- within Government and Public Sector topic(s)

- in United States

- within Transport, Energy and Natural Resources and Employment and HR topic(s)

- with Inhouse Counsel

Australia's anti-money laundering and counter-terrorism financing (AML/CTF) regime is undergoing significant reform. Part of these reforms is the expansion of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (Cth) (AML/CTF Act) to the real estate sector and providers of professional services. This expanded scope will take effect from 1 July 2026.

We have highlighted key steps that we recommend entities in the real estate sector undertake to ensure that they are ready for these significant regulatory reforms.

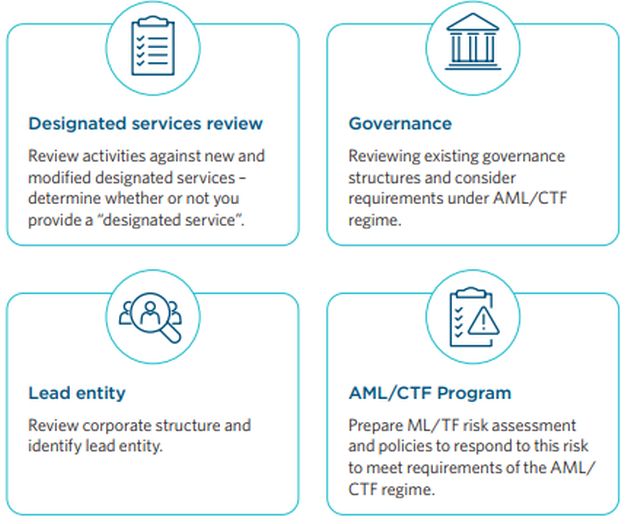

Designated service review

The AML/CTF Act will only apply to providers of "designated services" – providers of designated services are known as "reporting entities".

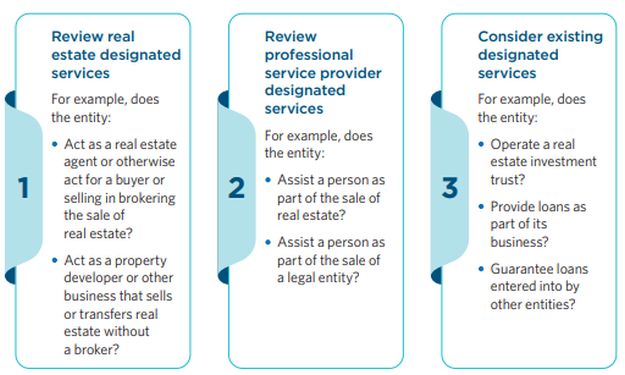

A designated services review is an appropriate first step in determining the impact of the AML/CTF reforms. For entities in the real estate sector, the designated service review should focus on:

- whether any real estate services are provided;

- whether any new professional service provider services are provided; and

- whether any other designated services are relevant to the activities of the entity.

Identify a lead entity

Where an entity does provide a designated service, as part of putting together a compliance framework the entity must identify a "lead entity" as part of its group. All reporting entities will need to consider what "reporting group" they are part of and what entity will fulfil the role of lead entity.

Many entities in a group may be able satisfy the criteria of a lead entity – it will therefore be important to consider which entity is best suited to perform the functions and manage the ML/TF risk that the lead entity is required to.

Review of governance arrangements

All reporting entities will need to consider their governance and decision making processes in establishing a compliant framework going forward.

Prepare and adopt AML/CTF Program

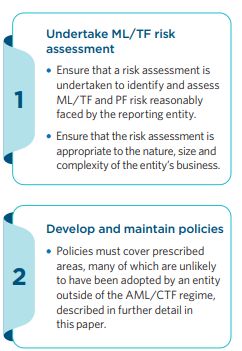

All reporting entities must:

- Undertake an assessment that identifies and assesses the risks of money laundering, financing of terrorism and proliferation financing (ML/TF and PF) that the entity may reasonably face in providing its designated services; and

- Develop and maintain policies, procedures, systems and controls that appropriately respond to these ML/TF risks as well as ensuring that the reporting entity complies with the requirements of the AML/ CTF regime.

Together, these requirements are known as the reporting entity's AML/CTF Program.

Many entities will have policies in place for managing ML/TF and PF risks however the content of the AML/CTF Program is highly prescribed so existing compliance frameworks must be reviewed to ensure compliance with the requirements of the AML/CTF Act.

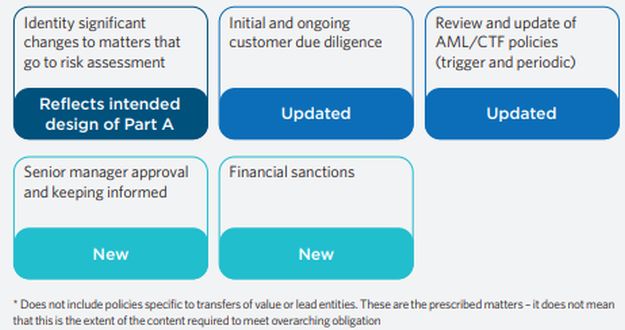

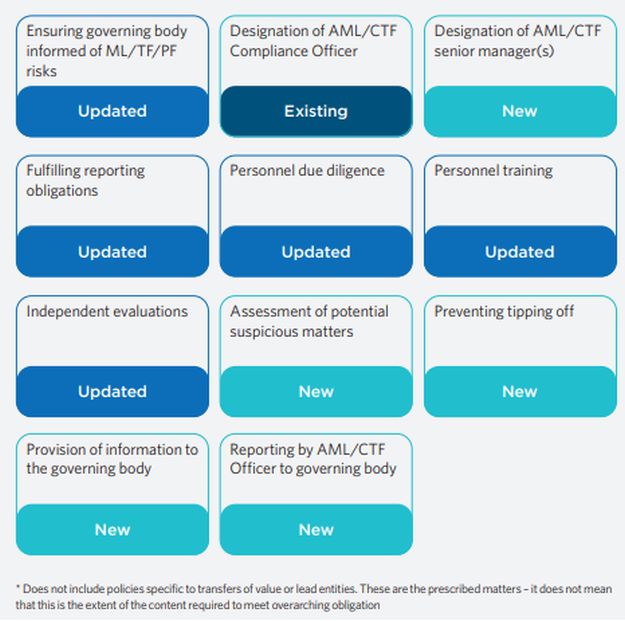

AML/CTF policies – risk mitigation measures

A reporting entity must develop and maintain policies, procedures and systems and controls that appropriately manage and mitigate the risks of ML/TF and PF that the reporting entity may reasonably face in providing its designated services. For entities that are already subject to the AML/CTF Act and have AML/CTF policies in place, we have highlighted where the content and scope of the policies under the AML/CTF reforms differs from existing requirements.

AML/CTF policies – internal controls

A reporting entity must develop and maintain policies, procedures and systems and controls that ensure the reporting entity complies with the obligations imposed by the AML/CTF Act, regulations and Rules on the reporting entity. For entities that are already subject to the AML/CTF Act and have AML/CTF policies in place, we have highlighted where the content and scope of the policies under the AML/CTF reforms differs from existing requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]