchanges, or joint operations;

c. Non-vessel-operating common carriers (NVOCCs).

IX. Enterprises and Organisations in Which U.S. Entities or Individuals Directly or Indirectly Hold More Than 25% of the Equity (Voting Rights or Board Seats)

The reference in the Announcement to entities "in which U.S. enterprises, organisations, or individuals directly or indirectly hold 25% or more of the equity, voting rights, or board seats" is substantively based on the concept of the Ultimate Beneficial Owner (UBO), though it is not entirely identical to that concept.

China's Anti-Money Laundering Law (2024 Revision) and the Administrative Measures on Beneficial Ownership Information establish clear standards for identifying a beneficial owner — namely, a person who directly or indirectly holds more than 25% of the equity, beneficial interest, or voting rights, or who exercises ultimate control or enjoys the principal economic benefits of an entity through agreements or other arrangements. Accordingly, the criteria for identifying entities falling under this category in the Announcement may be interpreted by reference to these legislative and regulatory standards. This approach is consistent with FATF Recommendation 24, which also suggests a 25% ownership threshold as the baseline for beneficial ownership identification. Similarly, the United States' Corporate Transparency Act (CTA) and the FinCEN Beneficial Ownership Rules apply the same 25% standard for control or substantial influence. However, the purpose of this countermeasure differs: while the UBO concept typically focuses on identifying individuals with ultimate control, the Announcement targets the nationality of the controlling entity or person. Thus, the two concepts are related but not entirely interchangeable.

In simple terms, if a company or organisation's beneficial owner (which may include not only natural persons but also corporate entities or organisations) is a U.S. enterprise, organisation, or individual, that entity is highly likely to be affected by the Announcement. Moreover, even if the beneficial owner is not a U.S. person per se, a collective group of U.S. organisations, enterprises, or individuals that together directly or indirectly hold 25% or more of the equity, voting rights, or board seats of an entity may also cause that entity to fall within the scope of the Announcement.

Certain special types of entities may require particular consideration:

a. Publicly Listed Companies – If a company is publicly listed and its shareholding is widely dispersed, making it practically impossible to determine the nationality of its shareholders or voting right holders, the assessment may primarily rely on the composition of the board of directors.

b. Partnerships – The assessment should consider the aggregate proportion of partnership interests held by partners of U.S. nationality.

c. Trusts – The determination should focus on the natural persons who exercise ultimate effective control or enjoy the final beneficial interest in the trust, including but not limited to the settlor, trustee, and beneficiary.

o If the settlor, trustee, or beneficiary is a non-natural person, the identification should drill down layer by layer to trace the natural persons who ultimately control or benefit from the trust.

o Where a trust has unspecified beneficiaries at the time of establishment or during its existence, the determination may be deferred until the beneficiaries are identified; in the meantime, the settlor or trustee may be treated as the basis for assessment under this category.

In assessing the equity ownership, voting rights, or board seat distribution of an entity, the analysis must be tailored to its corporate structure, taking into account articles of association, financial statements, board meeting minutes, and board resolutions, and applying a penetrating ("look-through") approach to reveal the ultimate controlling or beneficial interests.

X. Implementation Mechanism and Possible Exemptions

It is expected that the forthcoming implementation rules to be issued by the Ministry of Transport will specify the reporting obligations and exemption mechanisms related to the Announcement.

(1) Reporting and Information Disclosure Obligations

The parties likely to bear the reporting obligation are the shipowners or operators. They may be required to submit relevant information to the competent authorities several days before arriving at the first Chinese port, declaring whether the vessel falls within the scope of the Announcement. If a vessel is determined to be within the scope, the responsible party should proactively pay the special port charges. Failure to report truthfully or deliberate concealment may result in denial of port entry, suspension of operations, or administrative penalties, with the competent authorities retaining the right to conduct investigations.

(2) Exemptions and Special Circumstances

The detailed rules are expected to provide for certain exemptions, including:

- Small vessels below a specified tonnage threshold;

- Vessels in distress requiring emergency entry into Chinese ports;

- Vessels entering for repairs or reconstruction;

- Vessels engaged in humanitarian or government missions.

The exemption conditions may, to some extent, correspond to or mirror the provisions of the U.S. CBP Announcement.

XI. Applicability of the Announcement to Hong Kong

Under the principle of "One Country, Two Systems," this Announcement does not directly apply to the Hong Kong Special Administrative Region. However, it is reasonably expected that the Hong Kong Government may subsequently introduce parallel or corresponding measures, given the close linkage between Hong Kong's maritime industry and the Mainland system. The shipping community should therefore remain vigilant and prepare for potential alignment or follow-up measures.

XII. Legal Significance and Outlook

The Announcement represents the first practical application of the countermeasure provisions under the revised Regulations on International Maritime Transport, marking the operational implementation of China's countermeasure framework in the maritime sector.

Its significance lies in the establishment of a comprehensive legal framework centred on ownership, control, nationality, and place of construction, thereby extending China's sanctions and countermeasure mechanisms into the maritime domain and demonstrating the country's growing legal and regulatory capacity in international economic relations. Given that the measures are scheduled to take effect on 14 October 2025, it is anticipated that the detailed implementing rules of the Ministry of Transport will be released imminently. Our firm will continue to closely monitor subsequent developments and provide timely commentary and analysis once further regulatory guidance becomes available.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.